The divvying of Gene Hackman’s $80 million Hollywood fortune faces major roadblocks following the Oscar-winning actor’s death last month at 95.

Laura Cowan, an estate planning attorney and founder of 2-Hour Lifestyle Lawyer, told the Daily Mail that Hackman made one crucial mistake with his trusts before passing: All of his successor trustees have already died.

She explains that when creating a living trust, a person will “pick a successor trustee to manage and distribute the trust assets when they’re gone,” which makes Hackman’s situation particularly complicated and could lead to major problems with his estate later on.

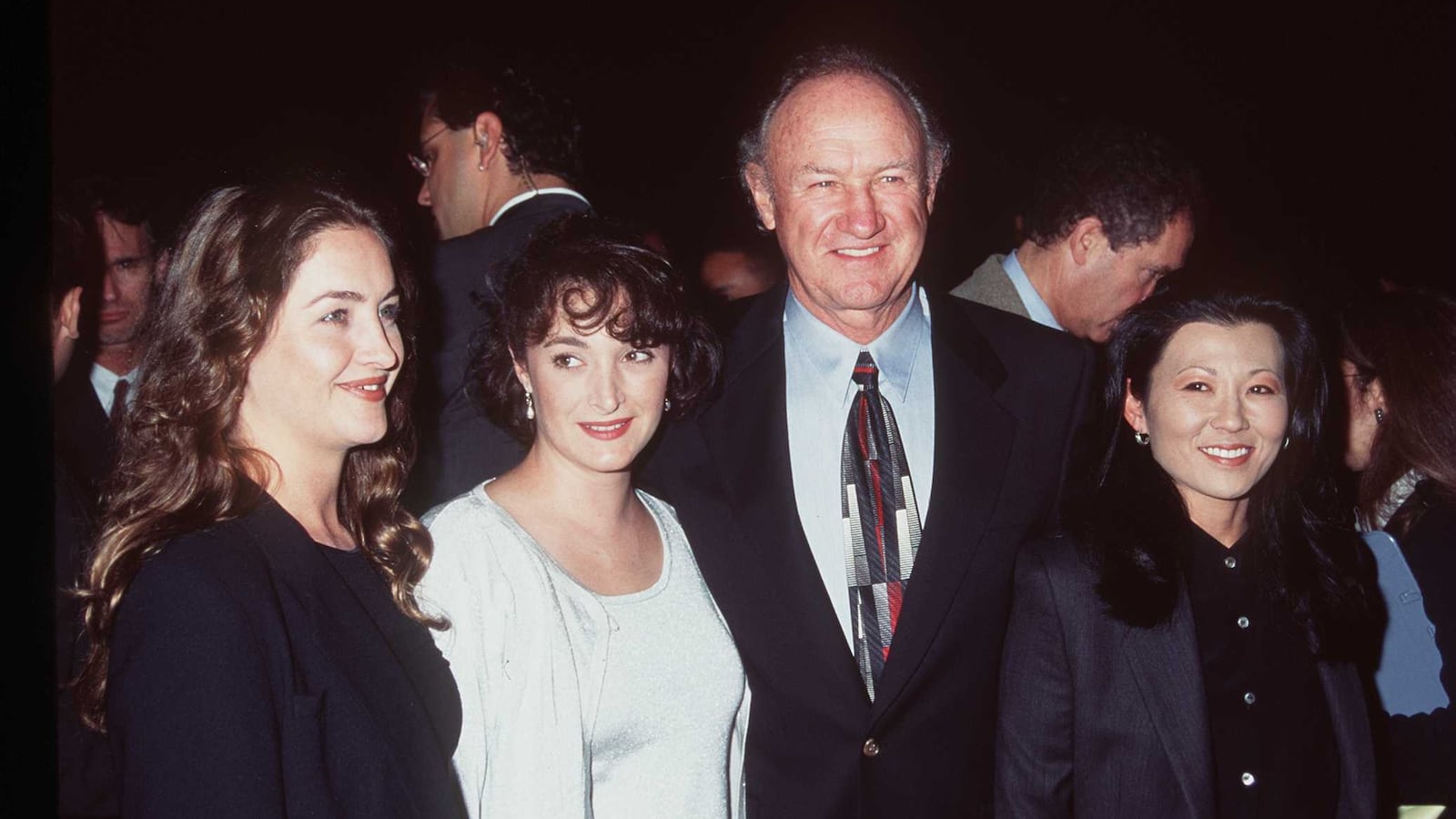

Hackman had left everything to his wife, Betsy Arakawa-Hackman, but she passed away days before him.

New Mexico law states that had the couple died within 120 hours of one another, their deaths would have been considered “simultaneous.” But since investigators have found through his pacemaker activity that Hackman outlived his wife by seven days, experts are saying that his estate may then be divided among his remaining beneficiaries.

“If he died first and she [Betsy] had survived, it would’ve been World War III,” a legal expert told the Daily Mail.

Santa Fe Sheriff Adam Mendoza told reporters Friday that though he is confident of the timeline of events, the case will remain open until they look through more evidence and manage to “close the loopholes.”

The late actor’s estate filed a petition Monday to request a new temporary successor trustee be appointed, which subsequently got approved on Thursday of this week. Avalon Trust, LLC, was appointed as the temporary sole trustee of Hackman’s trust, as per the recommendation of the estate’s representative.

According to Cowan, this is “a common, proactive step in high-stakes estates, especially when multiple deaths or complex family dynamics are involved. She adds that what’s interesting about Hackman’s estate is “that the problems he had has nothing to do with him being wealthy,” but that his will was 20 years old.

“As an estate planning attorney, what we struggle with so often is people think wills are only for the wealthy,” Cowan said. “And now there’s the question about whether it really reflects his wishes.”

As a result, the estate might face complications like delays, tax burdens, and additional probate costs.

John Budagher, an attorney at Budagher & Tann., said that given Hackman’s deterioration from Alzheimer’s, the dates any legal documents or wills were signed could open the doors to queries regarding any updates to his papers, leaving them “riper for a potential challenge.”

Any prenuptial or postnuptial agreements could also come into play, and anyone else might attempt to make a claim on the estate, such as potential beneficiaries or children, the latter of which were possibly omitted from his will.

“There are many unknowns that could come into play in the coming weeks,” Budagher said.