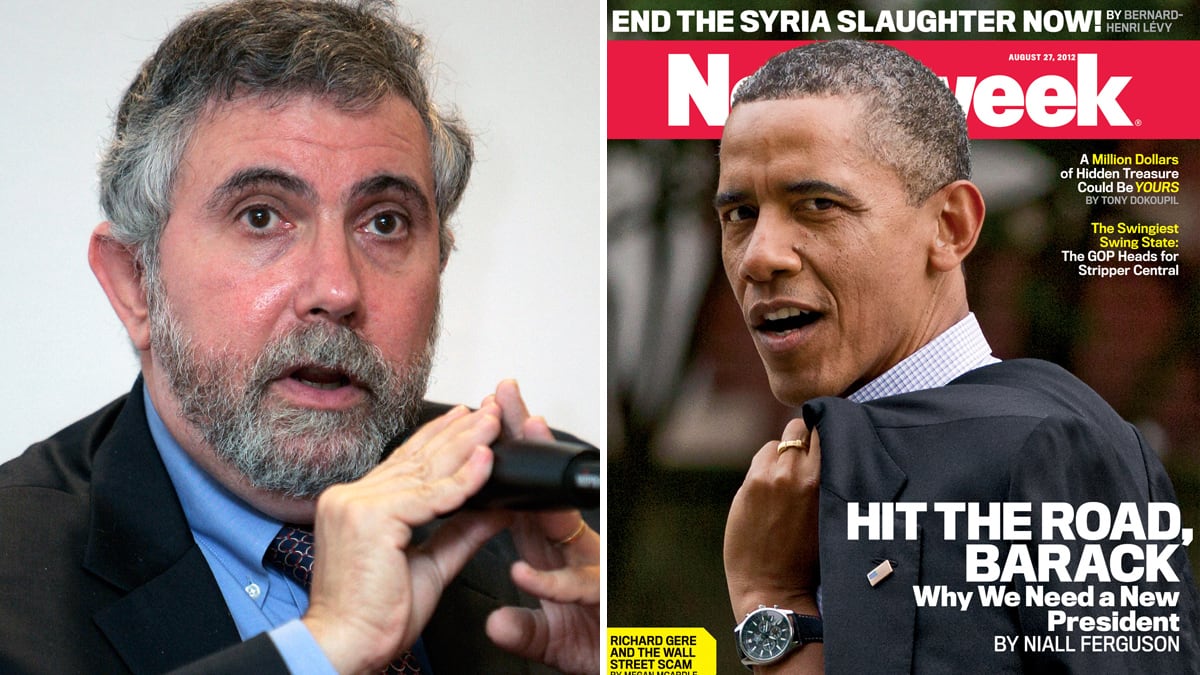

You know you have hit the target when Paul Krugman takes time out from his hiking holiday to accuse you of “multiple errors and misrepresentations” ... but can only come up with one truly feeble objection.

In my piece I say: "The president pledged that health-care reform would not add a cent to the deficit. But the CBO and the Joint Committee on Taxation now estimate that the insurance-coverage provisions of the ACA will have a net cost of close to $1.2 trillion over the 2012–22 period."

Krugman counters in his Conscience of a Liberal blog by saying: “The ACA would reduce, not increase, the deficit—because the insurance subsidies were fully paid for.” But I very deliberately said “the insurance coverage provisions of the ACA,” not “the ACA.” There is a big difference.

Krugman suggests that I haven't read the CBO's March 2010 report. Sorry, I have, and here is what it says:

“The provisions related to health insurance coverage—which affect both outlays and revenues—were projected to have a net cost of $1,042 billion over the 2012–2021 period; that amount represents a gross cost to the federal government of $1,390 billion, offset in part by $349 billion in receipts and savings (primarily revenues from penalties and other sources).”

But thanks for trying, Paul. You reminded me of a point I really should have made in my piece: that in pushing though ACA, Obama violated his most famous pledge of all—made on the campaign trail back in 2008—not to raise taxes on the middle class.

As the CBO report put it, the costs of the ACA will partially be met by “impos[ing] an excise tax on health insurance plans with relatively high premiums [and] impos[ing] certain taxes on individuals and families with relatively high income.” But that’s not all. The fines imposed on people not complying with the ACA will also be a source of revenue. As the Supreme Court ruled back in June, those too are a tax.

In March of this year, the CBO estimated that during the next decade, the total revenue from the “mandate tax” and other ACA taxes would exceed $400 billion. That’s quite a tax hike. But it is far short of the gross cost of the insurance provisions, which is why the net cost is still over a trillion.

If you are wondering how on earth the CBO was able to conclude that the net effect of the ACA as a whole was to reduce the projected 10-year deficit, the answer has to do with a rather heroic assumption about the way the ACA may reduce the cost of Medicare. Here’s the CBO again:

“CBO’s cost estimate for the legislation noted that it will put into effect a number of policies that might be difficult to sustain over a long period of time. The combination of those policies, prior law regarding payment rates for physicians’ services in Medicare, and other information has led CBO to project that the growth rate of Medicare spending (per beneficiary, adjusted for overall inflation) will drop from about 4 percent per year, which it has averaged for the past two decades, to about 2 percent per year on average for the next two decades. It is unclear whether such a reduction can be achieved ...”

Indeed, it is, which is why I wrote what I wrote.

In other words, there is a big difference between “the net cost of the insurance-coverage provisions of the ACA” after $400 billion in new taxes have been collected and the total net budgetary impact of ACA, which will be deficit reducing only if Medicare costs grow more slowly.

I suggest Krugman reads a wee bit more carefully before his conscience next starts blogging.