It’s official: the United States government is overdrawn on its debt limit of $14.294 trillion as of yesterday. Well, not technically overdrawn, as the U.S. Treasury directed by Secretary Timothy Geithner has taken a variety of measures to forestall any actual federal defaults on its operations—which range from keeping the lights on at the Smithsonian to maintaining combat forces in Afghanistan. These accounting sleights-of-hand will delay any actual defaults to early August. But still, after months of inconclusive wrangling by both parties, a new Rubicon has been crossed.

This impasse is an escalation of a similar imbroglio over this year’s budget, but this time, both Republicans and Democrats are playing with real fire. A government shutdown was averted in early April, but that would have been resolved through public outrage within days, and with little real-world effects. A government default, however, would have consequences so severe that not only are the tactics of the Republicans destructive, but the response of the White House and President Obama smacks of rolling the dice with the universe.

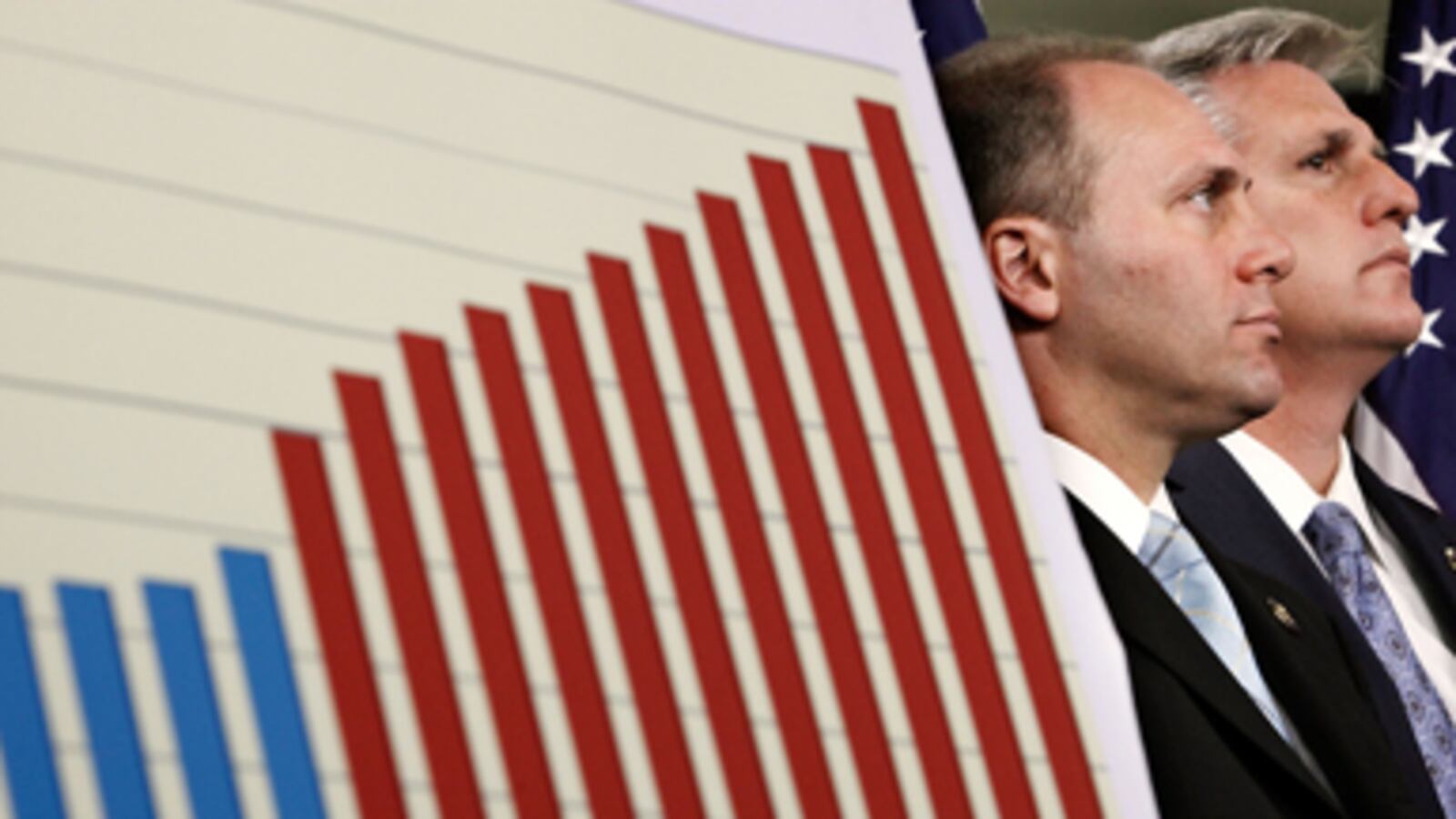

The Republican position, urged on by the Tea Party, is simple: use the debt ceiling as a bargaining chit to force ever deeper cuts in government spending. House Speaker John Boehner said recently that any extension of the debt ceiling would have to be accompanied by equivalent cuts in spending, to the tune of trillions of dollars. Said Amy Kraemer of the Tea Party Express, “Our message has not only been no, but hell no” to raising the debt limit, and many members believe that the warnings of government officials about the consequences of default are just fear tactics. The federal government, they believe, has enough revenue to cover costs. In short, they oppose raising the debt ceiling while not actually believing that we have reached it.

Let’s start with the axiom that the congressional Republican and Tea Party position on the debt is in the realm of fantasy. In the next four months, the federal government will be unable to pay its bills absent authorization to issue more debt. Immediate cuts of $2 trillion in spending represents a level of draconian policy whose real-world consequences its advocates conveniently ignore.

One would have thought that in response Obama, with his steely calm, would enter the fray and call for maturity. But no. Instead, he had this to say on Sunday: “If investors around the world thought that the full faith and credit of the United States was not being backed up, if they thought that we might renege on our IOUs, it could unravel the entire financial system… We could have a worse recession than we already had. A worse financial crisis than we already had."

