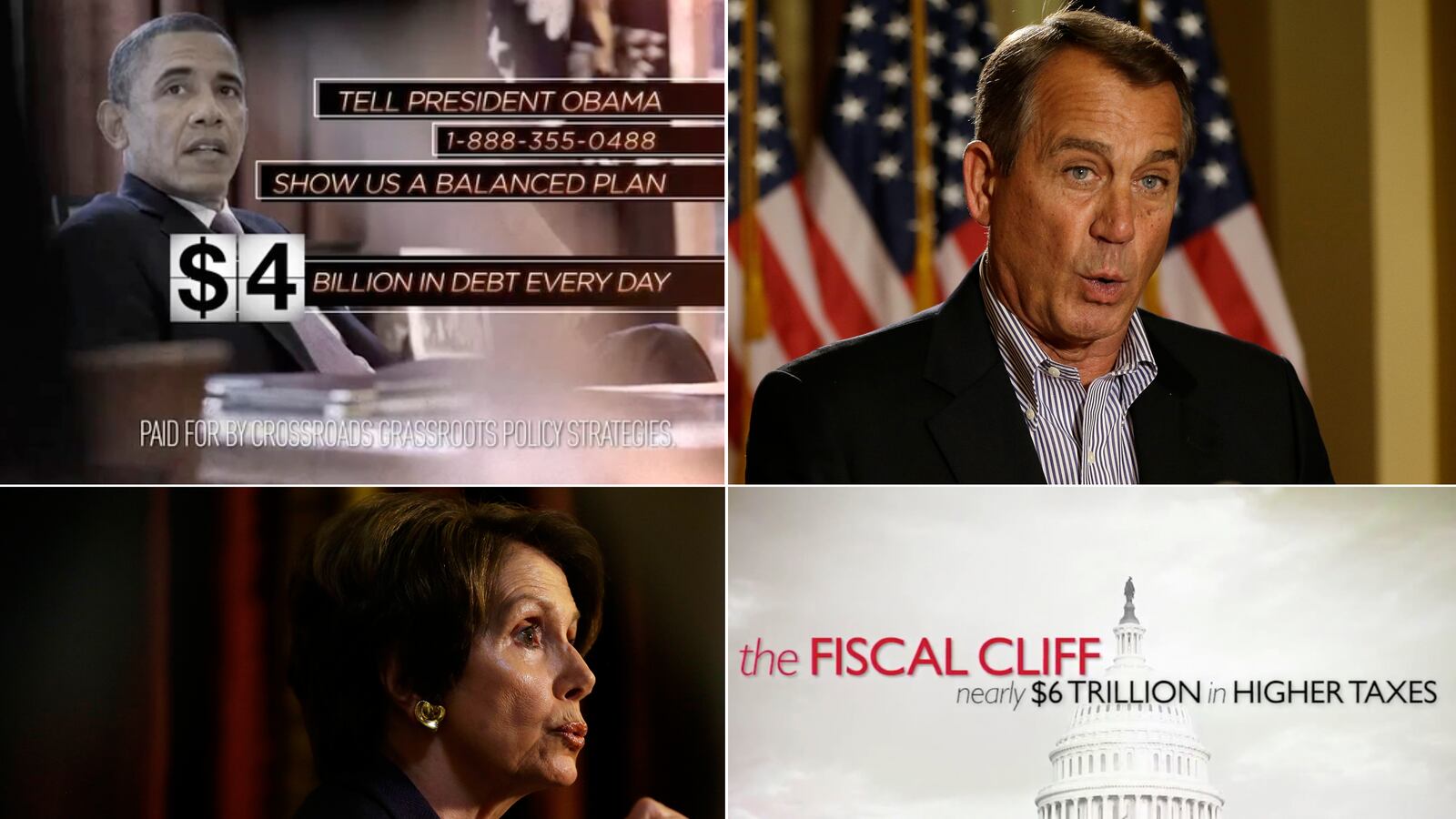

Fiscal Cliff Hostage Situation. Day 31. There was little progress on a slow Friday.

But as we contemplate the fiscal cliff, and the very contentious issues surrounding taxing and spending, it’s worth stepping back to look at the big picture.

