As a video circulated that appeared to partially absolve President Donald Trump in the administration’s Russian meddling scandal on trading floors on Thursday, stocks surged for the first time in days on the apparent breaking news.

The video, it turns out, was actually two weeks old, misleadingly edited with the intention of falsely accusing former FBI director James Comey of perjury—and was initially aired by conspiracy website InfoWars on Thursday around noon.

Trump wasn’t cleared. In fact, since the video had been around since May 3rd, nothing had changed at all. But by the time traders found out, the dollar index had spiked anyway.

The fallout of the story is leaving analysts wondering how to absorb information in a market that is suddenly waiting on bated breath for the latest rumors to come out of the White House—even when those rumors are intentionally misleading or untrue.

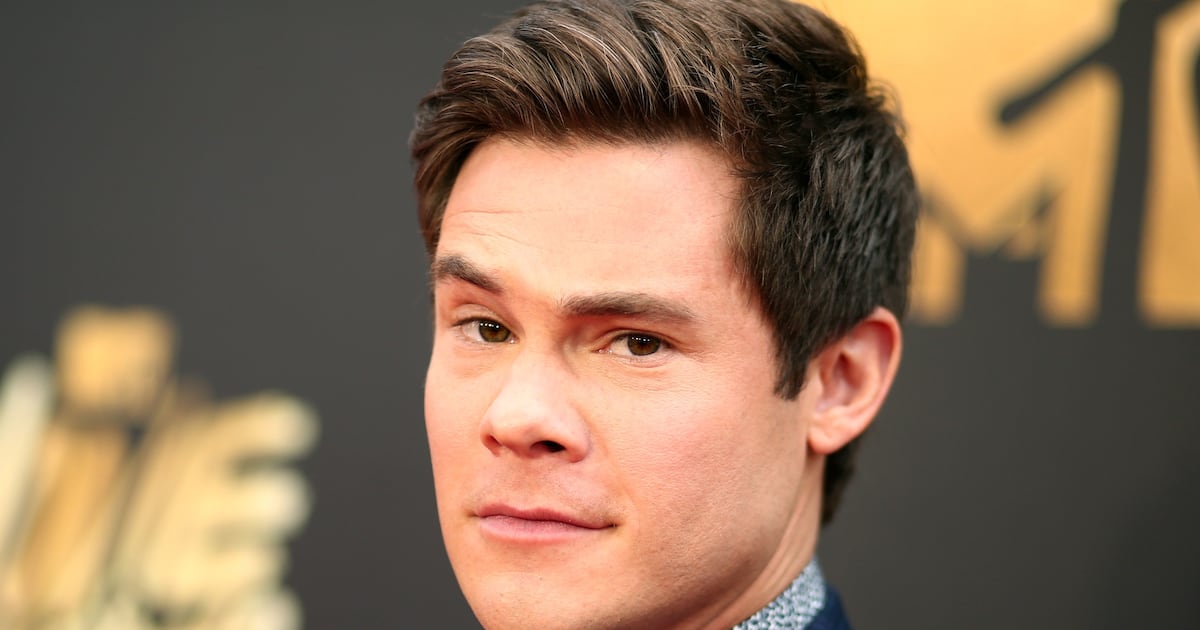

“The market is used to trading on rumors. There are always rumors of takeovers or bankruptcies. In those situations, when you bet on a rumor, you lose big time,” Adam Button, the chief currency analyst at ForexLive, told The Daily Beast.

“With political rumors, they don’t have to be true.”

In other words, the news can be fake, but the rally it creates in the stock market is very real.

Button was one of the first to trace the bump in the American dollar back to InfoWars on Thursday.

“It’s an unprecedented time. The market is getting a taste of what the post-truth world looks like,“ said Button.

An InfoWars segment and article posted around noon titled “Breaking! Comey Caught Committing Perjury to Congress” shows Comey saying “he has not been pressured to close an investigation."

The clip on InfoWars omits that the question, asked by Hawaii Senator Mazie Hirono, specifically asks Comey if the attorney general or Department of Justice has asked him to close the investigation, and doesn’t mention President Trump.

The InfoWars story ends with the sentence “This story is developing,” even though Comey’s testimony had occurred 15 days ago. No further updates arrived.

Still, the intentionally misleading clip made its way around trading floors after the website ZeroHedge picked it up two hours later, and stocks hit session highs at Thursday afternoon.

The day before, on impeachment concerns, stocks experienced their biggest sell-off of 2017. Breitbart had covered the same story with less urgent language that same day.

The Daily Beast reached out to the InfoWars article’s writer, Kit Daniels, for comment, but didn’t receive a response.

CNBC’s Jacob Pramuk and Fred Imbert recognized the source of the spike on Thursday, saying traders “misinterpreted the video,” and spoke to BK Asset Management foreign exchange strategy director Boris Schlossberg about the rally.

“It's very, very fraught with risk right now because nobody knows what the truth is. It seems very binary. There's no guilt or we're looking at impeachment," Schlossberg said.

Button said that InfoWars isn’t a site that “anyone on Wall Street usually really believes,” but people may change their reading habits after Thursday’s surge.

“People were asking me today, ‘Is Infowars a site I have to start reading now?’ And I said, ‘The answer is yes,’’ said Button.

“You’re not trading on what’s true and what’s false. You’re trading on what the average voter believes is true. It’s a propaganda war.”

Markets have been in “uncharted territory” since the beginning of the Trump administration, Button said. He called Comey’s upcoming testimony “the No. 1 thing on every trader’s calendar next week.”

“Politics generally in financial markets is generally a distraction,” he said. “Since the election, we’ve had this push and pull between politics and fundamentals. Just this last week, politics have won out and taken over. Now the market is trying to make sense of what’s happening.”

The markets chose a particularly inauspicious day to use InfoWars source material to determine what’s happening. Less than 24 hours before the rally, InfoWars host and founder Alex Jones was forced to apologize to and retract articles about Chobani as part of a settlement.

The yogurt maker sued InfoWars for an amount over $10,000 for defamation last month after the website accused Chobani of “importing migrant rapists” and its workers of causing a tuberculosis outbreak.

It’s the second time in two months Jones was forced to apologize and pull down content for claims made on InfoWars. In March, Jones read out a written apology on his show to James Alefantis, whom InfoWars had falsely suggested was running a child sex ring tied to Hillary Clinton’s campaign out of the basement of a pizza shop. Content that had included those allegations were pulled down.

“The idea of trading on propaganda—it’s a strange feeling,” said Button. “Politics is a distraction for the most part, but it’s not anymore. This is taking over.”

Still, would Button recommend reading InfoWars just in case it’s a predictor of how the market might react to bombshell political news—even if it isn’t true?

“I want to say, ‘Yeah, read it now,’” he said. “But the rest of me says, ‘Don’t read that garbage.’”