I’m with Bernie—the SALT cap is way too high.

A little history is in order here to understand why some Democrats in high-tax states like New Jersey and New York are so intent on restoring SALT. Before President Trump took a wrecking ball to SALT, there was no ceiling on how much you could deduct in state and local taxes on your federal income tax return. Limiting the deduction to $10,000 “will kill New York,” then-Governor Andrew Cuomo said in 2017.

That was the point, it turned out. Trump wanted to punish the blue states that didn’t vote for him by constraining those governors from raising taxes if their constituents weren’t able to write off those taxes.

Now, in order to win the votes of House Democratic moderates who represent high-earning districts mainly in New York and New Jersey, the Build Back Better bill takes the cap on deducting state and local taxes from $10,000 to $80,000, an eight-fold increase that would give millionaires and billionaires a big fat tax break that if enacted into law goes against everything progressives in the House and Bernie Sanders in the Senate have been fighting for in the battle for income equality and fair taxation.

As it now stands, the tab for SALT is the biggest single agenda item in the BBB bill working its way through the Senate. The $10,000 cap is too low and penalizes some genuinely middle-class families, but Bernie is right that anybody who’s paying tens of thousands more than that in state and local taxes qualifies as wealthy and shouldn’t be able to write those off on their federal returns as a result of a provision inserted to win over a handful of holdouts for a bill designed to help middle-class families.

"Beyond unacceptable,” says Sanders. "At a time of massive income and wealth inequality, the last thing we should be doing is giving more tax breaks to the very rich. Democrats campaigned and won on an agenda that demands that the very wealthy finally pay their fair share, not one that gives them more tax breaks.”

Sanders’ sentiment is widely shared, and not just among progressives. “It’s very hard to find an item that is both bad policy and bad politics, and with unerring aim, the Democrats have hit one,” says Bill Galston, a senior fellow in the governance program at the Brookings Institution.

It’s not new of course to offer goodies to gain votes, but when it’s this blatant, and the payout is this excessive, the expectation is that the provision will be scaled back in the Senate.

Sanders wants everyone earning below the $400,000 threshold that President Biden has set to be able to fully deduct their state and local taxes while phasing out the deduction for higher earners. “80 and 10, these are negotiating positions, they will come down to where... I don’t know— [Sen. Chuck] Schumer will have a lot to say,” says Matt Bennett with Third Way, a moderate Democratic group.

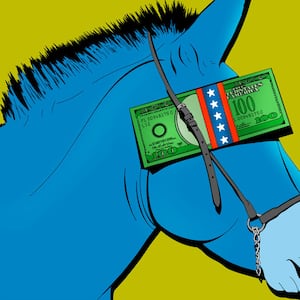

A New Yorker who has gotten an earful about SALT, Majority Leader Schumer is up for re-election next year “so it’s certainly on his radar,” says Shai Akabas with the Bipartisan Policy Center. “There are political considerations among people who have a lot of constituents who have been impacted by the $10,000 cap—upper-income people who happen to be strong participants in the electoral process, who give campaign contributions.”

This is the Democrats’ dilemma: whether to be true to their principles or bow to the realities of politics in an election cycle where moderates representing higher-income swing districts are endangered unless they deliver for their constituents, and that means substantially altering SALT.

Democrats are seeking that elusive sweet spot that placates the party’s high earners and big donors without being totally hypocritical. Under the 80K threshold, people in the top federal income tax bracket, which is 37 percent, would be able to deduct $70,000 more of SALT which translates into a $25,900 tax benefit, says Seth Hanlon, a tax expert with the liberal Center for American Progress. A Wall Street trader making $10 million a year is already paying way more than $80,000 in income tax in New York City, says Hanlon. “It’s unnecessary for extremely wealthy people to receive a $26,000 tax cut, they’re not even going to notice it, and it definitely goes against the principle of no tax breaks for millionaires and billionaires.”

A student asked New Jersey Senator Cory Booker early this year during a virtual discussion at Rider University when he would fix SALT because it was hurting his parents and their ability to help pay his tuition. Booker responded with a basketball analogy, saying that he had thought that once a Democrat was in the White House, it would be an easy lay-up. But now he saw it as a three-point shot—harder but still doable.

Everybody making under $400,000 should be able to fully deduct SALT. The argument is how much to give people above that dividing line. It’s unclear how dug-in the House moderates are, and whether their position can stand the light of day. The assumption is that they will land with Schumer, who faces the same pressures they do.