At least one billion dollars of customer funds are missing from failed crypto exchange FTX, according to reporting by Reuters. Sam Bankman-Fried—the founder and CEO of FTX—covertly transferred $10 billion of customer funds from FTX to his own trading company Alameda Research, the outlet reported.

Sources high-up in FTX told Reuters that a large portion of the funds have disappeared, estimating that between one and two billion dollars are missing.

On Saturday morning, disgraced cryptocurrency poster boy Bankman-Fried said he is in the Bahamas, where FTX is based, according to Reuters. He denied rumors on Twitter that he had flown to South America following the spectacular collapse of his crypto exchange FTX.

He also denied the outlet’s “characterization” of the $10 billion transaction. “We didn’t secretly transfer,” he wrote via text message, “We had confusing internal labeling and misread it.”

Bankman-Fried did not respond to a request for comment about the transaction.

On Friday, Bankman-Fried, now an ex-billionaire who once positioned himself as the face of responsible crypto, resigned from the exchange as the company declared bankruptcy.

“I’m sorry. That’s the biggest thing,” the 30-year-old wrote on Twitter the day before he quit, “I fucked up, and should have done better.”

Before the recent scandal unfolded, FTX was the third-largest cryptocurrency exchange in the world, valued at $32 billion. Bankman-Fried, known in the crypto world as “SBF,” was hailed as a responsible adult in the often wild-west atmosphere of crypto speculation. His company stepped in to bail out other struggling crypto companies. Bankman-Fried lobbied politicians, and was major Democratic donor.

But the company’s “death spiral” began earlier this week when Bankman-Fried announced that FTX would be acquired by one of its biggest competitors, Binance, amid rumors of a severe liquidity crunch. Less than 30 hours later, Binance pulled out of the deal, stating that the problems at FTZ were “beyond our control or ability to help.”

Bankman-Fried took to Twitter on Thursday to reassure users the company was doing “everything we can to raise liquidity.” But it was too late. A day later, he resigned.

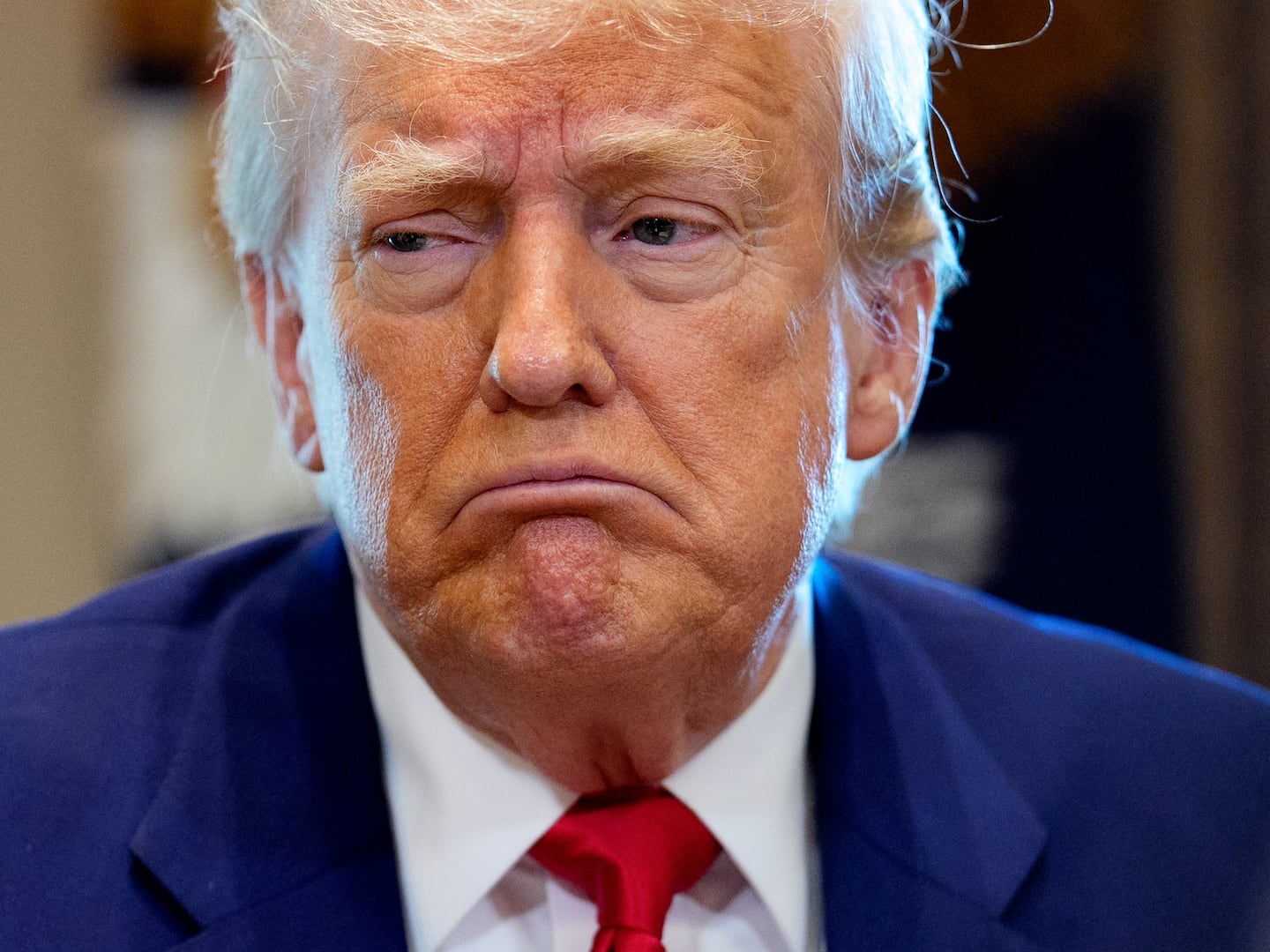

Elon Musk said his opinion of Sam Bankman-Fried was “this dude is bullshit.”

CARINA JOHANSENElon Musk weighed on the scandal in the early hours of Saturday morning, telling 60,000 users on Twitter Spaces that he had met with Bankman-Fried when looking for potential investors in his bid to buy Twitter.

“I talked to him for about half an hour. And I know my bullshit meter was redlining. It was like, this dude is bullshit–that was my impression,” Musk said, according to reporting by Coin Desk. “Then I was like, man, everyone including major investment banks–everyone was talking about him like he’s walking on water and has a zillion dollars. And that [was] not my impression… that dude is just–there’s something wrong, and he does not have capital, and he will not come through. That was my prediction.”

Musk advised listeners to keep their crypto in cold wallets, which are storage devices not directly connected to the internet, rather than in cryptocurrency exchanges like FTX.

The company’s swift collapse has now caught the eye of federal authorities at the Securities and Exchange Commission and the Justice Department, according to reporting by The Wall Street Journal.