Few adjectives in the English language arrive on our doorsteps with as little freight as “simple.” Simple is good. Simple is welcome. Simple almost always makes us exhale with relief (assembling that Ikea desk is simple, really). Even the one negative connotation, that of simple-mindedness, produces a stock response of sympathy. After all, Lenny didn’t mean to kill those mice or strangle that poor girl. He was just ... simple. So who can argue against a simpler tax code? I can. I hereby wave the flag of complexity, and I do so proudly.

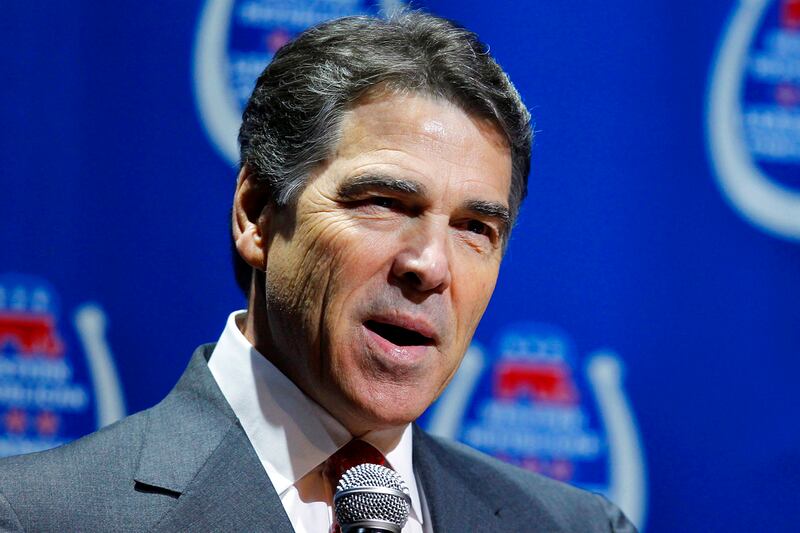

Herman Cain has given us 9-9-9. This week sometime, Rick Perry is going to announce the details of his plan for a flat tax. He keeps nattering on about simplicity. He wants to “scrap the 3 million words of the tax code,” he snarls, to great harrumphs of approval.

The details of Perry’s plan are predictable, with a couple of twists. His flat rate is 20 percent, but he says a taxpayer can decide to pay under the current rates or the flat rate, whichever works out better. That’s his little sop to the working poor, who pay less than 20 percent now. But even with that tiny asterisk, this plan, like all flat-tax plans, is a gussied-up way of stealing money from the working and middle classes and handing it to the rich. Why is all too straightforward. Have a look at this list of current marginal tax rates. You’ll see that rates change at various levels, which everyone knows, but what everyone forgets is that even if you make more, within any given income range, you pay that rate. If you make $100,000, you are in the 28 percent bracket, but you’re not paying 28 cents on every dollar you earned, which is what most media shorthand would lead you to believe. You’re paying in accordance with the rate scale in the above link, each chunk of salary taxed at the appropriate marginal rate.

This means that what a person actually pays can be hard to figure, but this calculator gets us most of the way there. A $50,000 earner (married, filing separately, as all these examples will be) pays 17.25 percent. A $100,000 earner pays 22 percent. A $250,000 earner pays 29 percent. A $500,000 earner pays 32 percent. And a $1 million earner pays 33.5 percent. Remember—I told you I was celebrating complexity!—these dollar figures are taxable income, i.e., after deductions.

So let’s say there were a 20 percent tax on income. A married-filing-separately taxpayer who makes around $74,000 right now pays 20 percent. So under Perry’s plan, people above that figure would be getting a tax cut. And obviously, the farther away from $74,000 you go, the larger, in real and percentage terms, your cut. And I hope the obverse has already occurred to you: yes, the lower earners would be in for sizable tax increases under the 20 percent plan. For example, a $25,000 earner would go from paying 13.3 percent to 20 percent, which is about a 35 percent increase, while our $1 million earner gets around a 46 percent decrease. And Kim Kardashian, forget about it. She’d pay a fraction of her current rates.

Of course, the low-income person would probably just continue to pay at the current rates. That insulates Perry from the charge of raising taxes on the poor. But it also deprives the Treasury of even more income. And on the topic of simplicity: doesn’t Perry’s either/or scenario mean that every middle-class person is going to have to sit down and figure out what she’d pay under the current rates and what she’d pay under the flat tax, meaning she has to do her taxes twice? Simple!

But the overriding fact is that this is blatant highway robbery. As you can see from the above paragraphs, the tax code is hard to explain. And it’s hard to explain why progressivity is good policy, but it is. Even if you reject the moral argument that Kardashian should give more back to society than a waitress, there is the very practical argument that a progressive income-tax code makes up for other, more regressive forms of taxation—the payroll tax and sales taxes, notably. The waitress pays payroll taxes on her entire income, while a $1 million earner pays it on just one tenth of his (roughly), and of course the waitress spends far more of her income on sales taxes. The income tax helps even these things out, as has long been understood.

This is precisely where “simplicity” comes in so handy for supply-siders and others who want to steal from the middle class. Simple has to be good. A tax return the size of a postcard! Imagine! How awesome life would be.

Not. We need complexity in the tax code. Conservatives want you to believe that the tax code is complex because liberals and bureaucrats love nothing more than sitting around all day making rules. “Let’s see,” the liberals and bureaucrats say to one another in this dystopic vision, “what can we do today to make a future Steve Jobs waste a lot of time on red tape instead of tinkering around in his garage like he should be?”

That ain’t how it works. The tax code is complex for three reasons. First, it’s complex because of the power of certain lobbies—and here I would agree with some conservative health-care economists that, for example, we’d be better off with no health-care deduction, and no employer-sponsored health care, period. Second, it’s complex because millions of Americans have over the decades dreamed up endlessly inventive ways of cheating on their taxes, and the government has to try to catch them. And third, and mostly, it’s complex because society is complex. If we were starting a country of a few hundred thousand people from scratch, with minimal income disparities and other equities that America doesn’t have (national health care), a flat tax might be OK. But in the real context of the United States, it is an obscene transfer of wealth. Rick Perry may be such a bubblehead that he doesn’t understand all this, but you can be sure that the people who sold him on the flat tax understand it.

And whether Perry revives his candidacy or not, the real issue here is that a flat tax or something like it is getting ever so closer to becoming GOP dogma. Some years ago, it was just the messianic loons: Steve Forbes. Now the flat tax is mainstreaming within the GOP. Mitt Romney, who used to hate it, has recently opened up to the idea. It’s getting ... respectable.

Simplicity is for simpletons: a handy slogan for the ruling class that wants more of your money. Don’t be that simple.