Last week, the Federal Trade Commission made clear that dishonestly undermining Americans’ privacy can remain a part of a successful corporation’s business plan. The commission closed its investigations into the two most prominent corporate data breaches in recent memory. The Equifax hack and Facebook’s Cambridge Analytica scandal investigations have yielded back-to-back out-of-court settlements that are all bark, no bite.

That means there will be no real accountability to prevent these companies, or others, from getting careless with your personal information again. In Equifax’s case, 147 million US-based consumers—about half of the country—had their names, Social Security numbers, birth dates, addresses, and even driver’s license details stolen by still-unknown hackers. It took Equifax two months to even notice the hack, and another month to finally admit it to the public.

Facebook’s case began when we learned a British political consulting firm harvested private information from more than 50 million users without their permission. This personal social media activity fueled Cambridge Analytica’s so-called “psychographic modeling,” which may have played a role in the political strategies of the Brexit campaign and Donald Trump’s presidential run. Of course, the investigation into Facebook and Cambridge Analytica ultimately unearthed other major Facebook violations as well.

Equifax will likely pay $575 million, and Facebook $5 billion. Those both sound like big numbers, but they are each barely a fraction of these corporate behemoths’ quarterly profits. Indeed, following the announcement of a new FTC antitrust investigation after Wednesday’s markets closed, Facebook stock “initially rose 4% in the extended session.”

The commission is rightly taking knocks for its wimpy responses to these scandals. But if you’re wondering why the FTC acted so weakly, the answer isn’t complicated: Just look at the signatures at the bottom of each settlement document. To quash these cases, both Facebook and Equifax hired lawyers who were once leaders within the FTC.

It’s a sad illustration of the agency’s long-standing revolving door with the industries it’s meant to regulate. In our current age of mass corporate consolidation, we need strong agencies to protect consumers and workers. But that will never happen as long as young, ambitious lawyers see jobs in the federal government as merely jumping-off points to their real career goals: cashing in on connections.

