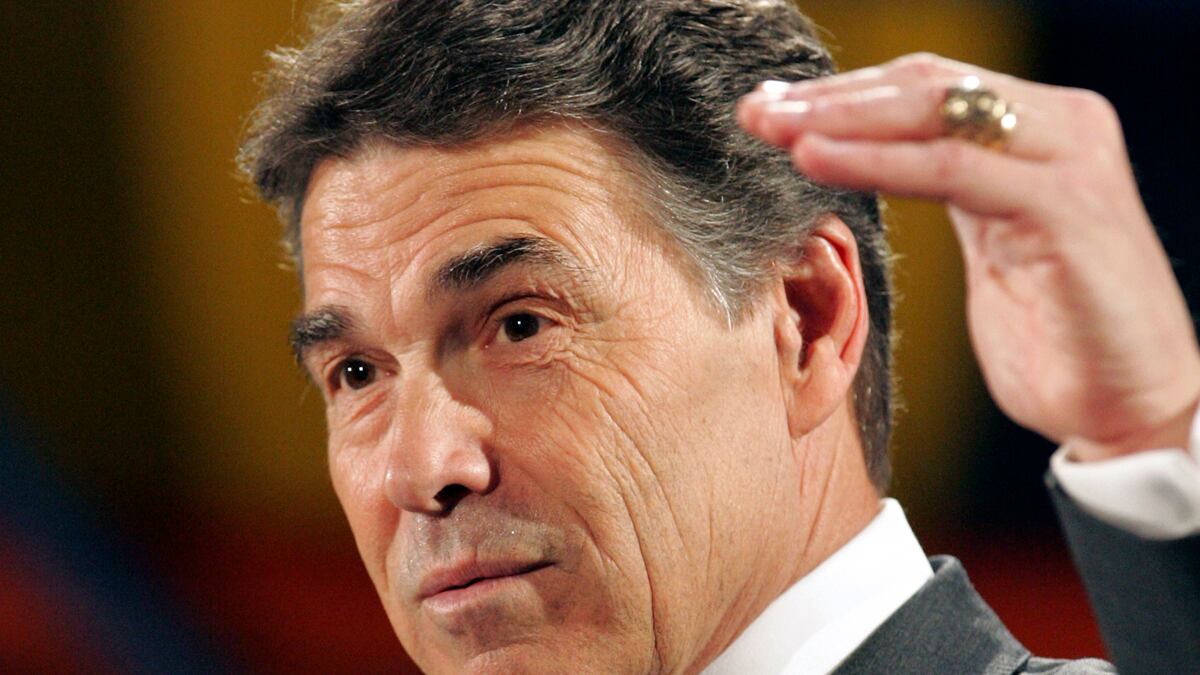

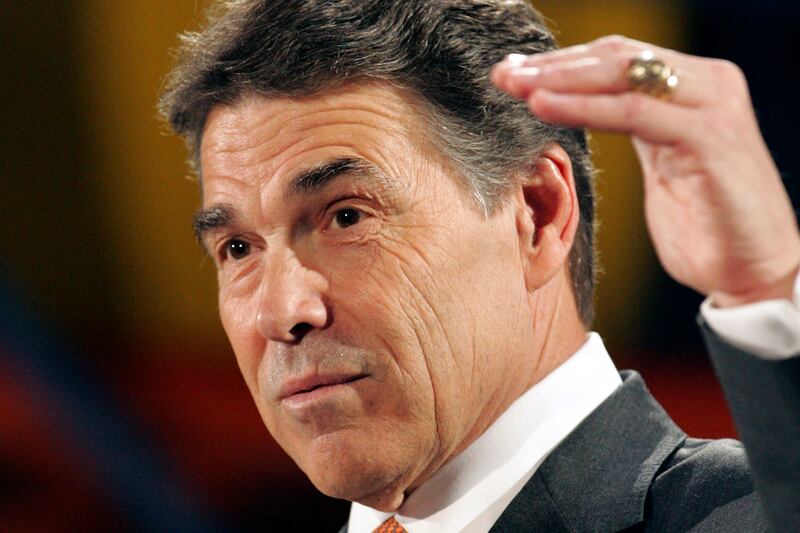

The response to Rick Perry’s new tax plan, which would create an optional 20 percent flat tax that Americans could choose instead of their current rate, was swift and vicious Tuesday as policy journalists pointed out its contradictions and defects.

