Congressional Democrats are gaming out strategies to try to reverse the Trump administration’s controversial decision last month to lift sanctions on businesses controlled by Russian oligarch Oleg Deripaska.

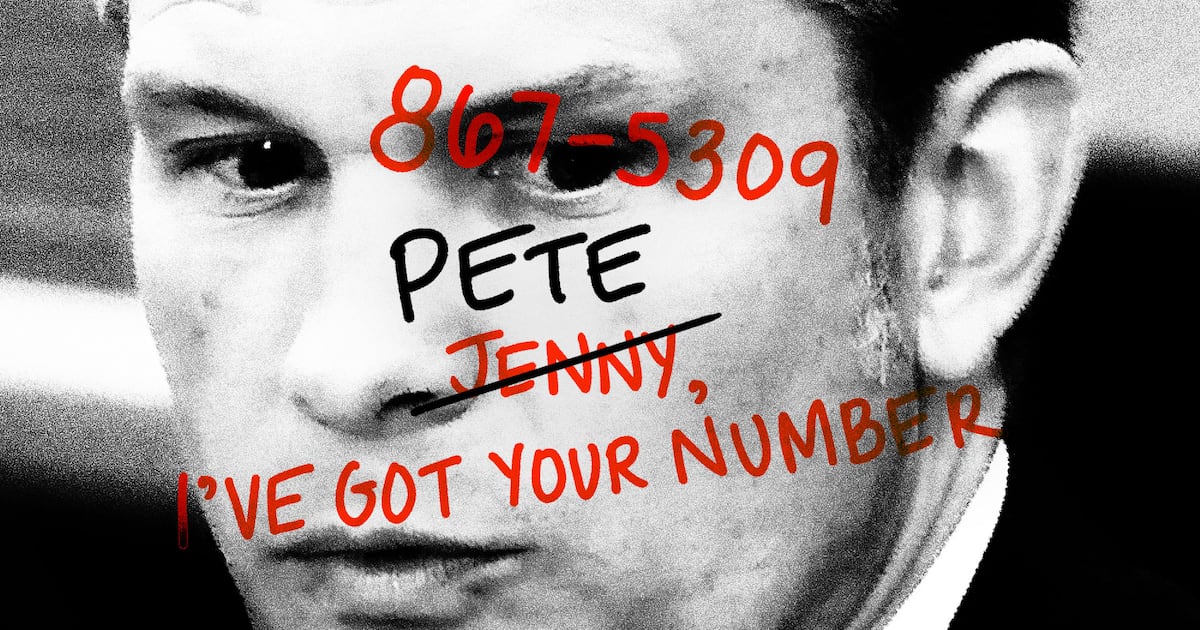

Rep. Jim Himes (D-CT), a member of the House intelligence committee, told The Daily Beast he has been discussing the matter with other members. And he’s eager for Trump administration officials to answer lawmakers’ questions about their move.

“I think senior Treasury people should come to the Hill and explain this deal,” he said, referring to the agreement between the U.S. and Deripaska that allowed the sanctions to be lifted.

“We need to get more information fast,” he added, “and of course the leverage that we have is a resolution of disapproval.”

While House Democrats are considering their own response, Senate Democrats have taken more concrete steps. On Friday, Minority Leader Chuck Schumer (D-NY) took the first formal step in registering his caucus’ discomfort with the sanctions relief by setting the table for a resolution of disapproval.

“I do so not because I have concluded that Congress should act to disapprove this agreement—I have not made that determination yet—but to preserve the procedural option of moving to bring up such a resolution at the end of the review process, if necessary, for expedited review and a vote by the full Senate,” Schumer said in a statement.

In his statement, Schumer said lawmakers will continue to assess the basis for the Trump administration’s decision to provide sanctions relief to Deripaska-linked businesses.

If Schumer decides to file a resolution of disapproval, the effort would face a tough path toward success. It would need simple majorities in both the House and Senate in order to reach President Donald Trump’s desk. But Trump would almost certainly veto the measure, so lawmakers would need to cobble together enough votes to override a presidential veto.

If successful, the resolution would prevent the Treasury Department from lifting sanctions on the Deripaska-controlled companies EN+, Rusal, and EuroSibEnergo. A mechanism in the 2017 Russia sanctions package, the Countering America’s Adversaries Through Sanctions Act (CAATSA), would trigger the reversal. Passed overwhelmingly by Congress over Trump’s objections, CAATSA allows the House and Senate to block White House efforts to alter sanctions by passing a joint resolution of disapproval within 30 days of the administration’s announcement.

Lawmakers involved in the talks told The Daily Beast that CAATSA appeared to be the best legislative vehicle to block the lifting of sanctions on the Deripaska-linked businesses.

