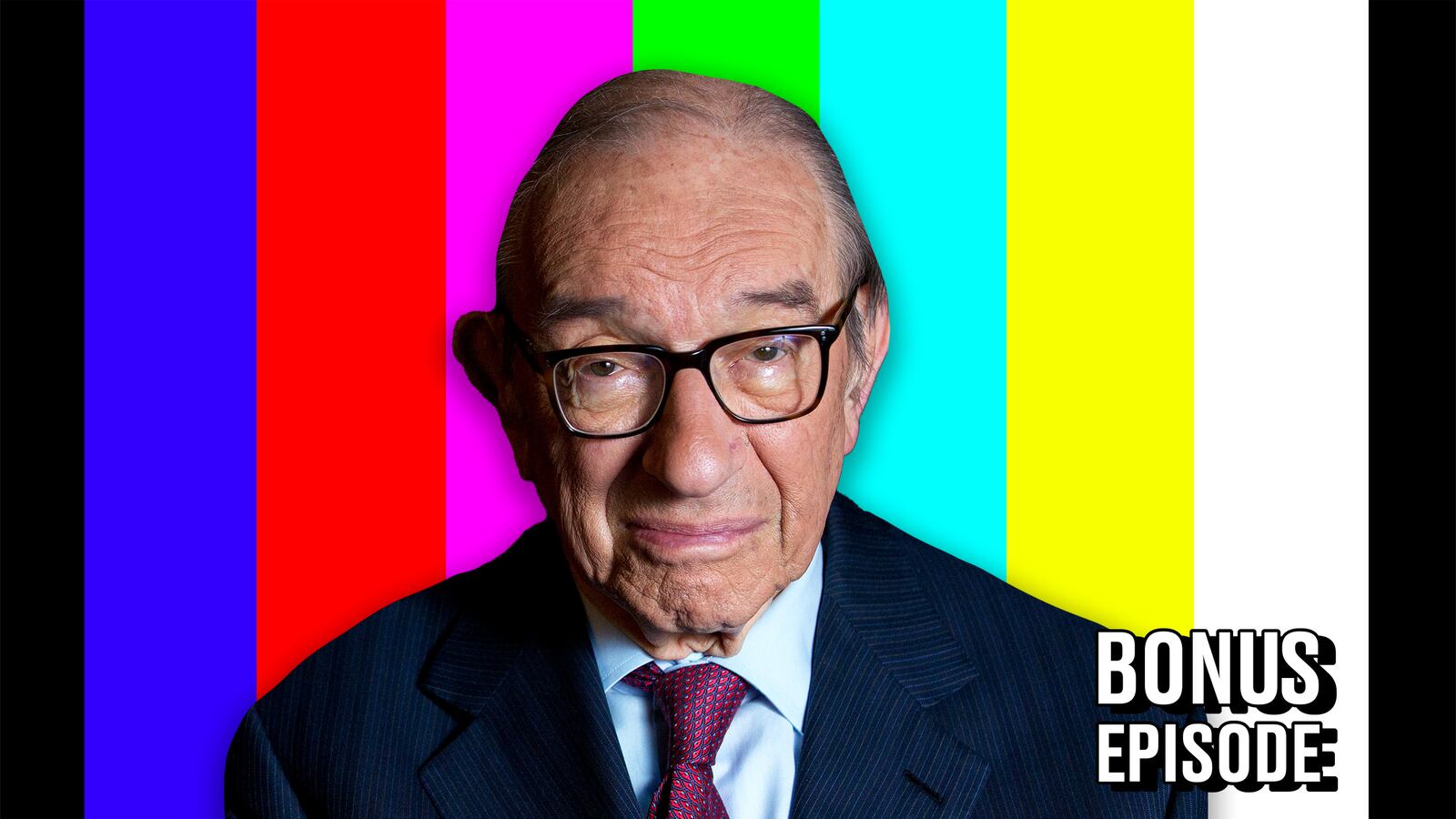

When writer and filmmaker Rupert Russell sat down to write his book Price Wars, which covers how price volatility is the root of global chaos, he didn’t expect Alan Greenspan, the longtime former Federal Reserve chairman, to be a “villain” in the story.

But in this bonus episode of The New Abnormal, Russell explains how a move by Greenspan to deregulate the commodity markets in 1998 has caused decades of market trouble and sparked a “butterfly effect” of problems around the world.

This leaves Molly with a burning question: Why did Greenspan do what he did?

Did you know you can listen to The New Abnormal bonus episodes in your member dashboard or a podcast app? Click here to get set up and sign up for new episode email alerts here.

It all started with a feud Greenspan had with a woman named Brooksley Born, who at the time served as the chair of the Commodity Futures Trading Commission. Basically, Born thought commodity derivatives should be regulated, and Greenspan didn’t—and he won.

“Within about four to five years, speculators came to dominate these markets. Where before they were, say, 20 percent of the market, they became 80 to 90 percent of the market,” Russell explains.

“These are people who don’t even know what the price of milk at their local bodega is. They’re instead operating with a very different set of rules and a different set of expectations, an entirely different game.”

The result? Insane volatility in the markets and prices. And Russell maps out the surprising number of global crises he can trace back to Greenspan’s stance.

Listen to The New Abnormal on Apple Podcasts, Spotify, Amazon and Stitcher.