Following a hearing which begins today, a bankruptcy-court judge is expected to approve General Motors’ “363 Sale,” in which GM’s good assets would be sold to a new entity controlled by the U.S. government, the United Auto Workers, lenders, and the Canadian government, while the bad ones would left behind and wound down.

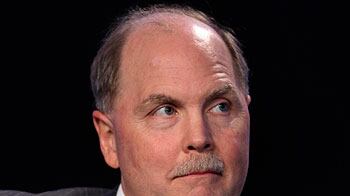

Leading “good” GM going forward: Frederick “Fritz” Henderson, tapped three months ago after the White House forced out Rick Wagoner. Ironically, the 50-year-old Henderson had a career path that largely echoed that of his predecessor, down to the Harvard MBA and assignments managing GM’s operations in places like Europe and Brazil. But there was one critical difference—where Wagoner vocally resisted the idea of putting GM into Chapter 11, Henderson was openly willing to accept the idea that the only way to save the automaker was to declare bankruptcy—which it did on June 1.

“As a management team and as a firm, our highest overriding objective is to pay back both the Treasury and Canadian government and pay the highest possible return on their equity.”

Henderson admits the Obama White House is keeping him on a “short leash,” and that despite the president’s promise to stay out of GM’s day-to-day operations, there’s been a lot of oversight during the restructuring process. “The government will be the purchaser of GM in the 363 Sale," he says, “so they are naturally involved, day-to-day. Any buyer would want to exercise their right and make sure the sale process is being handled correctly.” The new CEO recently took time out from a frenetic schedule to talk about his vision for what he previously called, “a leaner, quicker, more customer-, completely product-focused company.”

Chrysler CEO Bob Nardelli left when that automaker reemerged from Chapter 11. What’s your future with GM once the bankruptcy process is complete?

I have to prove myself. I’m on a short leash, but I’m not worried. As for the management team, we’ll be reducing our executive staff by 35% [comparing] the end of ’08 and ’09. Between now and October…we’ll have more announcements about leaning up the management team, but I can’t talk about that now.

OK, so let’s talk about the bankruptcy process, which is moving fairly quickly. The sales hearing is scheduled for [today]. What are the next steps for GM?

This is a critical period…for us to get it done professionally. I hope we can get it done well. In terms of getting the business itself ready to go, we have a solution and we’ve got our breakeven down, which is fairly well documented. The key is making sure we’re as lean and fast as we can be. Then the key steps are making sure we’re ready to launch new products rallying us behind our four core brands.

There’s been plenty of debate over the Chrysler and General Motors bailouts. Are you concerned about surveys that show many buyers might steer clear of you, especially while you’re in bankruptcy?

We are concerned about it—one reason we’ve put so much emphasis on speed as we go through the bankruptcy process. Revenue perishability is a key issue. But we’ve stayed open from Day One. And suppliers have stayed with us, so we’ve not lost one day of production. We’ve used this process as an opportunity to correct issues like excess inventory. We’re open for business and we’re doing everything we can to stay aggressive in the marketplace. Still, the situation is fragile and we don’t want to take chances.

Not only are some folks steering clear, but others, like conservative talk-show host Hugh Hewitt, have actually suggested people boycott what they’ve dubbed “Government Motors.” Will that be a problem?

I’m going to bet that U.S. customers will make their own choices. We had one party call for our death, but that wasn’t very credible. So, our job is to do the best we can [domestically], and the same thing outside the country.

President Obama has insisted the government won’t try to run GM on a day-to-day basis. Are they really not involved?

The government will be the purchaser of GM in the 363 Sale, so they are naturally involved, day-to-day. Any buyer would want to exercise their right and make sure the sale process is being handled correctly. The second point is that they’re now getting a new board in place and has named Ed Whitacre as chairman. Ed doesn’t officially begin his job until after the sale, but we’ve had time with him, bringing him up to speed. There are four more board members to recruit and the Canadians need to recruit their board member, too.

Lee Iacocca recently broke his silence, in an AP interview, and he said the industry needs to get the government out of their business as soon as possible. Do you agree?

As a management team and as a firm, our highest overriding objective is to pay back both the Treasury and Canadian government and pay the highest possible return on their equity. It’s our job to create real value for our shareholders and to repay the loans. The government said, and I believe them, that they will sell off their equity over time. My job is to do the best we can and if we do, we’ll create real market value for them.

So, you don’t see their involvement as a problem?

The Auto Task Force viewed this as a private-equity investment from Day One. They need to be confident, so there will be world-class oversight, and the market will hold me and the management team accountable.

That’s a word we’ve been hearing a lot, lately.

Myself and the management team need to produce results and do it quickly. We’ll be looking at how new product launches do. We’ll have to do things as quickly as we can. We’ll have to hit our numbers. We’re planning a breakeven in 2010 and to have a small profit in 2011.

But those goals could run up against some things outside your control, like the economy and the size of the automotive market, couldn’t they?

Some things are out of your control, like the price of oil and commodities. But we’ve gotten our breakeven down to 10 million, and so, even if the market is less than that, we’ll now be robust enough we won’t bleed. Back in 2005, our structural costs were $40 billion a year. Next year, they’re forecast at just $23 billion.

People used to describe GM as a behemoth, but it’s clearly now a smaller company. What exactly is GM, post-bankruptcy?

No one wants to be a behemoth. We want to be big and successful. We want to win and do it profitably. Our aspiration is to be a product- and customer-focused company and spend our time focused on that, rather than we’re we’ve been spending it over the last year. We’ll be focused on four core brands—and each nameplate they launch will have to be a hit. GM will be a global business, but a very different type of global business. We’ll be operating in a power-sharing environment—which we’ve actually had some experience with, in places like China. So, we’ll have to leverage our global scale in places like Europe, where we’ll be working with our new partners at Opel.

Paul A. Eisenstein is a veteran journalist who has won numerous awards for his work during 30 years covering the automotive industry. He is founder and editor of TheDetroitBureau.com, an online magazine serving as the voice of the auto industry.