“How does a hedge fund get an edge?” postulates a prominent New York corporate lawyer from a white-shoe firm. “Cheating, that’s how. How do you outperform the market year after year? You can’t, so you cheat.”

No wonder then that Preet Bharara, the U.S. Attorney for the Southern District of New York, focused his latest insider-trading attack on financial “professionals willing to traffic in confidential business information, all to obtain an illegal inside edge….”

As hedge funds have risen to prominence in the last decade and remained largely sheltered from onerous regulation or much public disclosure, they have grown enormously, with between $1.7 trillion and $2 trillion now estimated to be under management. Miraculously, hedge funds rarely seem to lose, with Hedge Fund Research reporting only three calendar-year losses for the industry since 1990. One of those years was 2011, with hedge funds down 4.8 percent, and the group that concentrated on equities—stocks—down 8 percent.

One cannot help but wonder whether at least some of those hedge funds lost their “edge” because suddenly flows of inside information dried up as prosecutors in New York racked up convictions and uncovered what they called widespread corruption by hedge fund types manipulating securities markets.

Certainly, the unveiling Wednesday of seven new defendants—including three now cooperating with the Justice Department—must be striking more fear among some of the biggest players in the hedge fund industry. Court documents unsealed Wednesday suggest the three defendants who are cooperating have been taping their phone calls with others for months, under the direction of the feds.

The most obvious worrywarts could be Steven A. Cohen and his colleagues at his hedge fund based in Stamford, Conn., SAC Capital, although neither he nor the firm has been charged with any criminal acts.

Reuters first reported in 2007 that the firm was under investigation, and three SAC employees have been charged in the last two years before the latest filings. SAC has had a wildly profitable run over the years, and reported an 8 percent profit for 2011. It now has $12 billion entrusted to it by investors, according to Hedge Fund Research. The firm declined to comment Wednesday to the financial news wires, except to reiterate its previously disclosed cooperation with the federal investigation.

