The former CEO of America’s second-largest investment bank, a former treasury secretary of the Treasury and one of America’s most sought after economic gurus, and America’s most famous technology analyst all have something in common besides vacation plans that overlap in Aspen and Davos: they sit on the board of a smallish company that specializes in helping low-risk borrowers pay off their credit card debts.

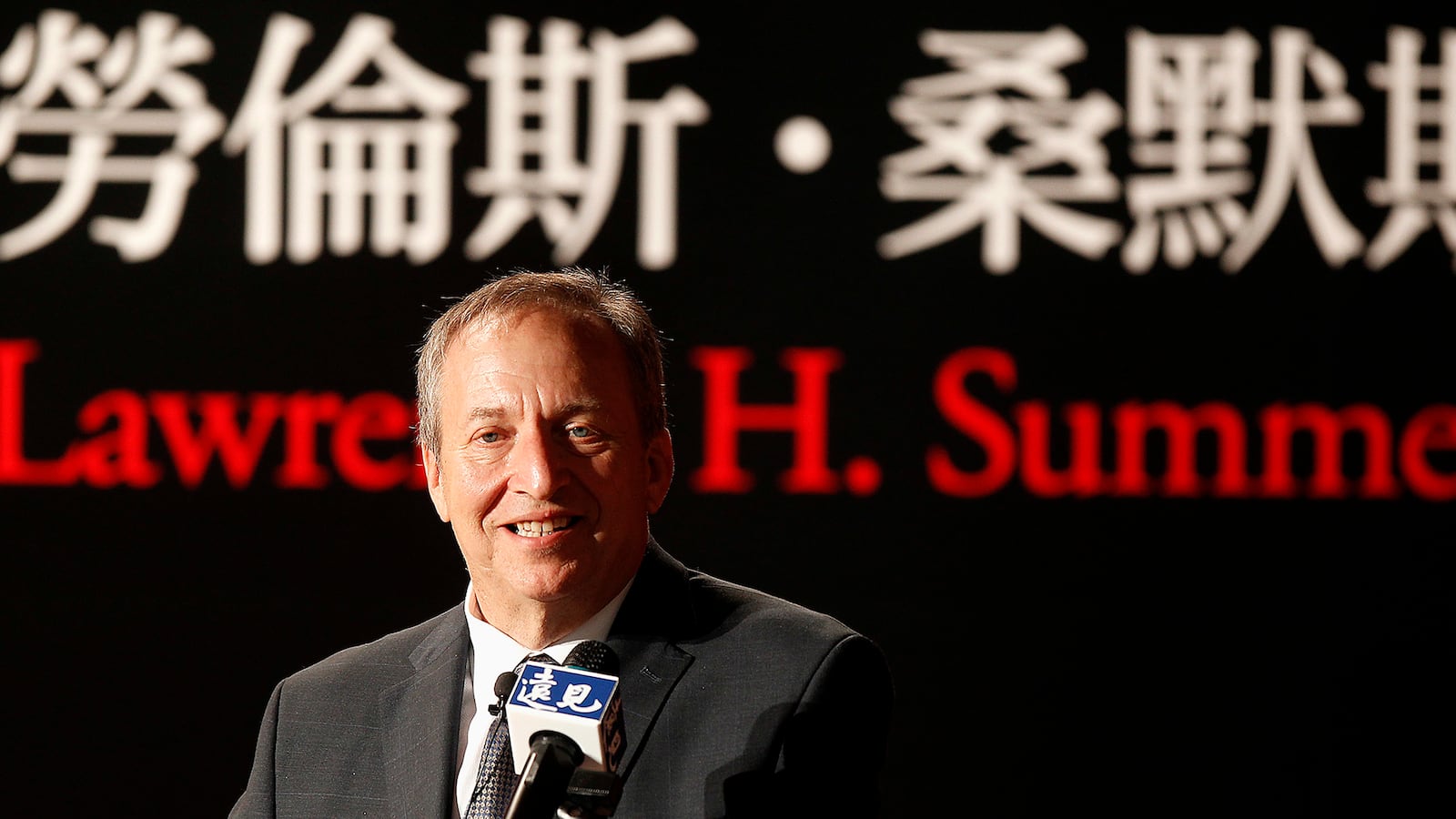

The illustrious trio is John Mack, former CEO of Morgan Stanley; Mary Meeker, the famed technology stock analyst and partner at the venture capital firm Kleiner Perkins Caufield & Byers; and Larry Summers, who was appointed to the board of the San Francisco–based finance startup today. The company, started in 2006, is one of a new breed of financial firm: a peer to peer lender. TechCrunch, the John the Baptist to the assorted Messiahs of Silicon Valley, regularly writes about the company and sings its praises. It has been anointing its model and that of the entire peer-to-peer lending industry as disruptive. (In Silicon Valley, there is no higher compliment.)

