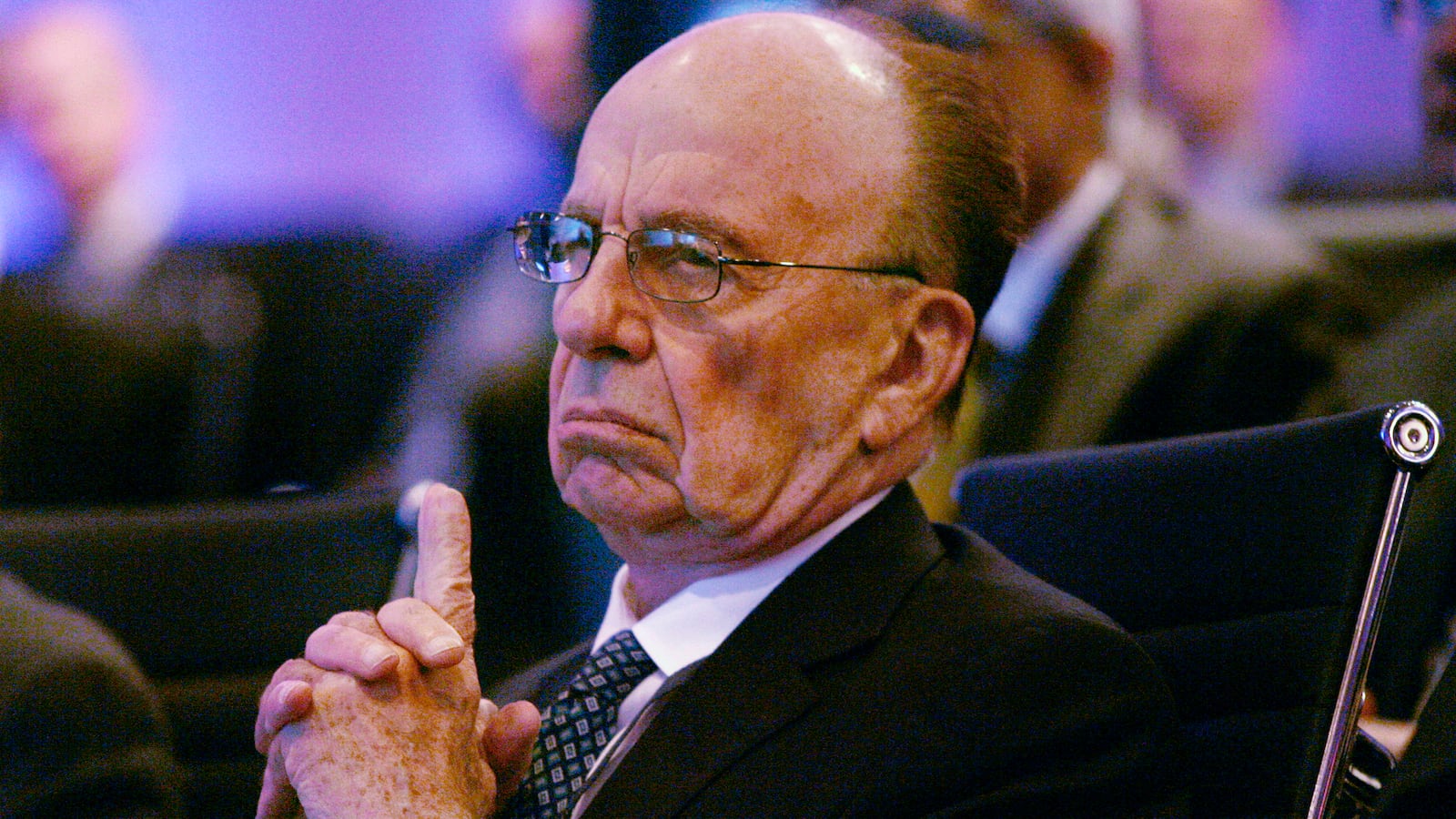

Rupert Murdoch has done it again. By lobbing in an $80 billion offer to purchase rival Time Warner, the octogenarian entrepreneur has once again staked his claim on the investing world’s attention – at a time of his life cycle when most of his cadre are passing their days with golf, visiting grandchildren, and perhaps serving on a non-profit board, should their health permit.