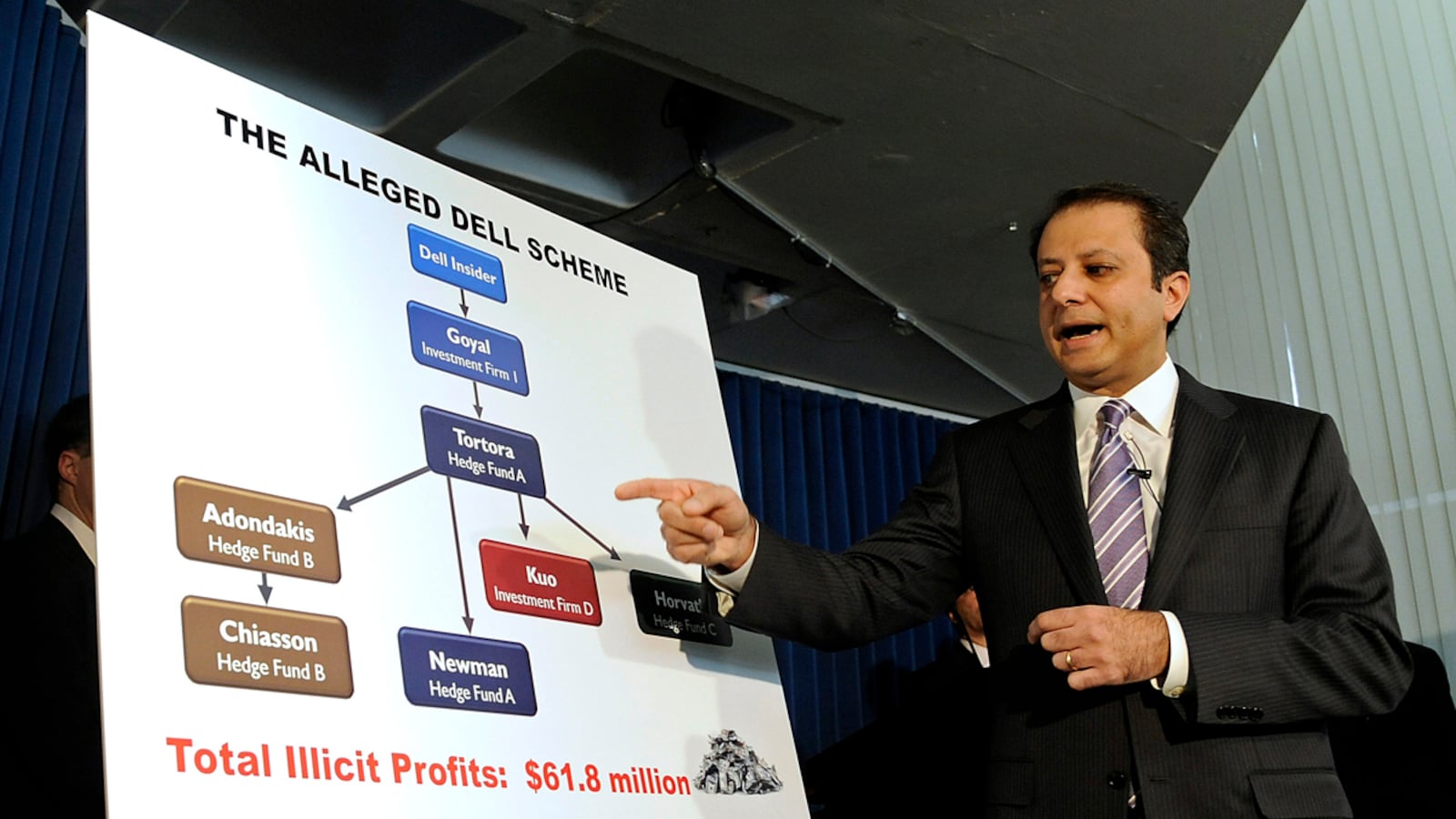

The latest criminal complaint outlines a scheme where the accused received inside information about financial earnings reports Dell was about to make. In the first instance, those tipped learned that Dell was going to report better-than-expected earnings in early 2008, and subsequently they bought Dell stock before it rose on the earnings news. The bigger profits came later in 2008, when those charged bet against Dell after learning Dell’s profits would be far lower than anticipated.

SAC alum Anthony Chiasson was charged with overseeing the trades that allegedly made $53 million shorting Dell for Level Global, a New York-based hedge fund where he was head of research and cofounder, with David Ganek. The two men had met while working at SAC Capital, and since 2003 had built Level Global into a $3 billion hedge fund, before it closed last year after news of the investigation first hit, according to Bloomberg.

Also charged was Todd Newman, a former analyst at Diamondback Capital, a $4 billion Stamford, Conn. hedge fund cofounded by two other former SAC Capital employees who have not been charged.

A third man arrested Wednesday, Jon Horvath, was employed as a technology analyst by Sigma Capital, a New York-based unit of SAC, when his firm made $1 million from the alleged insider trading in 2008, according to the criminal complaint.

Given the new charges, the following partial transcript obtained last year by Reuters of an exchange between the normally reclusive Cohen and a combative lawyer taking his deposition becomes more fascinating. Cohen was interrogated in a civil suit that accused a group of hedge fund managers of collaborating to destroy a Canadian insurance company called Fairfax Financial. At one point, Cohen told Michael Bowe, the lawyer for Fairfax: “The way I understand the rules on trading on inside information, it’s very vague.” Bowe persisted.

Bowe: “Mr. Cohen, are you familiar with the term “edge”?Cohen: “Yes, I am.” Bowe: That’s a word that you use at S.A.C., correct? Cohen: “I hate that word.”Bowe: What’s that word mean?Cohen: “It just means that somebody believes that in a particular situation, stock, that the word suggests that somehow their expectations are different than either investors’ expectations or Wall Street’s expectations.”Bowe: They think know something everyone else doesn’t, right?Cohen: “You know, I think that’s an over — I think that’s an incorrect characterization of the word.”

At his press conference Wednesday, Bharara said 63 defendants have now been charged in the last two years, 56 already have been found guilty, and more should expect to be caught soon. He said: “Insider trading activity in recent times has, indeed, been rampant and routine, and this criminal behavior was known, encouraged, and exploited by authority figures in several investment funds.”

Together with FBI Assistant Director Janice Fedarcyk and Securities & Exchange Commission Enforcement Director Rob Khuzami, the U.S. Attorney sketched a picture of hedge fund employees whose idea of friendship was functioning as “a criminal club, whose purpose was profit and whose members regularly bartered lucrative inside information.”

The FBI assistant director talked tough: “Each wave of charges and arrests seems to produce leads that lead us to the next phase… This initiative is far from over.”

Khuzami was most pointed in his overall assessment of hedge funds, claiming there is “systemic dishonesty” and “a deeply embedded level of corruption.” He continued: “Hedge funds are also characterized by a lack of transparency in trading practices, market power that can give them influence over those who possess inside information, access to leverage and large amounts of capital, and the techniques to trade extremely quickly. Those characteristics, if put to use for illicit purposes, present a grave threat...”

At the press conference, the authorities declined to say whether the huge short-sale trades were detected by SEC computer analysis at the time. One suspects they were not, and that raises the next question: Could the SEC go back over trading records for every short sale worth more than $50 million in profits and turn up more hedge funds acting illegally?