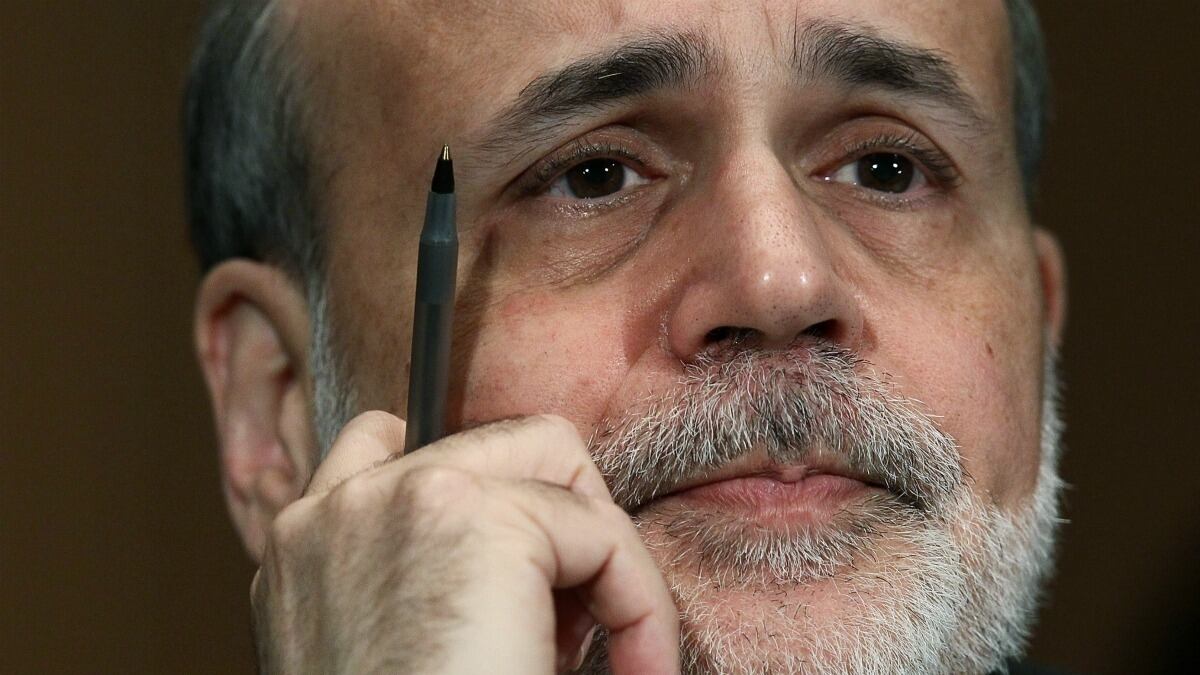

AEI blogger James Pethokoukis argues in this blog post that if Obama wins a second term, he should thank Ben Bernanke for trying to reduce the unemployment rate for him. Pethokoukis then offers a dire warning about the long term damage that working to reduce unemployment might do to the country:

If Obama does win a second term, he may have the extraordinary monetary actions of Bernanke to thank. But the easy money can’t last forever. The spigot will close and interest rates will rise (as will our debt interest). How will the Obama Recovery function without its monetary morphine? Just how much pain will the U.S. economy endure because we’ve wasted years not reforming the tax code, entitlements, or education?

The argument is that what Bernanke is doing is not a real recovery, it is instead ephemeral. This is a common critique on the right. Paul Ryan likes to refer to these sorts of actions as "sugar highs".

There is another school of thought which argues that the single biggest crisis facing the US economy at the moment is the unemployment rate. America also faces long term fiscal challenges, and deep structural problems, but those problems become exacerbated when high unemployment persists. Those without jobs don't develop skills, get worse jobs, have lower lifetime incomes, have less to pay in income taxes, might become dependent on the state, and so on.

If you are a devotee of Paul Ryan and concerned about how Medicare will cause a fiscal crisis in the 2030s, then you should want lower unemployment now so that the American economy will be in a stronger position when that time comes.

There is much not to like about Federal Reserve policy. The policy of paying interest on excess reserves has sent the wrong message to the banking system, and I agree in principle with conservatives who want the Fed to adopt a rules-based policy as opposed to discretionary policy.

But it is pretty stunning to critique Bernanke for doing the most he can to reduce unemployment. I don't even think that Bernanke is doing enough (I am a NGDP-target advocate) but it is not accidental that periods of Federal Reserve monetary easing have been accompanied with improved economic circumstances and without any of the significant inflation we have constantly been warned about. A constant focus on the long-term problems as the expense of the short-term ones seems likely to make the long-term ones even worse.