The $1.2 billion question loomed only larger and more confounding as Jon Corzine arrived early Thursday afternoon for the third of three congressional hearings into the collapse of MF Global.

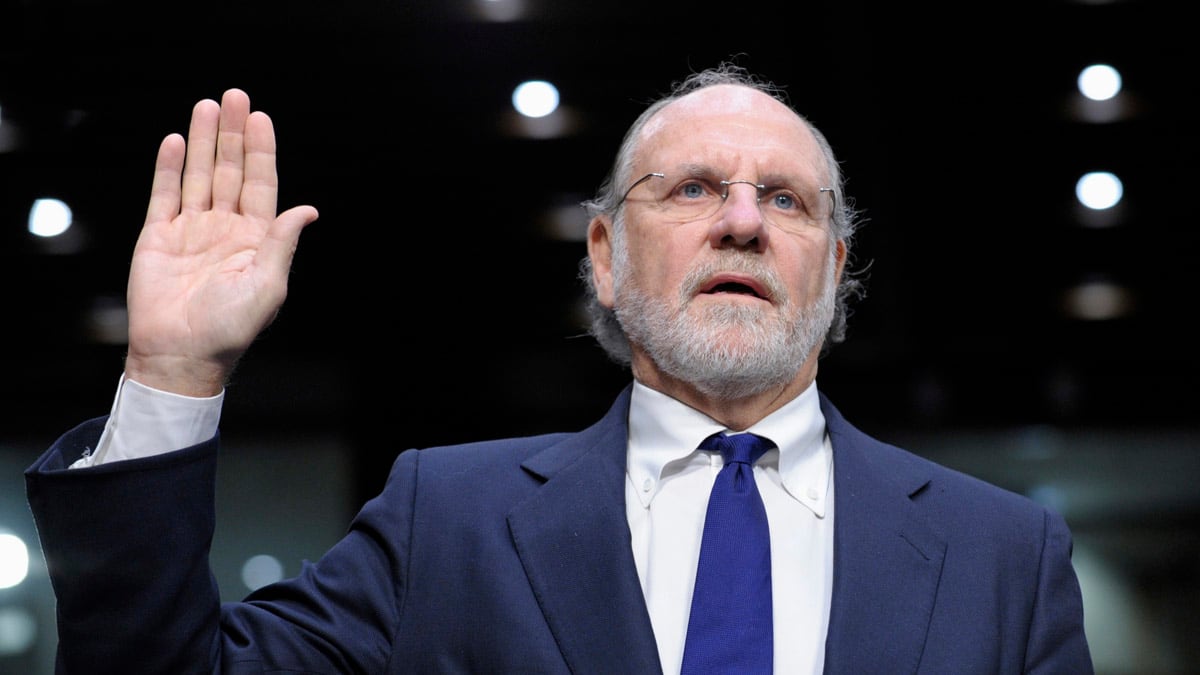

He had on a dark blue suit and a white shirt as he stood with his right hand raised and swore to tell the truth. He delivered an oral statement again professing that he had no idea what the truth might be as to how so much supposedly sacrosanct customer money went missing. He began by saying once again that he understood his downfall accorded little solace to the customers, investors and employees whose lives had been upended.

“Is your button on?” inquired Rep. Randy Neugebauer, chairman of the Oversight and Investigations Subcommittee of the House Committee on Financial Services.

Corzine had been at many more than three hearings when he was a U.S. senator, and he understood that Neugebauer was referring to the button that turns on the microphone.

“It is,” Corzine confidently replied, but in his unamplified utterance realized he was wrong. He pushed the button and re-repeated his contrition at a volume clearly heard by everyone in this modern chamber in the sub-sub-basement of the Capitol that a staffer rightly compared to a food court. The regular hearing room had been damaged in the summer’s earthquake.

“My pain and embarrassment do not blind me to the fact that they bear the brunt,” Corzine said of the MF Global victims.

Equally audible was his continued insistence that without access to the firm’s records he could offer no insight into the question foremost in everybody’s mind. He once more described in a word his reaction when he was informed the money was missing: “Stunned.”

He sounded as if he had yet to completely recover himself as he insisted that he still had no idea what happened to the funds. He was certain that he never even inadvertently authorized the improper transfer of customer funds in violation of the law. He remained unwavering in this regard during the question-and-answer period that ensued.

“Did you say, ‘We’ve got to find the money’?” Neugebauer asked of the time of the collapse.

The fact that Neugebauer could righteously demand to know if anybody had said anything put this proceedings in a sub-sub-sub-basement as marked by the distance between high office and low behavior. Neugebauer is the guy who last year shouted “baby killer!” on the floor of the House at a fellow congressman he deemed insufficiently resolute against abortion. Neugebauer then spent 12 hours pretending he never said it, owning up only in the face of multiple witnesses. He continued to insist he had been speaking of a bill, not a colleague.

