When historian James Truslow Adams coined the term “the American dream” in his 1931 book The Epic of America, he was echoing the sentiments of John Winthrop, Thomas Jefferson, and Benjamin Franklin, citing America's relenting ambition for a “richer, better and happier life for all citizens of every rank.” One could argue that the American dream's possibilities felt tangible during the Jazz Age just prior, thanks to newfangled technologies like washing machines, dishwashers, and automobiles. But once the Great Depression hit, the U.S. government worked to revive one specific American ideal in particular: homeownership.

The Great Descent

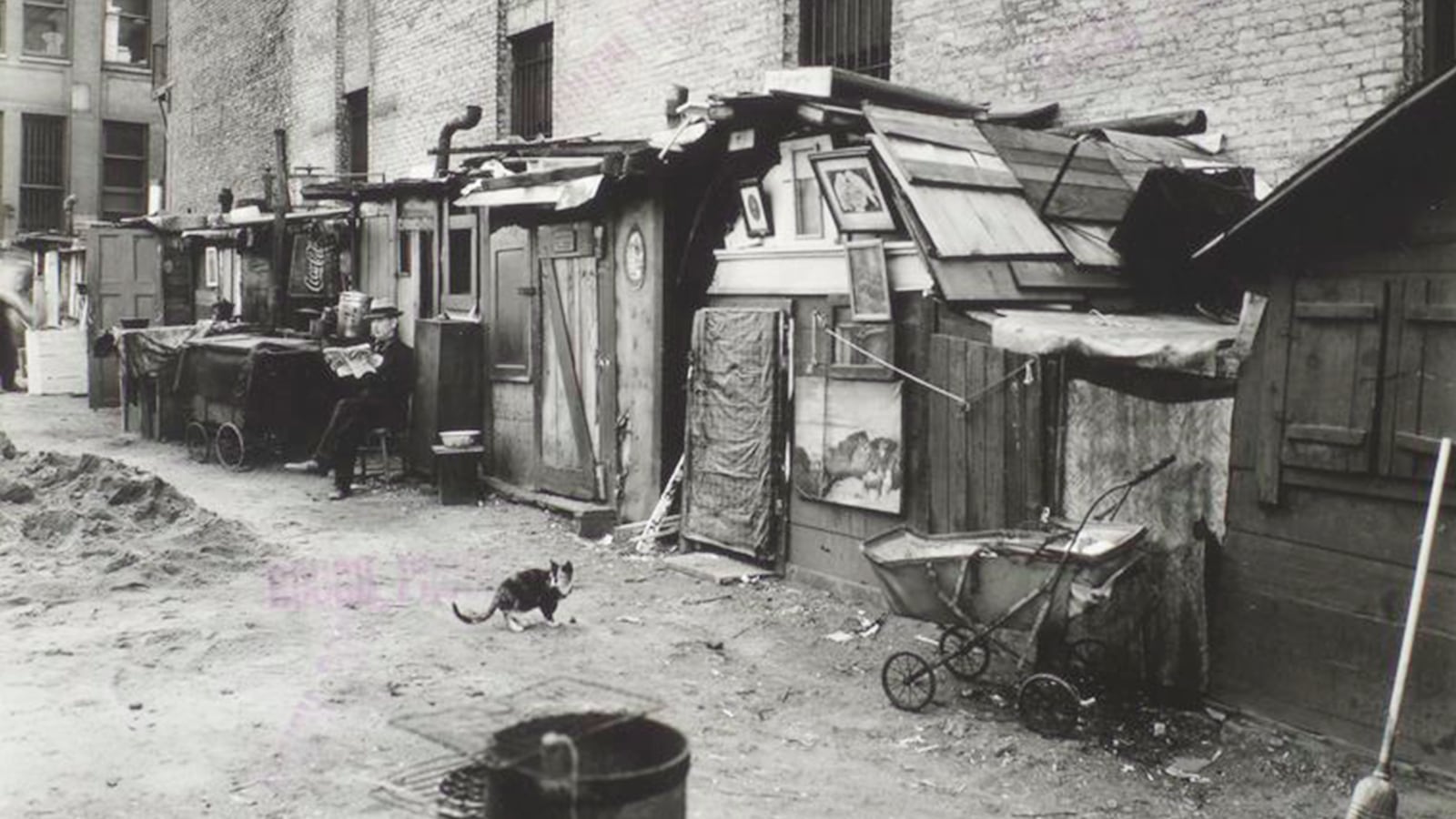

America had no choice. At the Great Depression’s height in 1932, the country’s wealthiest pulled their investments and money from banks in a panic. The average national income fell to below 50 percent of what it was just three years prior. More than one million homeowners faced foreclosure, as people immediately resorted to homes made entirely out of scrapyard materials—loose lumber, cardboard, with newspapers as blankets. Some people simply lived out of empty conduits and water mains. The U.S. Department of Commerce found a $300 million to $500 million demand for homes, “which could be undertaken if financing was available.” Meanwhile Charles Michelson, a newspaper-reporter-turned-Democratic-National-Committee-publicity-manager, nicknamed the era’s shantytowns “Hoovervilles,” epitomizing the popular opinion that sitting U.S. president Herbert Hoover deserved the lion’s share of the blame.

