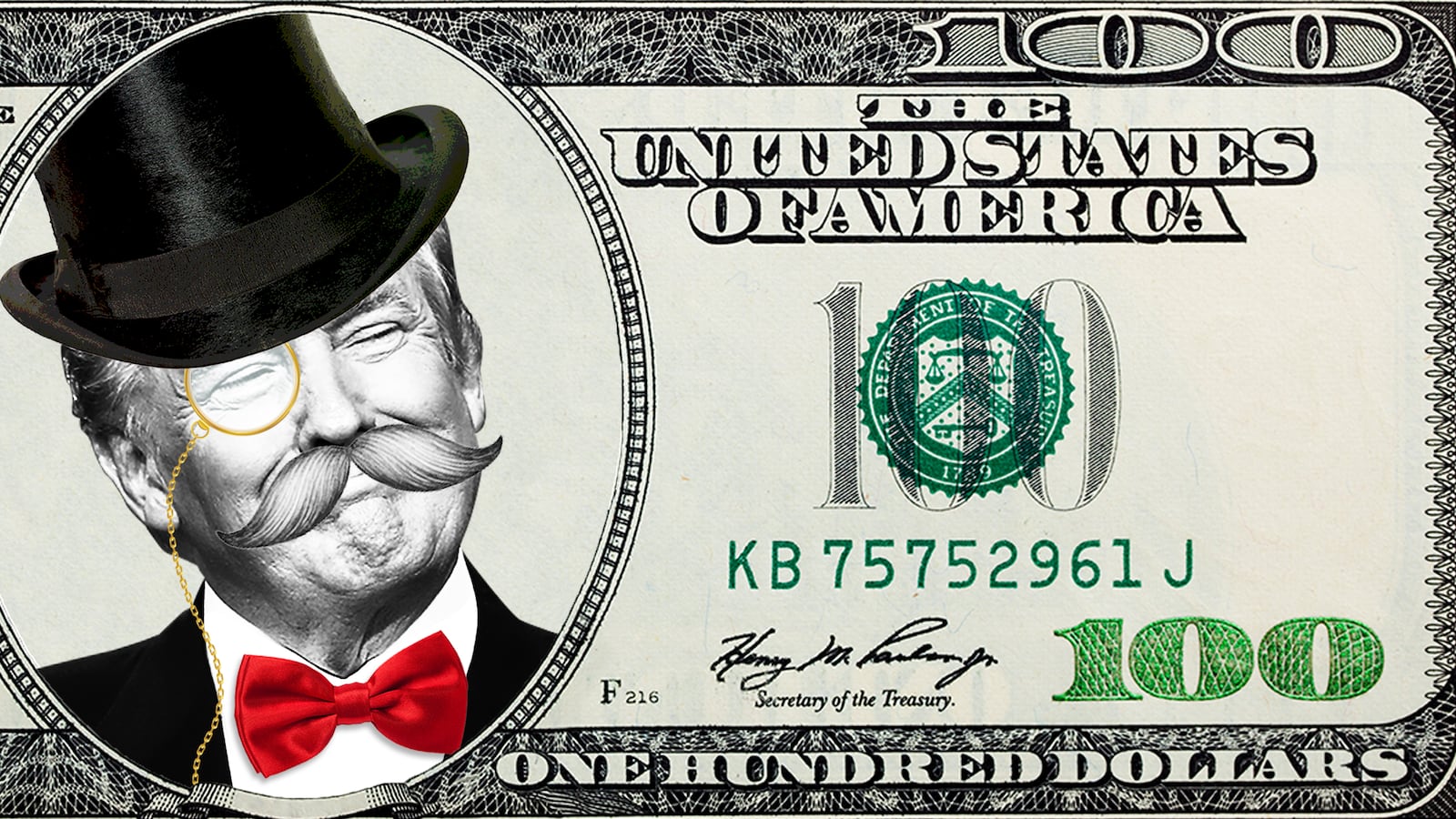

Donald Trump promised voters the biggest federal tax cut in American history, saying it would spur such tremendous economic growth that we need not worry about increasing the federal debt he bemoans.

Now we have new and powerful evidence of what happens when we do as Trump says. In an earlier column I detailed the 12 years of economic damage that flowed from the George W. Bush tax cuts in 2001, with stagnant wages and weak job growth.

The new economic evidence comes from two states that made major changes to their tax systems in 2013. One cut tax rates and allowed most business owners to enjoy tax-free profits. The other raised tax rates on people with the highest incomes.

Like Trump, you may assume that Kansas, which lowered taxes, entered a boom. And that California, which hiked taxes on those at the top, endured a painful economic slowdown with few new jobs.

Instead Kansas suffers while California’s economy blooms.

Since the tax changes, the California economy has grown 1.7 times faster than the Kansas economy. Perhaps even more significant, California grew its share of the national economy from 13.8 % of the U.S. Gross Domestic Product to 14.2%. Kansas stayed flat at 0.8% of national GDP.

How Tax Cuts Bled Kansas

Kansas voters elected Sam Brownback, a right-wing Republican, governor in 2010 on his promises that a huge tax cut that would make Kansas attract investments the way a magnet drawn through sand attracts iron.

