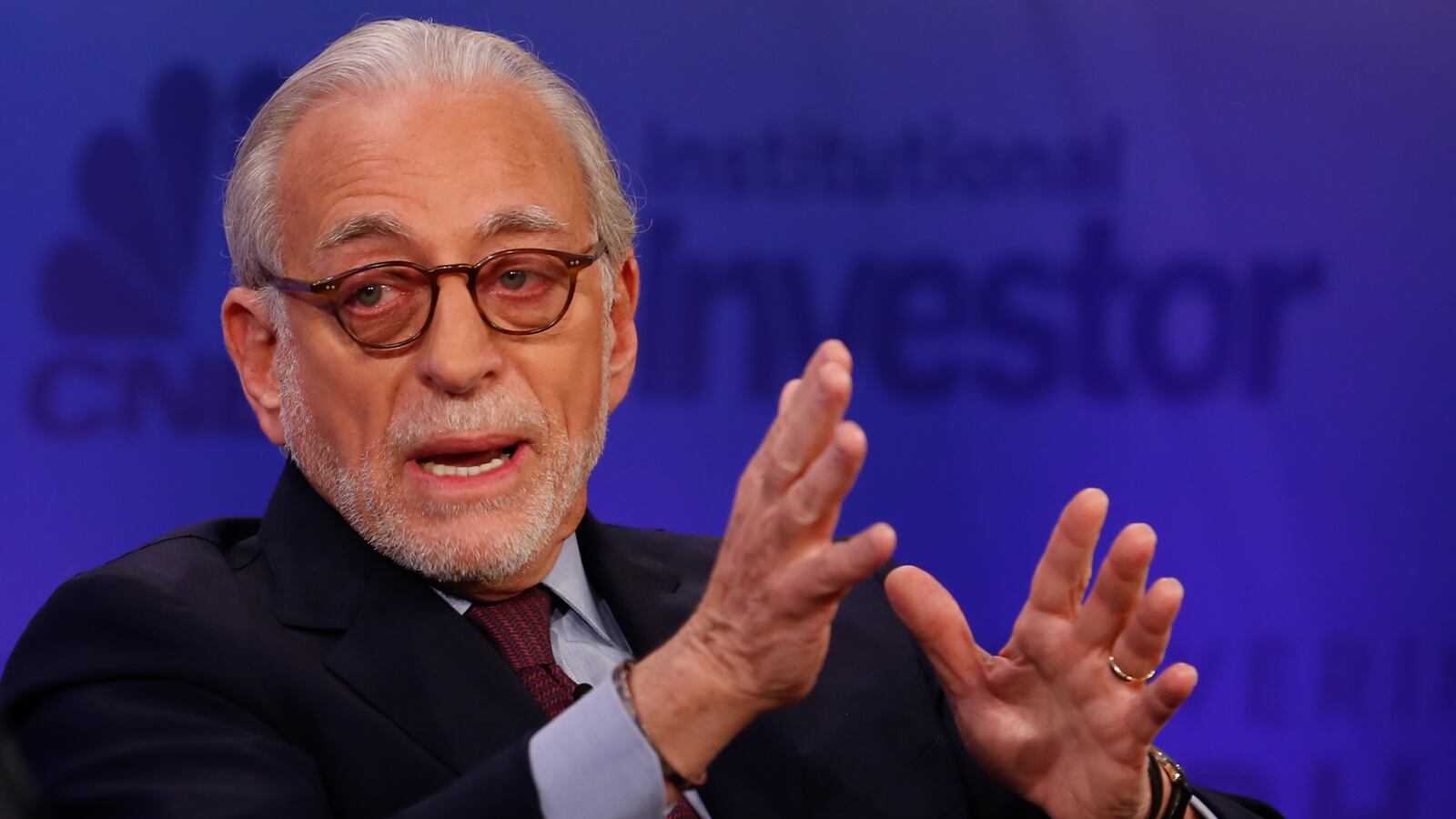

Billionaire investor Nelson Peltz brought his escalating war with Disney directly to the Magic Kingdom last week, taking a field trip to its theme park in Orlando with six other members of his team.

“The employees were smiling, and that’s probably in large part because they didn’t own any Disney stock,” Peltz said in a television interview with CNBC on Thursday. He added that he visited the park without special passes or a tour guide.

Peltz, who controls roughly $3 billion worth of Disney stock through his firm, Trian, has spent a year tussling with Disney’s management. Last winter, he took aim at CEO Bob Iger and suggested the executive wasn’t prioritizing the business, declaring in a public filing that Iger wanted a board meeting scheduled around his plans “to sail his yacht off the coast of New Zealand.”

Peltz briefly dropped his demand for board representation after reaching a truce with Iger and his cohorts, but the stock’s performance didn’t improve to his liking and he reignited the feud.

In a preliminary proxy statement filed on Thursday, Peltz said the company is suffering from governance issues and that its streaming business isn’t sufficiently profitable. He is seeking a board seat for himself and former Disney exec James Rasulo. The company had previously denied Peltz’ request for a seat.

“It saddens me that the board didn’t welcome me because our goal is just to work with them, to help them and to help them make the company better,” Peltz told CNBC.

“They said I have no media experience. I don’t claim to have any,” he continued. “But I will tell you, I don’t think they have much media experience.” Peltz argued that several of Disney's recent movies have underperformed.

“If that comes with media experience, I want a guy who doesn’t have media experience,” he said.

Peltz’s website, RestoretheMagic.com, claims that “Disney shareholders and fans [are] not feeling the love,” and that investors over the past decade would have been better off putting money into the S&P 500 or one of its competitors.

Disney did not immediately respond to a request for comment.