Deripaska has proven to be an inviting target for lawmakers. His ties to Trump’s former campaign chief Paul Manafort, which Special Counsel Robert Mueller’s team has investigated, run deep. And the nature of the deal concerns Democrats. Lord Barker, a former U.K. energy minister who now sits as a member of the House of Lords, chairs EN+ and helped negotiate the terms under which the Treasury Department would lift the sanctions on the businesses. Barker’s Russia ties have concerned some of his British colleagues, as The Daily Mail has detailed. The Guardian reported that a parliamentary committee asked Barker for information about his work for EN+, and he refused to provide anything publicly because of his work trying to lift U.S. sanctions.

Another concern for Democrats is the fact that Deripaska has maintained major holdings in the companies. As Treasury demanded, Deripaska’s stake in EN+ will go from 70 percent to just under 50 percent. He will still have major sway over the company’s activities. And he will transfer some of his EN+ shares to VTB Bank to pay down debt to the bank, as Bloomberg detailed. VTB is also under U.S. sanctions.

Sen. Richard Blumenthal (D-CT), one of the lawmakers who has been cued into the effort to preserve the sanctions, told The Daily Beast that lawmakers should act “in a way that avoids interference with any law enforcement investigations or the House’s possible investigations.” Other senators involved in the discussions include Chris Murphy (D-CT) and Ron Wyden (D-OR), both of whom have criticized the Trump administration’s implementation of mandatory sanctions against Russia.

House Democratic leaders have not yet committed to bringing up a resolution of disapproval, but Majority Whip Steny Hoyer (D-MD) told The Daily Beast that “Democrats will look at all available options on this important issue.”

Last month, Sen. Bob Menendez (D-NJ), the top Democrat on the Senate Foreign Relations Committee, wrote a letter to Treasury Secretary Steven Mnuchin urging him to reconsider his push to lift the sanctions against Deripaska. But the administration announced two weeks later that it would formally lift them, prompting furious condemnation from Menendez and other lawmakers.

The administration has argued that the sanctions—which The Daily Beast first reported were conceived inadvertently and without following proper inter-agency protocols—were roiling international markets. European nations pleaded with the U.S. to lift the sanctions in particular targeting Rusal, a major global aluminum supplier which Deripaska controls, because the financial punishments against the company had triggered significant increases in aluminum prices worldwide.

In exchange for lifting the sanctions, Deripaska was required to abandon his majority ownership in EN+, the main company which has Rusal in its portfolio. Under the agreement, Deripaska must also add Americans to his corporate boards, and he will personally remain on the official U.S. list of sanctioned Russians. Menendez had said the sanctions should not be lifted “unless and until Mr. Deripaska divests from and relinquishes control of both companies.” Himes said he wants more information from the Treasury Department about the terms of the agreement.

“I think it’s important for us to dissect the specifics of a post-transaction EN+ and Rusal because one concern I have is that Mr. Deripaska will retain effective control with the transaction as outlined by Treasury,” Himes said.

Jamil Jaffer, who previously served as chief counsel and senior adviser to the Senate Foreign Relations Committee where he helped write two sanctions laws targeting Russia, told The Daily Beast that Treasury’s move to lift sanctions on the Deripaska-linked businesses deserves more scrutiny from Capitol Hill.

“Given that Congress overwhelmingly pushed for these sanctions in a bipartisan fashion and provided the Treasury Department with the statutory authorities in play here and particularly because Russia continues its aggressive covert and overt influence campaign against the United States, close and continuing oversight is wholly appropriate and, indeed, is critical,” said Jaffer.

A Treasury Department spokesman did not immediately respond to a request for comment.

Democrats’ potential move has drawn criticism from some former government officials. Dan Fried, a former State Department official who helped craft sanctions against Russia during the Obama administration, told The Daily Beast that he thinks Democrats should allow the sanctions be lifted.

“It may surprise you to hear this, given my reputation as a Putin hawk, but I think that Treasury made the right call in this deal,” Fried said. “They dug themselves out of a hole that they shouldn’t have jumped down in the first place. I think Deripaska certainly deserved to be sanctioned, but he would not have been my first choice because hitting Deripaska meant hitting Rusal, and that had downstream implications that I don’t think the U.S. government fully understood when they took that step.”

And Mike Dobson, a lawyer with the firm Morrison and Foerster who recently left the office within Treasury responsible for sanctions, said a congressional move to keep the sanctions in place would undermine Treasury’s credibility. Deripaska complied with Treasury’s requests, Dobson said, so failure by the U.S. government to uphold its end of the deal would signal to other potential sanctioned entities that changing their behavior could be fruitless.

“For Congress to come in and make what should be a straightforward administrative process into something political undermines the credibility of U.S. sanctions,” he said.