The biggest problem is that what Perry calls a “flat tax” isn’t, writes Dylan Matthews at The Washington Post. A flat tax can sound attractive because it is simple—a virtue Perry himself calls out in his Wall Street Journal op-ed announcing the plan. But Perry’s version is optional, meaning the mind-bendingly complex tax code he despises will remain in place but will now be fitted with a new parallel tax structure. “By making the flat tax optional, Perry’s plan actually complicates the tax code,” Matthews writes. “It would force households to determine whether they should pay the flat tax or the regular income tax, making the process more time-consuming and expensive, not less.”

“It is an embarrassment,” writes Reihan Salam at National Review, describing the Perry plan as an “alternative maximum tax, or MAXTAX.” Middle-class Americans will still face frustration and high tax-prep costs figuring out if they should go with their old rate or Perry’s new “flat” rate, but the flat tax will be an automatic steal for the wealthy. “Essentially, what Perry has done is reverse the Buffett Rule,” Salam writes. “He has guaranteed that no American will ever pay more than 20 percent of her income in federal taxes. Indeed, affluent homeowners living in high-tax jurisdictions like New York City and Los Angeles earning up to $499,000 will likely pay much less than that, as they’ll continue to have access to the mortgage interest, charitable and state and local tax exemptions … This plan defies credulity.”

The assurance that the wealthy will pay much lower taxes under a Perry administration is exactly the message the Texas governor is going for, writes New York’s Jonathan Chait. “Perry’s embrace of the flat tax allows him to outflank Romney with the GOP money class. Romney, on account of his wealthy personal life, has to tiptoe around policies that redistribute wealth upward. Perry doesn’t have to abstain, or pretend to abstain, from waging class war. He can carry the torch of reducing the progressiveness of the tax code that the front-runner has dropped.”

The Daily Beast’s Michael Tomasky agrees. “This plan, like all flat-tax plans, is a gussied-up way of stealing money from the working and middle classes and handing it to the rich.”

“You can guess where this gets us,” writes The Atlantic’s Derek Thompson of the Perry plan’s regressive orientation mixed with generous low-income deductions. “Half of the country continuing to pay no federal income taxes plus lots of rich people paying fewer overall federal taxes means much less money for government. On the one hand, that’s the point. On the other hand, it would lead to huge deficits or dramatic cutting.”

Dramatic cutting is exactly what the GOP base wants, David Weigel points out at Slate. Rather than seeing the plan as a wink to the moneyed GOP elite, Weigel believes it is a product of Perry’s desperation with the far right, which has increasingly abandoned him. “This is the plan of a candidate who’s crashed to fourth or fifth place in the polls. He’s stepping on his launch by talking about Barack Obama’s birth certificate. All true. But this is big, sweeping, somewhat sloppy reform that says a lot about what the GOP base demands.”

Mother Jones’ Kevin Drum also sees the plan as an incoherent regurgitation of the current conservative id. “What can you even say about this? It sounds less like a tax plan than a big ol’ stew pot of right-wing applause lines, all the way up to the inane insistence that eliminating the estate tax has nothing to do with rich people and is only designed to provide ‘needed certainty to American family farms and small businesses.’ Should we laugh or cry? Perry has actually managed to combine two separate conservative memes (the estate tax is all about family farms, uncertainty is hobbling the economy) into one single sentence that makes even less sense than either of them separately. It’s hard not to be impressed.”

But will the plan’s incoherence matter to a Republican base that is famously uninterested in fiscal math? The Economist’s Will Wilkinson speculates: “The early bipartisan wonk consensus seems to be that Mr. Perry’s plan is as incoherent as his typical debate monologue. Of course, bad policy can be good politics. Will run-of-the-mill conservatives like the plan? My guess is they won’t as soon as Mr. Perry’s opponents make it clear that the proposal actually promises a confusing complexification of the tax system, offers huge tax cuts to the rich, all the while threatening to deepen America’s already perilous level of indebtedness.”