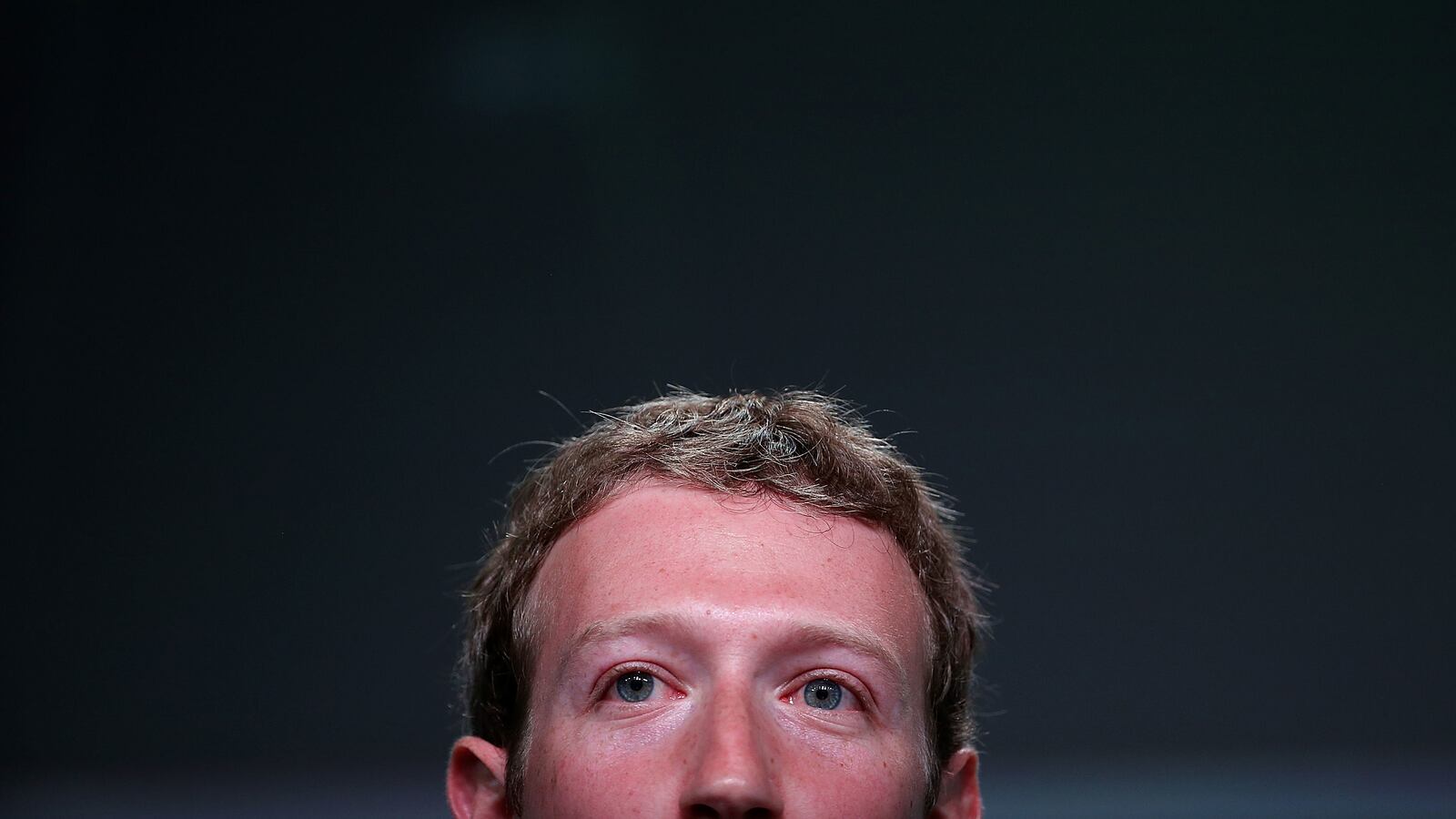

When Facebook faces privacy troubles with the FTC, it calls Sean Royall of the corporate law firm Gibson Dunn. Royall signed a 2011 consent decree that laid out privacy rules for Facebook. Those rules have been in the news—for Facebook’s systemic breach of them in the Cambridge Analytica case. Now Royall has helped settle the FTC investigation into that rule-breaking—his initials are right below CEO Mark Zuckerberg and Vice President Colin Stretch’s signatures in the document.

Why is Royall so effective at stopping FTC oversight? In no small part because under George W. Bush, he was deputy director of the Commission's Bureau of Competition. (Royall was appointed on the same day that another young lawyer got a job as director of the Office of Policy Planning. His name was Ted Cruz.)

After two years as an FTC higher-up, Royall stepped down to return to his job at Gibson Dunn. Since then, he’s won numerous awards as an anti-antitrust lawyer, according to his official bio. He successfully defended AT&T’s swallowing of Time Warner. He’s a regular hired gun for Big Pharma, protecting Allergan against class-action lawsuits for several of its eye medications. As Royall brags in his law firm bio, he “regularly represents clients before the Federal Trade Commission and Department of Justice in antitrust and consumer protection matters.”

It should go without saying that having served as the deputy director of the competition bureau gives Royall unique insight into how to safeguard his clients against the FTC’s tactics. It also puts FTC lifers in the awkward position of having to argue against their old boss on significant cases—an old boss to whom they might owe a career, a promotion, or a mentorship.

The bipartisan revolving door played an even larger role in last week’s Equifax settlement. Equifax turned to the corporate law firm Hogan Lovells for outside counsel, which put together a team led by Democrat Edith Ramirez. Her name is listed first among the Hogan Lovells attorneys on the final settlement document.

Merely two years ago, she was the FTC’s chairwoman. Ramirez’ FTC bio brags about “promoting competition in the technology and healthcare sectors, safeguarding consumer privacy, and protecting vulnerable communities from deceptive and unfair practices.” None of that stopped her from snapping up a job settling cases for the same corporations which commit those abuses. Representing Equifax is an especially low mark—even Republican Congressman Patrick McHenry wants to regulate the credit-rating industry.

Tellingly, Ramirez co-heads her new corporate firm’s antitrust practice—antitrust law being one of the most powerful tools the FTC wields, and something which she’d have unique insight on as an ex-commissioner. It’s also an increasingly relevant sector of law: Google, Amazon, Apple, and Facebook are all facing federal antitrust investigations at the moment. Considering Ramirez’s new firm has experience representing three of those four in cases against the government, we wouldn’t be surprised if she ends up across the table from her old FTC colleagues again soon.

Royall and Ramirez are representative of a deep, cynical problem across the executive agencies. It should serve as a wake-up call when twice in the same week, former civil servants deprive the American people of accountability for wrongdoings that left millions vulnerable and furious. We’re loathe to speak positively of Ronald Reagan, but his mantra that “personnel is policy” is accurate. We need to build an FTC where the personnel are dedicated to a career in which their first and last duty will be to the public, not their future employers.

Jeff Hauser is the founder and executive director of the Revolving Door Project at the Center for Economic and Policy Research.

Max Moran is a research assistant at the Revolving Door Project.