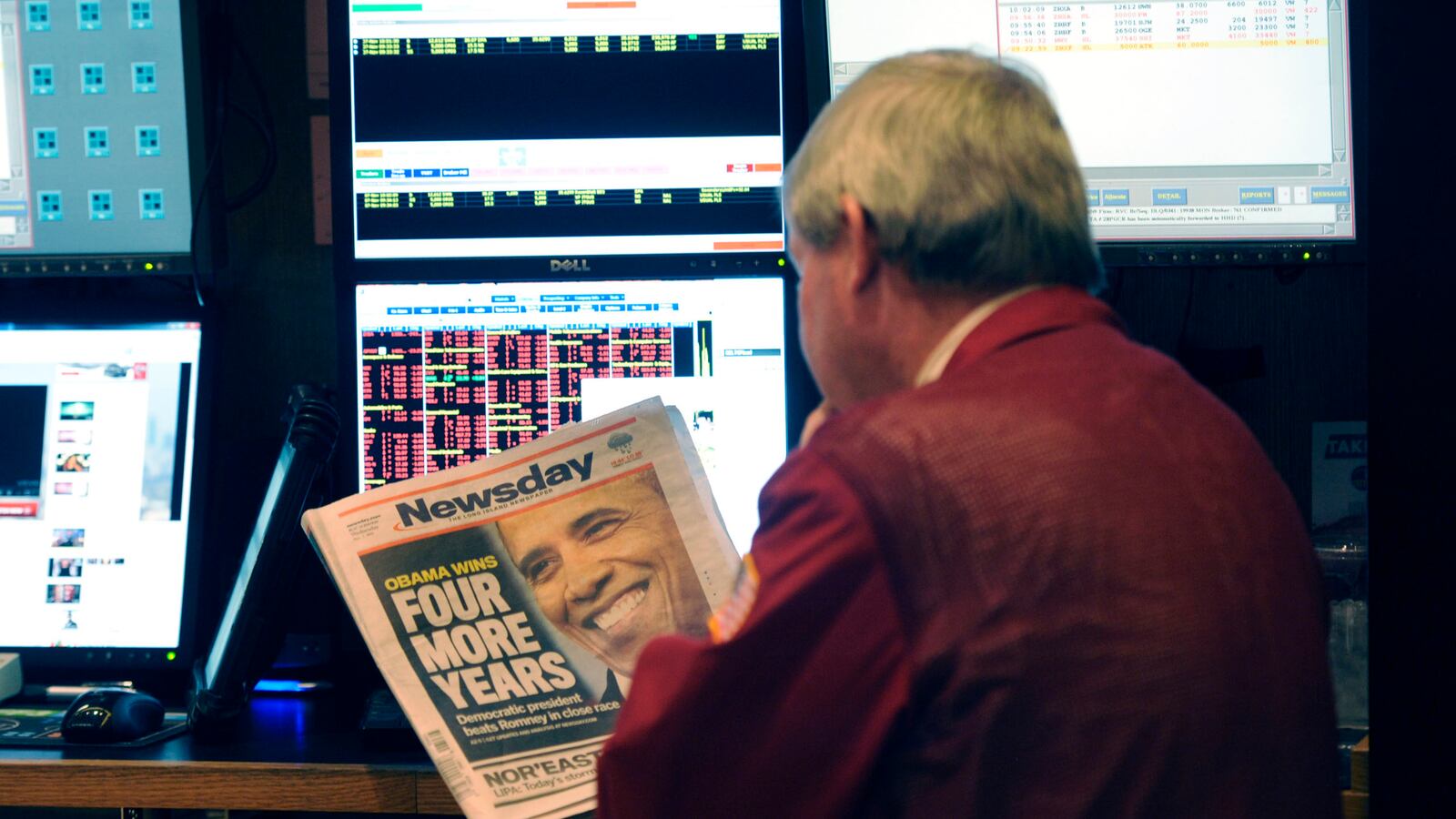

With the election behind us, the financial-political complex now has another source of uncertainty to lose sleep over: the fiscal cliff. If Congress and the White House fail to come to terms by Jan. 1, 2013, taxes on income, dividends, and capital gains will soar to their pre-Bush levels—as they were originally designed to at the end of 2010. Meanwhile, a set of self-imposed automatic spending cuts will kick in simultaneously. If the spending cuts and tax increases last for a year, many analysts believe it would reduce economic growth enough to throw the economy back into recession.

