Four years have passed since Lehman Brothers’ collapse; two since Obama signed financial reform into law; one since the occupation of Zuccotti Park. But the Justice Department has yet to convict a single high-profile banker. And despite the Dodd-Frank reform package, critics suggest that the system is hardly safer than it was in 2008—from JPMorgan’s beached “whale” to MF Global’s missing billions. In a recent report (PDF), the International Monetary Fund called the capital markets just as “vulnerable” to crash and fraud as they were four years ago.

Why? There’s no simple, satisfactory answer. But in recent weeks, memoirs by crisis insiders, like former Federal Deposit Insurance Corporation Chairman Sheila Bair, have shed new light. Interviews with officials -- from former senator Ted Kaufman to former Justice Department prosecutors -- lend further color to the crystallizing narrative. The Obama Justice Department was too timid and short-staffed to hunt down the bad guys. The White House, Treasury Department, and Federal Reserve stifled or sold out real financial reform, leaving megabanks too big to fail, and dangerous crisis-era practices untouched.

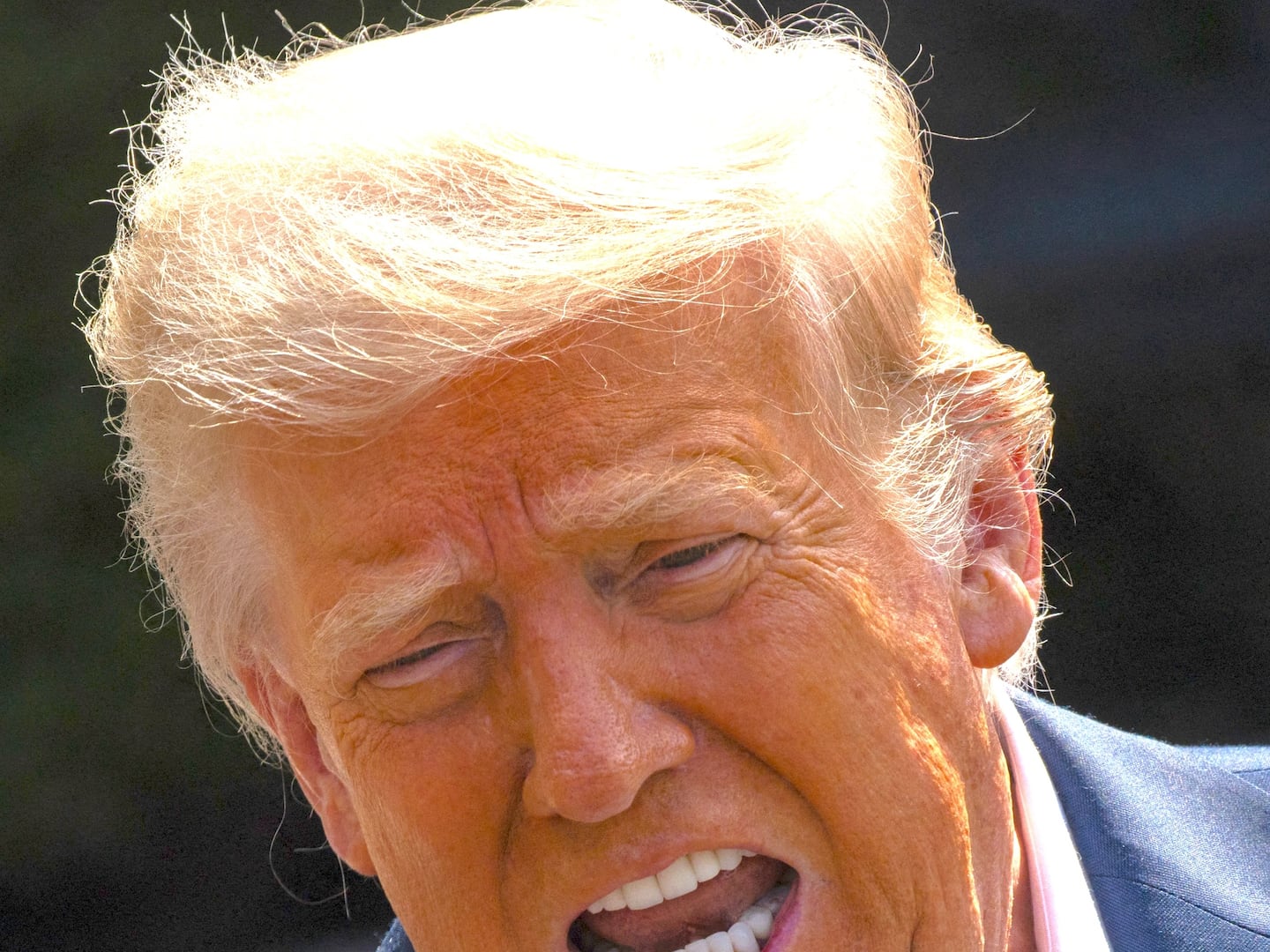

Months after taking office, Obama told the CEOs of the nation’s third biggest banks, “My administration is the only thing standing between you and the pitchforks.” It has served as an effective shield.

In a departure from previous administrations, Eric Holder’s Justice Department won’t say how many bankers it has convicted. President Obama formed a “Financial Fraud Enforcement Task Force” in November 2009 to “hold accountable those who helped bring about the last financial crisis.” The current group says that the department is “working hard to investigate and prosecute” Wall Street “criminal activity,” and has sent many mortgage fraudsters to jail.

But the Obama administration has generally chosen to pursue institutions over individuals. As the head of the Justice Department’s Criminal Division, Lanny Breuer, put it in a speech in September 2012 at the New York City Bar, “our prosecutors … know the difference between a rogue employee and a rotten corporation.” Last February, the Justice Department settled with five of the nation’s biggest banks, which agreed to pay homeowners a collective $25 billion over charges of mortgage fraud. In July, it settled with Wells Fargo for $175 million over predatory subprime lending, targeted at minorities.

Sure sounds rotten. But none of these settlements entailed admissions of wrongdoing. And the price tags are little more than the cost of doing business. Meanwhile, Wall Street bankers have generally remained safe from criminal prosecution. Last month, the Justice Department declined to prosecute Goldman Sachs in a financial fraud probe. Former senator Ted Kaufman, appointed to fill Vice President Joe Biden’s senate seat in late-2008, says that the lack of individual prosecutions—of those who lost billions, not millions—is “a cause for wonderment.”