A typical bank takes in deposits and then lends out money, and keeps the difference between the interest rate paid to its depositors and the rate paid to its borrowers. By contrast, Lending Club allows individual lenders to be connected to borrowers who meet criteria specified by Lending Club. By focusing only on low-risk borrowers—Lending Club plays almost exclusively with “prime” and “super prime lenders, rejects 90 percent of applicants, and borrowers have an average credit score of 715—it is able to present a wide range of relatively safe lending opportunities. Renaud Laplanche, the co-founder and CEO, describes Lending Club borrowers as largely young professionals with high incomes who haven’t necessarily built up a ton of savings or home equity.

Before the housing crash, people were able to get home-equity loans on easy terms, which allowed them to take money out of their homes and add another room to their house, pay off credit-card debt, splurge on a wedding, and so on. But with those heady days over, people are instead putting more equity into their homes and paying off mortgages as fast as possible.

So, there’s a demand for a type of loan that isn’t a credit card but allows people with assets or high earning potential to get credit on reasonable terms. But Laplanche says that Lending Club’s competitors are really credit-card companies, not home-equity lenders. Why? For a $12,000 loan, he says, “it doesn’t make a lot of sense to go through 50 pages of documentation” that a home-equity loan requires.

Lending Club is also able to fill a niche created by the Federal Reserve’s four-years-and-running policy of near-zero interest rates. Banks are able to fund themselves at near-zero rates while still charging 18 or so percent on credit cards. Lending Club, by having lower costs than its lumbering competitors, can give some of that spread back to the lenders while still saving something for itself. “We can walk right in and give that spread back to borrowers and give more to investors more attractive than other investment options,” explained Laplanche. Also, the low-interest rates on traditional investment options like treasury bonds, bank deposits, and corporate debt have plummeted. So that makes the 5.7 percent to 13.5 percent returns you can get from Lending Club look even more attractive.

However, Laplanche insisted, the company is not only successful because of the strange macroeconomic times we live in. Instead, he argues, that the spread will still be there when interest rates go up, because credit-card rates (and the interest rates on other investments) will go right up with them. But, from the perspective of the investors, the high-ish returns combined with a 2.42 percent default and delinquency rate look quite good compared to the 6 or so percent investors can get on high-yield (i.e. riskier) corporate debt.

Lenders don’t lend directly to borrowers, as is the case with some peer-to-peer lenders. Rather, investors buy “notes” from Lending Club that are graded A through G according to the risk of default. The notes, which sell for $25 or more each, have annual returns ranging from 5.7 percent for the least risky (the “A Notes” ) to 12.2 percent for the most risky “G Notes.” The loans run for three or five years, which means 36 or 60 months of steady payments for the investors. For a borrower, these notes add up to a loan, which they then have to pay back over the term. The interest rate ranges from just over 6 percent for a three-year, highly rated loan to just under 25 percent for the most risky, five-year loans. Lending Club is able to charge these lower rates because they reject around 90 percent of their applicants. Lending Club then makes money by charging fees to both borrowers and the lenders.

Seventy-five percent of borrowers use their Lending Club financing for debt consolidation or credit-card debt. As Laplanche explained, despite rock-bottom interest rates on government debt, bank deposits, and corporate debt, credit-card rates are stubbornly high at around 18 percent. Lending Club is able to offer lower rates because it is solely pricing the risk of default. The company also has a suite of underwriting tools that, according to Laplanche, use individual credit histories along with a range of economic, behavioral, and geographic data to individually price the riskiness of the loan. Credit-card issuers—big banks like JPMorgan Chase—on the other hand, can’t do much fine-grained analysis of a credit-card user. That’s because credit cards aren’t just a way to get credit; they’re an expensive payment mechanism that only works for the company when they’re used by millions of people.

This means that a credit-card user who regularly pays her entire balance every month, and therefore pays no interest, is using an extensive payment system for free, which is being subsidized by the 18 percent annual rate (and all the fees) charged to the credit-card user who keeps a balance. By allowing people to get a loan at, say, 8 percent, to pay down $8,000 dollars worth of credit-card debt, Lending Club is allowing people to finance their purchases with interest rates adjusted to their risk profile instead of the risk profile of an entire population of credit-card users.

Lending Club surpassed $1 billion in loans originated and became cash-flow positive in November. And as with any start-up attracting big names and big money, there’s rampant IPO speculation.

So why do these luminaries want to sign on with a company that uses lots of technology and an attractive funding mechanism to help yuppies pay their credit card bills? Laplanche said that Meeker, Mack, and Summers “saw the potential for the transformative impact that Lending Club can have on the financial system.” They said that all three are “interested and curious about technology and innovation” and that they see Lending Club as “a perfect combination” of technology and finance.

All three, it should be noted, have acquired some level of notoriety. Summers encouraged and oversaw financial deregulation as Treasury Secretary under Bill Clinton, Meeker was one of the most enthusiastic boosters of the tech bubble, and Morgan Stanley under Mack’s watch almost went under. It took billions of dollars in government aid and a massive investment from Mitsubishi to avoid disappearing altogether.

In the case of the financial system in which the three high-profile directors thrived, reckless, massive peer-to-peer lending among giant banks ended in disaster a few years ago. Let’s hope the smaller scale effort they’re helping to oversee doesn’t end in tears.