Brownback boasted that, thanks to his tax plan, Kansas had the fastest formation of businesses in the country. In fact, the 100,000 enterprises were not new. Nearly all were merely conversions of taxable businesses into limited liability companies, partnerships and S corporations so the owners could enjoy their profits free of Kansas state income taxes under the Brownback plan.

Once the tax breaks launched, red ink began flowing across state government ledgers because the economic growth did not occur and tax revenues plummeted. The legislature is now debating a $900 million tax hike over two years so it can go back to buying black ink.

California’s budget is in much better shape, though the cost of public-worker pensions not fully funded in years past stalks the California economy.

Taxes and Job Growth

The disparity in job growth between California and Kansas was even more pronounced.

Brownback promised his tax cuts would create 100,000 new jobs per year. After four-and-one-quarter years, however, Kansas added just 51,300 private- sector jobs, Bureau of Labor Statistics data show. That’s about 12,000 jobs per year, laughably short of the promise.

Further west, in tax-raising California, jobs increased much faster. While jobs grew in Kansas by 3.8%, in California the lift was 11.8%.

How could California add new jobs at more than three times the rate of Kansas and grow its economy 1.7 times more than Kansas if tax cuts are the key to faster economic growth?

The answers go to the remarkable success of anti-tax ideologues at marketing what they want you to believe, using the same techniques that sell breast-enlargement creams and male-enhancement pills. The trick is to appeal to what you wish were true and to avoid thinking clearly and logically.

And Now the National Picture

These state examples have clear implications for the giant tax struggle taking place on the national stage and for the beliefs driving President Trump and his advisors.

Trump doesn’t know taxes, despite his claims to be a tax expert. I know because over lunch I once tried giving him tax advice – simple advice about the interlocking rings of partnerships with himself through which he owned his largest casino. I realized he could put another million dollars a year in his pocket at no cost. Trump couldn’t follow along and clearly did not understand how ownership can be structured.

That’s also what his longtime tax lawyer and accountant told me last year. Jack Mitnick, now retired, was the guy who came up with Trump’s tax savings, while Trump just signed his name as instructed.

Having a president who pretends to be an expert on that which he is not should give pause about any tax idea that springs from Trump’s head, where he has said that the world’s best advisors reside.

Those imaginary advisors have no idea that lowering taxes, like hiking them, can be bad for the economy both in the short run and, much more significantly, over the long run. The operative word in the previous sentence is the verb “can,” which means opportunity, not certainty.

What’s left out of our highly partisan tax debates is the simple fact that all wealthy nations have high taxes, while poor ones have low taxes.

If you like super-low taxes try Afghanistan, Iraq or Syria.

If vicious wars that kill civilians seem unattractive you could ask permission to move to Saudi Arabia, where the World Bank estimates taxes amount to a bit more than 1% of the economy—a low- tax environment likely to last until the oil runs out. The jobs there, outside of oil, are not very good, mostly servant positions. And violating the strict religious laws comes with a steep price: The kingdom beheaded people last year at the rate of three a week.

Go to Western Europe or Japan with their higher taxes and you will see a wholly different, and more humane, culture.

Rarely mentioned in America is that taxes form the foundation of our wealth and liberty. They buy us civilization, as Justice Oliver Wendell Holmes famously observed.

Poor countries lack education, roads, ports, scientific research and all the other commonwealth goods and services that make America and other rich countries great. Undermining this foundation risks collapsing the superstructures on which private wealth can be built.

Of course, how we build and maintain those foundations matters a lot. Adding to our tax burdens can make us worse off or better off depending on how we do it and, just as important, how we spend the tax money.

We need massive investments in our commonwealth. We need to fix decades of malign neglect of roads, bridges and other public furniture.

Even more we need to finance armies of scientists in everything from astrophysics and biology to physics because that is the key to a prosperous economic future.

Trump wants to slash that spending and, literally, go back to the age of steam. Visiting our newest aircraft carrier – which can launch a B2 bomber using the same technology as roller coasters now use – Trump said he would force the Navy to go back to steam catapults, which, if the laws of physics still apply, mean no B2 will take off from a ship.

Cut Property Tax, Add ‘Pothole Tax’

Cutting taxes when they are too high or poorly designed can help economic growth. But in America it is harder to make the case for more tax cuts. First, we are lightly taxed, compared to our wealthiest competitors. And then our country’s infrastructure is, as Trump reminds us often, literally falling apart.

Indeed, decades of neglecting roads in California after Proposition 13 in 1978 froze property taxes now cost the average Golden State family almost $800 annually in extra automobile repairs. When I first wrote about this emerging problem three decades ago I referred to it as the California pothole tax, a boon to automobile-alignment shops, but a drain on the pockets of motorists.

We all wish we could have all the government services we want and pay low taxes. But like childhood dreams of flying through the air and adult purchases of creams and pills to make parts of the human anatomy bigger, they are just fantasies.

That huge tax cuts, especially for business owners, will create accelerating economic growth is an idea that is easily marketed as reality. It is no more real than a television show whose host glories in firing people.