The Justice Department’s task force was a successor to Bush’s version, established after Enron. Neil Barofsky, later appointed chief cop for TARP, served on Bush’s and Obama’s. He characterized both as having “a lack of sophistication and high degree of timidity” when it came to financial crime. After 9/11, the lion’s share of its resources was redirected to counterterrorism, said Barofsky and a former Justice Department official. And many staffers lacked the accounting wherewithal to untangle the complex and toxic derivative products at the crisis’s ground zero, Barofsky added. The “inability of prosecutors to wrap their heads around [these] cases was somewhat stunning,” he said. Cases the FBI or Justice Department didn’t have the time or money to pursue were handed to the Postal Service. The taskforce “was much more of a press release repository,” says Barofsky. “They took preexisting cases and marketed them.”

Senator Kaufman and his former chief of staff, Jeff Connaughton—author of a new book—recall several frustrating meetings with Justice Department officials. In September 2009, Kaufman met with Lanny Breuer, then Assistant Attorney General for the Criminal Division, to ask why so few cases were underway. According to Kaufman and Connaughton, Breuer explained that “we take the cases the FBI brings to us.”

In an interview, a high-ranking Democratic official and Justice Department veteran called that explanation “disturbing … While some federal prosecutors might just sit and wait to see what comes through the door, the good ones are ready, willing, and able to initiate investigations on their own.” As Barofsky puts it, “I’d be hard pressed to say if a single additional case was made becomes of one of these task forces.” Kaufman adds: “It was pretty damning that there were no referrals from the regulatory agencies on this.”

Connaughton says that Kaufman’s office then called a U.S. attorney's office, a full two months after the Breuer meeting, to ask about prosecutions progress. The office told the senate staff that the Justice Department had only just been in contact, “asking [them] if they were working on any financial fraud cases.” By then, says Kaufman, “the trail had gone cold” on several promising cases, from Washington Mutual’s mortgage lending fraud to charges of false reporting at the ratings agencies. In late-November, 2009, the Justice Department lost its high-profile case against two Bear Stearns hedge-fund managers: a huge blow to morale.