Corzine nonetheless answered as if his questioner had the moral authority to ask. The reply was in the language of Wall Street.

“My CFO told me that there was an unreconciled difference with our segregated accounts.”

Corzine maintained that the firm had “policies and procedures” as well as an experienced and competent staff to prevent such things as a disappearing billion-plus.

“I relied on them,” Corzine said.

He allowed that he himself had little expertise in the mechanisms of moving and tracking money. He disputed an allegation supposedly made by an unmade MF Global executive that he had been aware of a $175 million transfer of segregated customer funds. He suggested that the sum in question was related to making good an overdraft at JPMorgan in London. He said he had been assured by MF Global’s general counsel, Laurie Ferber, and by a woman named Edith O’Brien in the Chicago “back office” that the transfer was in compliance with all applicable laws and regulations. He further denied even seeking special treatment because of his prominence as a former CEO of Goldman Sachs, not to mention a onetime U.S. senator and governor of New Jersey.

With regard to the missing $1.2 billion, various members of the committee declared themselves as astonished as any sensible person would be that such an amount could simply vanish in a way that nobody can explain six weeks later.

“No answer ... no clarity … Nobody knows anything,” said Rep. Steven Lee Fincher of Tennessee.

Corzine expressed total confidence that the mystery would be solved as the investigators untangle the particulars of MF Global’s chaotic final hours.

“I think this will be fact-dependent,” Corzine said.

After a half hour, the chairman called a recess so members could vote on what he termed important bills, an aide saying these prominently included bills for a commemorative coin and for the transfer of a land parcel in Alaska. Corzine stepped into the hallway with his wife, Sharon Elghanayan, and started for a witness room, only for a process server to appear and attempt to hand him papers for a lawsuit by Sapere CTA Fund, which had $95 million in an MF Global account.

“Speak to my lawyer,” Corzine said.

Corzine refused to accept the papers and the process server placed them on the floor. “You have been served,” the server said before the police took him off to be unceremoniously ejected.

“We usually take them to a loading dock,” a cop noted.

Another process server attempted to serve the former No. 2 at MF Global, Bradley Abelow, who again sat beside Corzine when the hearing resumed. Rep. Stevan Pearce used his turn either to express his outrage or to grandstand, or likely both.

“What hotel are you [in] here in the city?” Pearce inquired.

“The Ritz-Carlton,” Corzine replied.

“How many of the 36,000 clients that you defrauded have you called?” Pearce asked.

“None,” Corzine said.

“Have you created a scholarship for any of the families … just to help them with the college funds? Yes? No?” Pearce continued.

“Congressman, the answer is no,” Corzine said, in a resigned tone that suggested he felt he had the punishment coming, maybe even welcomed it a little bit.

The one questioner who seemed to rattle Corzine at all was Rep. Michael Grimm of New York, a former FBI agent who once worked undercover on Wall Street. Grimm spoke as if they were in an interrogation room, asking if it was possible that Corzine received special treatment simply because of his stature.

“It’s possible …” Corzine said.

“That’s all I need to know. Thank you very much,” Grimm said as Corzine attempted to qualify his answer.

Grimm proceeded to a Wall Street Journal report that MF Global had engaged in “window dressing,” lowering its debt just before a quarterly report only to pump it back up immediately afterwards. Corzine insisted he had not read the article.

“I don’t believe that answer,” Grimm said. “I don’t believe nobody called you and said, ‘Hey, did you see that article they wrote about you?’”

Grimm then honed in on Corzine’s Wall Street-speak.

“What is ‘unreconciled difference’? Does that mean there’s money missing from the account?” Grimm asked.

“It could mean we had money that moved that shouldn’t have moved,” Corzine replied.

Grimm inquired if there had even been “unreconciled differences” prior to the implosion.

“Not to my knowledge,” Corzine said.

“That’s good to hear,” Grimm said.

Had he been given an hour or two rather than the allotted 10 minutes, Grimm likely would have been able to wring from Corzine whatever he might be hiding, if he is indeed hiding anything

The third hearing ended as did the first two, with no significant revelations.

As a gaggle of regulators filed in to become the second panel of witnesses, Corzine departed, his still-admiring wife catching up with him in the huge Emancipation Hall. They passed a statue of Helen Keller, walking first with their arms around each other’s waist, then holding hands.

Love is so powerful that even after three hearings and with the $1.2 billion missing, and with the wrath of thousands of victims upon him, Corzine left the Capitol looking like a lucky guy. For a moment, anyway. It is only the beginning, and there’s much more to come.