Time Warner rejected the bid. Its executives, having just shed publishing unit Time, Inc., through a spinoff, are optimistic about their prospects. However, ownership of Time Warner's stock is very diffuse, meaning shareholders eager to sell out to Murdoch could amass large stakes and pressure the board.

Indeed late Thursday, two billionaire money managers --Ken Griffin, chief executive officer of hedge-fund firm Citadel LLC, and Mario Gabelli, CEO of Gamco Investors Inc--who own shares in Time Warner Inc. told Bloomberg News that Murdoch’s bid for the media company will be hard to resist, particularly if he comes back with a higher offer.

The stock market wasn't quite as dismissive of Murdoch's $80 billion bid as Time Warner was. In trading Tuesday, investors bid out the shares of Time Warner up by 17 percent, to a total value of $73 billion. The reason: they think Murdoch won't be easily deterred and will continue his pursuit. He may be 83, but investors clearly don't think that Time Warner will be able to run out the clock on Murdoch.

Scouring back through the annals of American business history -- or global business history for that matter – it is difficult to come up with an example of a magnate of Murdoch’s age who has attempted to craft such a ballsy, transformative deal.

John D. Rockefeller, the most successful and ruthless business man of the 19th century, checked out of Standard Oil at the age of 58 in 1897. Andrew Carnegie sold off his steel empire to J.P. Morgan in 1901 and called it a day. He was 65. Morgan himself, the great financial monopolist, was still an active banker at his death in 1913 at the age of 75, but his greatest exploits were several years behind him. Henry Ford, the eccentric genius behind the Ford Motor Company, left active management of the firm he founded while still in his 60s.

In the second half of the 20th century, as corporations evolved from the creations of individuals to institutions, ancient CEOs became more and more rare. Many publicly held firms instituted mandatory retirement ages of 65 or 70. Jack Welch, who took over General Electric in 1981, left his perch in 2001, not long after he turned 65.

Of course, when you control a company through special shares of stock, it is easy to stick around. But the astonishing thing about Murdoch is that he isn’t just stewarding a bunch of assets, or watching over some appointed heirs as they step up. He’s still buccaneering through the global media business, striking terror into executives half his age, redrawing the media map, and transforming his own company in the process.

In fact, if anything, it seems as if there’s a sort of Benjamin Button effect here. The older he gets, the younger he seems to behave. In 2007, at the age of 76, he bought the Wall Street Journal. Rather than divest or sell of his print properties, as many other media families have done, Murdoch carved off his newspaper holdings into a separate, well-funded company. The Wall Street Journal, which just turned 125, has thrived under his ownership. Murdoch, who took a bath after buying MySpace several years ago, joined Twitter in December 2011, visited Vice’s studios in Brooklyn in 2012, and bought a stake in the young media company the following year. He got divorced last year at the age of 82 because YOLO.

Yes, Murdoch has looked his age at times – especially during the London hearings on the phone-hacking scandals involving his newspapers. The titan briefly devolved into an object of pity and humor, as his answers were less than lucid and he needed his wife to step in and defend him from a guy with a pie.

But he certainly isn’t acting his age in the boardroom. And it’s hard to come up with an example of someone who has remained so relevant for so long. Alan Greenspan lasted as the head of the Federal Reserve until 2006, leaving at the age of 79. Warren Buffett, at 83, is still at the helm of Berkshire Hathaway, although he has promoted and hired individuals who are doing a lot of the heavy lifting. But that’s about it. George Soros, also 83, is titular chairman of Soros Fund Management. But he is clearly focused on big picture social and political issues than he is on running money in his hedge fund.

Murdoch’s stamina is all the more impressive given the huge bias toward youth in the converging worlds of media and technology, in which businesses are furiously chasing millennials for their skills and future consuming ability. In Silicon Valley, executives in their late 20s are often thought to be out of touch.

Of course, it could just be that in his life, as in his business, Murdoch plays by different rules and runs on a different operating system. His mother, Elisabeth, lived until the age of 103. Age is clearly not impeding Murdoch’s energy or ambition. Observers don’t expect the rebuff to be the last word in the tango between the magnate and Time Warner. The prevailing feeling is, if he really wants it, he’ll get it.