“The road goes on forever, and the party never ends”—a great folk lyric but a lousy fiscal policy.

I’m no economist. I don’t even play one on TV. I’m just a husband, a father, a taxpayer. And like many in America, I am weary. I’m weary of the way Washington works. More accurately, I’m weary of the way Washington does NOT work.

The fiscal cliff “fix” fixed nothing. Half of the new tax revenue raised in the “compromise” legislation is consumed by new spending. Few actual cuts were made. And we are still heading for another record trillion dollars in deficit spending this year.

We’re broke. We can’t kick the can any further—the road has come to an end.

The federal government has once again breached its borrowing limit. With more than $16.4 trillion of debt and a debt-to-GDP ratio unseen in 70 years, a shutdown showdown is likely in the next two months, unless Congress agrees to once again raise the debt ceiling.

But let’s get real. If your 16-year-old daughter kept maxing out your credit card, would you believe her promises to reform her runaway spending habits if you raised her credit limit—just one more time?

Well, it’s not just your daughter running up the bill. The folks in D.C. are doing it, too. And as a taxpayer, your share of that overspending is already more than $145,000.

But hold your wallet tight. It’s gonna’ get worse.

Entitlement programs already account for nearly 62 percent of all federal spending. And with 10,000 aging baby boomers reaching eligibility every day, Medicare and Social Security are nearing insolvency.

We are going to be even further in the hole. And it’s our sons’ and daughters’ futures we’re borrowing against.

It’s time for new thinking. It’s time for the parties to fight for America—not against each other. Here’s a few thoughts:

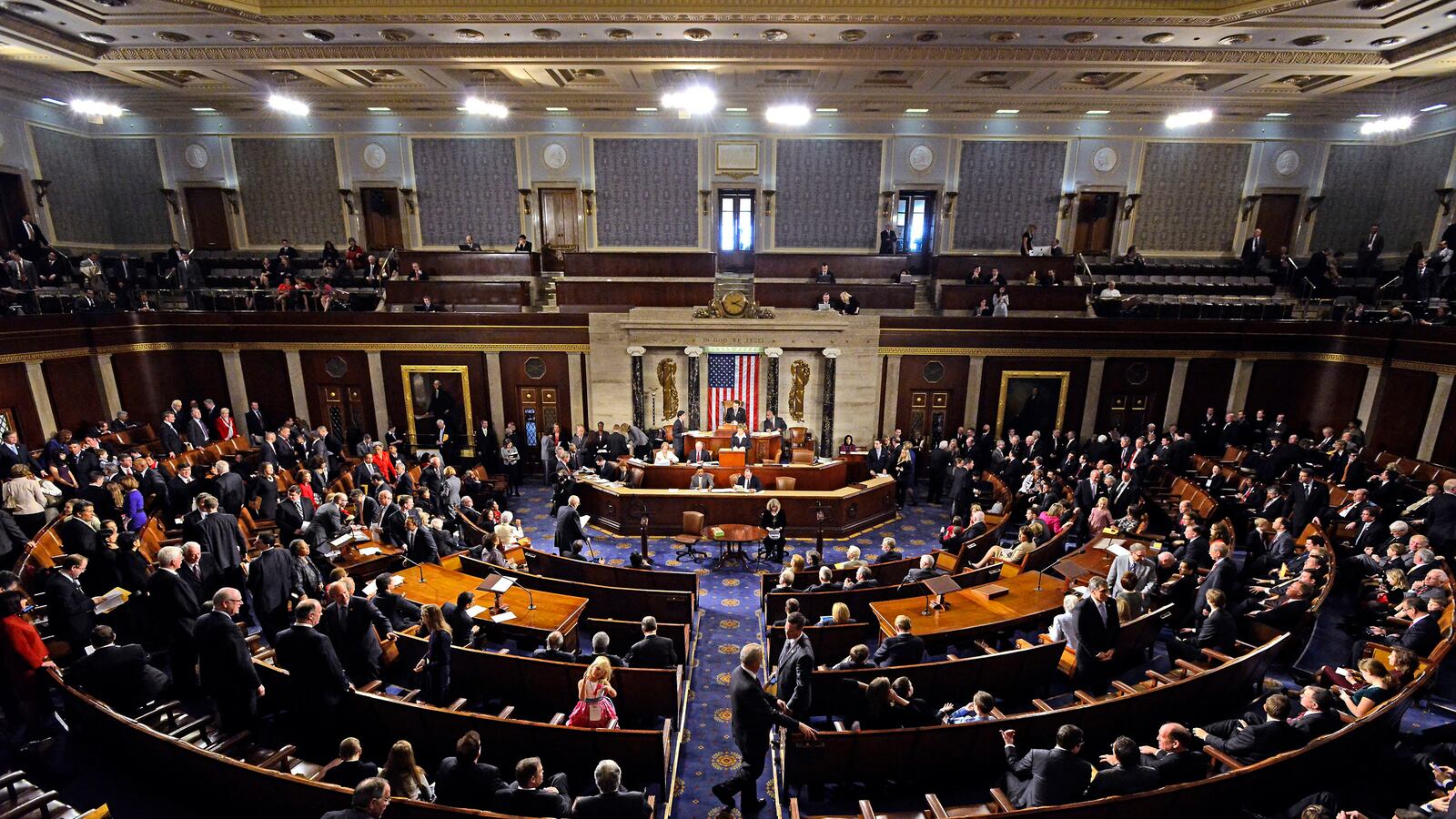

No budget? Then no pay. The Senate has not passed a budget since April 29, 2009. No wonder Congress has such a low approval rating. The budget process is intended to force Congress to set priorities and ensure some transparency in how our tax dollars will be spent. If Congress is not doing its job, why are they getting paid? Sen. Dean Heller has been a great champion of this idea, and it now has about 100 cosponsors in the House and Senate. And the powerful Republican committee chair Dan Lundgren, who refused to hear the bill last session, was defeated by newcomer Ami Bera largely on the strength of this issue.

Use one set of books. Forget the $16.4 trillion in public debt for a moment. Current unfunded liabilities for Social Security, Medicare, and federal employees' future retirement benefits exceed $86.8 trillion, but these financial obligations do not appear on the balance sheet. Why do we hold the federal government, our largest publicly held institution, to a lesser standard of transparency than Exxon?

Let sequester cuts take effect. Washington has again postponed the inevitable until March, when $1.2 trillion in automatic cuts spread over 10 years begin to take effect, with half of that hitting defense spending. Yes, it is illogical since defense represents less than 20 percent of the budget, but the true conservative answer cannot always be to “spend more” on defense. If we can easily see ways to cut costs in the Department of Education, we should not be blind to opportunities in the Pentagon.

Match any increase in the debt ceiling dollar-for-dollar to actual cuts. This does not require any understanding of “new math.” It is common sense—at least in the real world. If you always spend more than you have, you will never get out of debt. The president’s own Simpson-Bowles commission report already provides the blueprint for where the cuts can be made.

Then, redefine the debt ceiling from a dollar limit to a debt-to-GDP ratio: Rather than governing in continual crisis mode, tying the borrowing limit to a percentage of what the nation produces would end the political power plays and incentivize growth. It forces a better use of funds for a higher return.

Get rid of programs. We need to do more than cut back on program spending; we need to cut programs. For example, the federal government offers 56 financial-literacy programs through 20 agencies costing $30.7 million a year. (Congress obviously has not graduated from any.) Recommendations from the Government Accountability Office on reducing waste and duplication need to be enforced, not ignored.

Means test. Social Security and Medicare are necessary safety nets, but they are nearing insolvency as fewer pay in, more take out, and more take out more. By increasing the ages of eligibility, means testing benefits and adding competitive options to Medicare, we can meet our commitment to our parents—and our children, and theirs.

The tax code must go. If the president wants to make the tax code fair, incentivize growth, and spread the wealth, it’s time for real reform of personal and corporate taxes. Simplify the code, collapse tiers, cut rates, cap deductions, and end preferential treatment of favored industries.

Get money out. Let the people in. A proposed American Anti-Corruption Act transforms how elections are financed, how lobbyists influence politics, and how political money is disclosed. It will reshape the rules of American politics and restore ordinary citizens as the most important stakeholders instead of major donors.

Washington doesn’t have just a spending problem, or just an entitlement problem, or just a taxing problem. We have a leadership problem. Fix that, and the first three problems are solved.