This is dire stuff. And so before the election returns were even fully counted, the responsible parties began to posture and talk about the need for a deal—President Obama, Senate Majority Leader Harry Reid, and House Speaker John Boehner. Surely, this time Democrats and Republicans will be able to come together and reach a deal? I wouldn’t bet on it. But no deal may not be such a bad thing, either.

For much of the last two years, during the negotiations over the debt ceiling and budgets, there was a mismatch between the two negotiating parties. Simply put, there was no middle ground. President Obama badly wanted a large deal on deficits and taxes, in large part because he wanted to be seen as being able to govern a divided Washington. But Republicans were intent on denying him a deal for two reasons. One, they didn’t want to legitimize his presidency and make him look good by striking a deal. And two, even if they were in a mood to make a deal, asking congressional Republicans to sign off on a tax increase is like asking an Orthodox Jew to eat a lobster-and-bacon club sandwich on Saturday: it violates a host of taboos. When the Republican presidential candidates said at the debate that they wouldn’t accept a deal that cut 10 dollars in spending for every dollar in tax cuts, they really, really meant it.

As far as the fiscal cliff, this week’s election changed nothing—and it changed everything. It changed nothing because it preserved the status quo: a Democrat in the White House, a non-filibuster-proof Democratic majority in the Senate, and a Republican majority in the House. After the election, the parties simply restated their positions. Sen. Reid said they should start talking about a deal that must include higher taxes. House Majority Leader John Boehner said there could be no deal with higher tax rates, which left the door open for higher revenue through tax reform. Senate Minority Leader Mitch McConnell essentially said he wasn’t interested in a deal. For the past two years, every time Washington has set up a Deal or No Deal situation, it would have been smart to bet No Deal. And from this perspective, today is no different.

So how did the election change everything? Republicans essentially went all in on a Romney victory. They avoided making a deal and held out for the maximum gains that would ensue if Romney were to win—an extension of the Bush tax cuts, plus further tax rate reductions. But they lost. Big time. And come Jan. 1 they, and not President Obama, will be the supplicants. If no action is taken between now and Jan. 1, one could argue that it is the Republicans who will suffer the most. Yes, the middle class will suffer as the payroll tax cut expires, and many will pay a little more in income taxes. But as Mitt Romney so eloquently noted, lots of people don’t pay taxes on income. Rather, the wealthy will suffer disproportionately as they tumble over the fiscal cliff. They’ll see taxes on their income rise, as well as taxes on capital gains and dividends, and taxes on their estates. The hedge fund and private equity industry, which, thanks to the carried interest loophole, pays low long-term capital gain rates on its income, could face a doubling of tax rates. The billionaires who invested so much in ineffective anti-Obama ads (some of which ran in uncontested states like Texas and Connecticut) are going to be quite angry. Karl Rove took their money and delivered nothing—except for higher taxes. Meanwhile, Republicans will be hearing about the arbitrary budget cuts from defense contractors, hospital companies, and other businesses that rely on tax funds for their revenues.

Of course, President Obama doesn’t want to preside over big tax increases and arbitrary spending cuts. But with his last election behind him, he has a much greater capacity to weather economic pain than he did a year ago. And the cliff actually helps Obama achieve two stated goals: cutting the annual deficit and making the tax code more fair. The changes in policy that result from simply doing nothing will reduce next year’s budget deficit by several hundred billion dollars—more deficit reduction than any grand bargain would provide. The Congressional Budget Office says (PDF) the fiscal cliff would lead to $607 billion in deficit reduction in fiscal 2012 and fiscal 2013. (Take that, Bowles-Simpson!) And for the last several years, Obama has campaigned on the proposition that the wealthy should pay a higher share of their income in taxes. Come Jan. 1, they will.

Most significantly, the cliff will change the negotiating dynamic. After January 1, 2013, for the first time in several years, Republicans will desperately need and want something from the President. As CEOs, investors, and lobbyists wail, Republicans will only be able to deliver if they can coax President Obama into a deal. They can jump up and down and demand that Washington cut taxes on the very wealthy at a time of high budget deficits. And if Blackstone Group CEO Steve Schwartzman—who once compared the Obama administration to the Nazis, wants his low tax rate back—he can call the White House. Good luck with that. President Obama can counter with a more modest list of tax cuts that benefit the middle class. Or he can do what Republicans told him to do for much of Obama’s first term: tell your negotiating counterparty to go pound sand and come back with a better offer. At the bottom of the cliff, the rejectionist shoe will be on the left foot.