Former President Donald Trump and two of his adult kids are aggressively trying to avoid explaining—under oath—why so many of their business properties have wildly different values on paper. A New York judge will decide their fate on Thursday.

On Feb. 17, Judge Arthur F. Engoron will hear defense attorneys and investigators spar over whether Don Jr., Ivanka, and their former president father can keep dodging subpoenas recently issued by the New York Attorney General’s office, which is investigating potential bank fraud.

The trio was supposed to sit down with investigators at the New York City office of AG Letitia James during the first week of January. Instead, the civil lawsuit quickly spiraled into a nasty, high-stakes fight with both sides going straight for the proverbial jugular.

On one side is James, a state’s Democratic attorney general elected on the promise she would target the American president over his long history of corrupt behavior. She’s pursuing her own civil lawsuit against Trump while simultaneously teaming up with the Manhattan District Attorney on a similar criminal investigation.

On the other side is Trump, now facing an onslaught of local criminal and civil investigations seeking to hold him accountable now that he’s no longer shielded by the near-total executive power of the presidency—and before he gets a chance to get back into the White House.

In December, the Trump Organization went after James personally, suing her in federal court in an attempt to halt her investigation by claiming her political campaign promises have compromised her.

At the start of the year, Trump and his two adult kids—both executives at the family company—refused to show up to scheduled depositions. They then upped the ante by exposing details of the AG’s investigation in court documents. In those filings, the Trumps are trying to convince the judge that James’ lawsuit is just a thinly veiled attempt at double-dipping, getting them to make statements in a civil case that could be used against them in the separate criminal matter.

In mid-January, James hit back with an unconventional legal maneuver. She dumped reams of new evidence in public court filings that laid out what her investigators have uncovered so far.

On Twitter, James said her office had “uncovered significant evidence indicating that the Trump Organization used fraudulent and misleading asset valuations.” Court documents detailed how the company allegedly faked the value of at least six properties, including Trump’s neo-Gothic skyscraper at 40 Wall Street in Manhattan, as well as his golf clubs in the New York suburbs and Scotland.

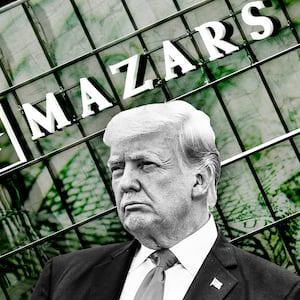

The details James exposed were cited as the reason the company’s outside accounting firm, Mazars USA, severed ties with the Trump Organization and disavowed 10 years of Trump’s personal financial statements in a letter Feb. 9.

That forced Trump to make a public statement defending his dynasty as a “great company with fantastic assets.” But the chest-beating also came with an odd financial disclosure about his personal wealth that made no accounting sense.

In the statement, Trump lumped together his “net worth” and “total liabilities”—which aren’t conventionally added together—in what appeared to be a sloppy attempt to distract from the fact that he owes a gargantuan $523 million in assorted business obligations.

The local judge overseeing this case could force the ex-president to subject himself to investigators’ questions, but it doesn’t mean Trump will even try to answer them.

During a deposition in October at Trump Tower, he reportedly dodged questions for four-and-a-half hours about how his building’s security team allegedly assaulted protesters in 2015. Then again, sometimes he’s said too much, as he did in his disastrous lawsuit against journalist Timothy L. O'Brien.

Regardless of whether the judge forces the former president to be deposed or not, the political damage is already done. The revelation that Trump’s long-time trusted accountants decided to ditch him—citing the AG’s investigation—has spooked Trump’s own inner circle. And the company is now on financially shaky ground, as banks could immediately call back their loans and force him to seek money elsewhere.

And if Trump vies the presidency again in 2024, the AG’s ability to nudge Trump’s accountants to ditch him has ramifications for American politics and national security.

“Since Trump is no longer in public office, the details of his personal finances are no longer required to be regularly disclosed to the public in ethics disclosures so we may not necessarily know what foreign or domestic interests swoop in to help him financially,” said Anna Massoglia, the editorial and investigations manager at the transparency group OpenSecrets.

With additional reporting from Asawin Suebsaeng.