Money was also shorter than anticipated. While the Fraud Enforcement and Recovery Act had approved $165 million in new funds for the Justice Department, the Senate Appropriations Committee only approved $30 million.

The New York Southern District, Barofsky says, had a better understanding of financial fraud. But according to Kaufman, Connaughton, and another member of the senator’s staff, Ray Lohier, the head of the Southern District’s Securities Fraud Division, didn’t make financial crime Lohier’s “top priority” in 2008 and 2009, when the trail was still hot. According to Kaufman, Lohier told the then-senator that his “top priority” was “cybercrime”—that is, the threat that hackers pose to large banks. Kaufman was incredulous. “I’m spending every day trying to put these guys in jail, and he responds ‘cybercrime’?” the former senator said. “That was a genuine shocker.”

Kaufman also met with SEC enforcement division director Robert Khuzami, Connaughton later wrote. Asked about the relatively small fines his agency was handing down—then capped on $725,000 per offense for firms—Khuzami responded, “I’m not losing any sleep over them,” as Connaughton wrote.

The explanation, say insiders, was simply fear. As the Justice Department’s Lanny Breuer said in a speech earlier this month, “I have heard sober predictions that a company or bank might fail if we indict [them] … even that global markets will feel the effects. Sometimes—though, let me stress, not always—these presentations are compelling.”

The lack of prosecution might be easier to swallow if the banks had been prodded to change their ways. But in the aftermath of the crisis, legislative efforts to institute systemic changes were resisted or outright blocked by the White House, the Treasury, and the Fed. One such effort was a 2010 amendment, proposed by then-Senator Kaufman and Senator Sherrod Brown (D-Ohio), to cap the size of a single bank’s assets to 10 percent of GDP—at the time, that would have required breaking up JPMorgan, Wells Fargo, and Bank of America. As recently as this July, Sandy Weill—the creator of the original superbank, Citigroup—endorsed this proposal.

As has been well documented, Larry Summers, then director of the National Economic Council, and Treasury Secretary Tim Geithner fought this and other reform efforts. Both tried privately to dissuade Senators Brown and Kaufman from pursuing their amendment, and asked other lawmakers to vote against it, according to Kaufman and his staffers. Instead, Geithner reached across the aisle to recruit Republicans in an effort to “water down” extant Dodd-Frank proposals and kill the Brown-Kaufman amendment, writes former FDIC chair Sheila Bair in her just-published memoir. As Kaufman told me, he was “surprised” that he couldn’t “get some Republicans” to vote for his bank breakup.

Major Democrats also apparently worked to undermine the proposed reform. According to Connaughton, Connecticut Senator Chris Dodd left Kaufman an angry voicemail, warning him to “stop saying bad things about my bill.” And as it was being debated in the senate, California Senator Dianne Feinstein dismissed the amendment with the words “This is still America, isn’t it?” wrote Connaughton. Changing tack this July, Feinstein told Bloomberg that a bank-break-up proposal “warrants further consideration.”

The Brown-Kaufman amendment died 33-60 on May 6, 2010. “We got pretty well clobbered,” said Kaufman. Beyond Brown-Kaufman, other proposed reforms fell aside or were delayed. After the federal bailout of Citigroup, Bair and others proposed stricter conditions on the money center bank, including higher capital ratio requirements. Geithner, then head of the New York Fed, again said no. “Tim seemed to view his job as protecting Citigroup from [the FDIC],” wrote Bair, “when he should have been worried about protecting the taxpayers from Citi.”

Finally, efforts to regulate high-frequency trading, which was partly responsible for the 2010 Flash Crash and last month’s chaos at Knight Trading, were ignored by the Securities and Exchange Commission (SEC), said members of Kaufman’s office. In October 2009, the then-senator told SEC Chair Mary Schapiro, “I don’t believe you’re going to do anything about high-frequency trading.” She responded, “You just watch.” But the SEC wouldn’t enact HFT rules until July 2011—and those were preliminary. This February, Schapiro said, “While we haven’t landed on concrete things that we will do next, [many] ideas are live and subject for discussion within the agency.”

Although the president has poured hot rhetoric on the Wall Street set, his policy has been far sweeter: no major prosecutions, few major banking reforms, a stock market that has doubled in the past three years, and a new round of monetary stimulus—one that will make for a very happy Christmas on Manhattan’s trading floors.