“Unravel the entire financial system?” “A worse financial crisis?” This is Armageddon talk, and some serious gamesmanship. Yes, it makes a certain sense in the insular Beltway world of politics. The debt ceiling has brought out extreme rhetoric at various points in the past decades, but in the context of the past three years of financial and psychological crisis, these words have an even greater resonance. They are especially powerful overseas, and news programs from Europe and Asia seized on Obama’s words as a sign that the United States might once again push the global financial system to the brink.

That is the real risk. The parties are locked in their octagon without a referee, aware only of the domestic news cycle and energizing their ideologically-driven bases. Meanwhile, the global financial system—which couldn’t care less about internecine American rivalries—is trying to integrate the risk that American myopia might once again trigger a worldwide credit crisis.

The parties are locked in their octagon without a referee, aware only of the domestic news cycle and energizing their ideologically-driven bases.

Some Republicans have floated the notion that a little default might be a good thing. Rates would shoot up, and the government would be forced to get serious about deficits. Market maven Stanley Druckenmiller said over the weekend that a default isn’t the end of the world; out-of-control spending is.

But for the rest of the planet, all of this—including Obama’s rhetoric—is yet another sign that the U.S. doesn’t get that it is a participant in a global world of capital, and that Republicans versus Democrats on the issue of how much is spent on Medicaid and Planned Parenthood is only one facet of a complicated system of credit, capital and payments that affects every corner of the globe.

This isn’t to say that the U.S. can make policy for the global financial system, especially given that it is a huge debtor nation and depends on global creditors. But these creditors and credit markets in general are prone to panic when major players show signs of irrationality and impulsiveness. Hearing the American president warn of impending financial collapse does nothing to stabilize those markets and everything to make them skittish, and the U.S. needs those markets calm in order to continue financing its deficits.

Raising the stakes is an old and familiar trope, but on this issue and at this time, it is foolish—and will only propel the world even faster to lessen its entanglement with America. The debt ceiling will be raised, now or later, but the damage that this debate does will take much longer to undo.

Zachary Karabell is President of River Twice Research and River Twice Capital. A regular commentator on CNBC and columnist for Time, he is the co-author of Sustainable Excellence: The Future of Business in a Fast-Changing World and Superfusion: How China and America Became One Economy and Why the World's Prosperity Depends On It.