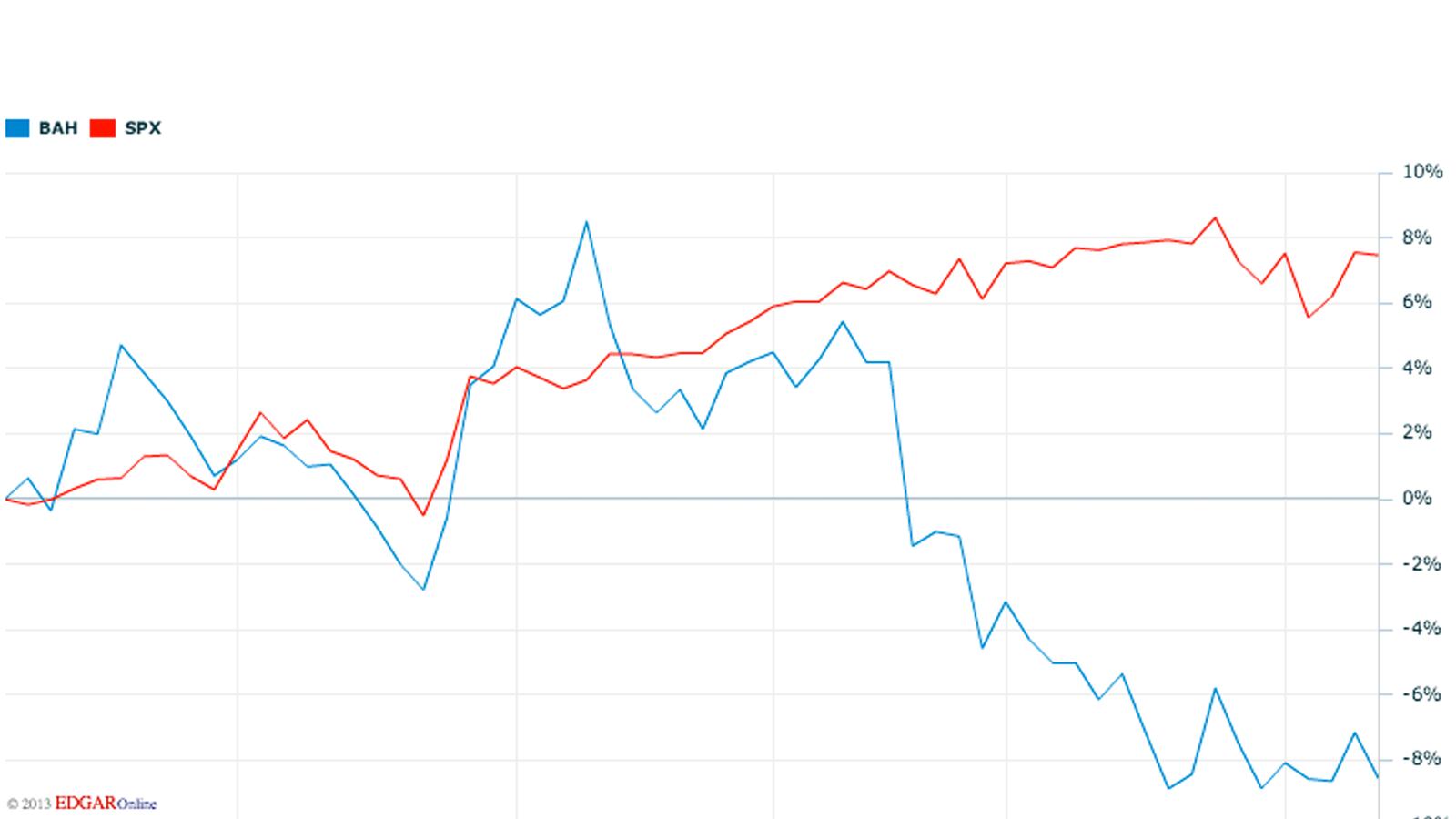

As the sequester deadline approaches, the broad stock-market indices have been pushing toward multiyear highs. The implication: investors aren’t sweating the sharp spending cuts that are poised to kick in. But investors are definitely freaking out about the impact of the sequester on particular companies. Check out the chart above.

That’s a pretty ugly chart. It shows the performance of the stock of Booz Allen Hamilton compared with the performance of the Standard & Poor’s 500 over the past three months. Booz Allen is down about eight percent, while the S&P 500 is up about seven percent.

The reason? Austerity.

Booz Allen is a management consulting firm that essentially has a single client: the federal government. Virtually all the company’s revenues are derived from contracts with federal agencies: the Pentagon, the Department of Homeland Security, the Department of Transportation, you name it. But last year’s recent budget cuts, combined with concern over impending cuts due to the sequester, mean federal agencies aren’t making long-term assignments like they used to. The company said that revenues in its most recent quarter fell 3.5 percent from the year before, and that “we expect revenue to decline by a low single digit percentage” for the entire 2013 fiscal year.

Booz Allen has about 25,000 employees and a market capitalization of about $1.8 billion. If the sequester takes hold and lasts, both numbers will be heading down.