Here’s another way of looking at the conflict. The Democrats want to protect the really expensive social welfare entitlements they created many years ago, like Social Security and Medicare. These are among the Democratic party’s greatest legislative achievements of the 20th or any century. Hence the Democrats are the party of entitlements. Republicans, for their part, want to protect their greatest legislative accomplishment in recent history: the Bush-era tax cuts. Hence the Republicans are the party of tax cuts. And that explains why both sides are so reluctant to cut a deal, and so eager to exact a heavy price. Democrats want Republicans to sign off on and participate in the partial destruction of the Bush tax cuts. Republicans want Democrats to sign off on and participate in the partial destruction of Social Security and Medicare. What’s needed isn’t just a compromise, but a willingness to tarnish both parties’ legacies.

The Republicans are particularly wedded to this view. Harvard political scientist Harvey Mansfield recently told The Wall Street Journal, “We have now an American political party and a European one.” The Democrats (the Europeans, in case you couldn’t guess) are for entitlements, which are bad. “Entitlements are an attack on the common good,” Mansfield said. And in the Republicans’ view, Obamacare simply adds to the list of costly, expensive entitlements that Democrats have passed over the years.

Of course, this worldview overlooks a couple of very important points. Yes, Social Security and Medicare are expensive entitlements. But they were created with financing mechanisms—payroll taxes—that were designed to fund them all (in the case of Social Security) or in part (in the case of Medicare). Obamacare also partially funds itself through taxes. So when they created open-ended, popular entitlements, Democrats proposed and enacted unpopular ways to pay for them.

But several years ago, when the Republicans led the charge to create a huge, new, open-ended entitlement, they simply refused to fund it at all. And because the cost of that particular entitlement is rising more rapidly, the failure to do so is contributing significantly to deficits over the coming decade.

I’m talking, of course, about the Medicare Prescription Drug benefit, known as Medicare Part D. It was passed in 2003, and could be described as a “gift” to the elderly in advance of the 2004 election. The notion was that the government would pay for all or a chunk of the increasingly expensive drugs that the world’s pharmaceutical companies had concocted to improve the quality of life.

Medicare Part D, which went into effect in 2006, was a Republican project—designed by the Bush White House, and passed by a Republican-controlled House in a fine example of party discipline. (The vote was held open on the floor until the House leadership could twist enough arms.) What’s more, the law prohibited the government from negotiating too aggressively with drug companies on price. There was no effort to enact a new payroll tax, or a new tax on pharmaceutical companies, or any other way to pay for the benefit. It was just presumed that the costs would be borne by taxpayers.

Fast forward several years. Medicare Part D is a popular and expensive benefit, in part because the population is aging, and in part because medications are becoming more expensive. In 2011, Part D cost $65.8 billion, or about 11.6 percent of total Medicare mandatory outlays. But over the next 10 years, the cost of Medicare Part D is poised to explode, thanks to the pre-existing trends, and because Obamacare expands the coverage.

Looking out over the 10-year period spanning fiscal 2013 through fiscal 2022, the total cost of Part D is about $1.165 trillion. Back out some clawbacks—the portions of the premiums that people pay, and it’s still huge. “The cost is $1.17 trillion gross, but $990 billion after netting out premiums and clawbacks,” said Edwin Park, vice president for health policy at the Center for Budget and Policy Priorities.

Annual expenditures are expected to rise from $71.1 billion in 2013 to $184.3 billion in 2022. That’s a huge increase—160 percent over 10 years. Virtually every year, the cost is expected to rise by about 10 percent, compounded. That’s a much more rapid rate than is expected in the other components of Medicare, which pay providers and hospitals. And as a result, Part D will account for about 18 percent of total Medicare spending in 2022.

Park notes that some of the increase can be ascribed to the Affordable Care Act, i.e., Obamacare, which provides more generous benefits. (About $86 billion over 10 years.) But Park says it also has to do with the design of the program. Under Medicaid, the government essentially dictates the terms at which it buys pharmaceuticals. Under Medicare Part D, private insurance companies administer the program. “Basically, the insurance companies are doing a poorer job getting lower drug costs than Medicaid,” said Park.

All of which is to say that a reasonably large chunk of the Medicare spending and funding mess can be ascribed not just to Democrats, who don’t want to make significant changes to the program, but to Republicans, who vastly expanded the program without even bothering to think about funding the expansion.