Despite his reputation, before he was president, Hoover seemed to acutely understand what homeownership meant to Americans. In 1919, before Warren Harding appointed Hoover as Commerce Secretary, the U.S. Department of Labor took over “Own Your Own Home,” a campaign spearheaded by the National Association of Real Estate Boards, now the National Association of Realtors® (NAR), that taught the hows and whys of homeownership through pamphlets and university lectures. By 1925, as commerce secretary, Hoover understood homeownership’s greater effects. He wrote, “The present large proportion of families that own their own homes is both the foundation of a solid economic and social system and a guarantee that our society will continue to develop rationally as changing conditions demand.”

The Long Road Back

And so then, as president, Hoover took the first step in a years-long economic recovery. The 1932 Federal Home Loan Bank Act attempted to make home financing more readily available. Federal Reserve banks were allocated $125 million in total capital that they could loan to savings banks and insurance companies—a sort of safety net that was previously reserved for commercial real estate. “The program had little effect in stemming the tide of foreclosures, but it did open the door for further government intervention in the mortgage market,” Vincent J. Cannato, historian and professor at University of Massachusetts, wrote in National Affairs. Look no further than Hoover’s successor, Franklin D. Roosevelt’s, administration for proof.

Under the 1934 Housing Act, the Federal Housing Administration insured home mortgages to lower the cost of lending. Banks could now offer longer terms and larger maximum mortgages to keep homeowners from defaulting. Hugh Potter, president of the Realtor® association, immediately saw the FHA's potential and lobbied for the act’s ultimate passage. “We are giving the FHA all the help we can,” he said. His instincts were correct: The FHA has since insured over 35 million home mortgages in its 84-year history.

The Realtor® association also advocated for a central mortgage bank that could consistently provide mortgage funds at low interest rates. The U.S. government first looked to private investors to act on the Realtor® association’s recommendation. But by way of the Federal National Mortgage Association, better known as Fannie Mae, it took matters into its own hands. Fannie Mae created a secondary mortgage market as it bought long-term mortgages from lenders. That way, as people spent years paying off their mortgages, lenders still had cash freed up to issue more loans.

These government agencies allowed for 30-year loans with fixed interest rates that could cover 80 percent of the cost of a home. As a result, homeownership rebounded between 1940 and 1960, as its rate climbed from 43.6 percent to 61.9 percent.

Unfortunately, those same agencies didn’t grant equal access to every American citizen. The FHA denied aid to applicants who lived in “definitely declining” neighborhoods, paving the way for redlining, a term that refers to disproportionally refusing to insure African-American residents and neighborhoods. A rule in the Realtor® association’s Code of Ethics, in effect from 1924 to 1974, was another unfortunate product of the times: Members could “never be instrumental in introducing into a neighborhood … members of any race or nationality, or any individuals whose presence will clearly be detrimental to property values.” Upon the 50th anniversary of the passage of the FHA, NAR spoke up about righting its wrongs. “We will never close our eyes to discrimination again,” said former NAR president Steve Brown. “It is time for us not only to follow the letter of the law but to embrace the spirit of the law. Not only is it good business, but it’s the right thing to do.”

The Path Forward

Today, as people continue to recover from a more recent recession, they debate whether the American dream remains accessible. Millennials, world-weary thanks to a half-lifetime of college debt, are unsure whether they should still believe in it or not. A new documentary, Generation Wealth, argues that the American dream has been corrupted to the point that it is overly driven by consumerism and reality TV-level displays of opulence. Meanwhile, people who long ago emigrated to New York from abroad are resettling in Philadelphia, where the foreign-born population has shot up 69 percent since 2000. Yet for all the ways that Americans continue to interpret Adams’ words, a home remains in the center of his vision: In January, the U.S. homeownership rate was at its highest since late 2014. A few months later, it ticked up again. After all, if the Great Depression couldn’t completely dash that aspect of the American dream, what could?

REALTOR® is a federally registered collective membership mark which identifies a real estate professional who is member of the NATIONAL ASSOCIATION OF REALTORS® and subscribes to its strict Code of Ethics.