As the Manhattan district attorney’s historic investigation into former President Donald Trump appears to spiral—and the grand jury with the power to indict Trump reaches its final days this month—it’s now clear a high-ranking employee who could have been a key government witness has instead remained loyal to Trump, chalking up a pattern of untaxed off-the-books executive compensation as a personal mistake.

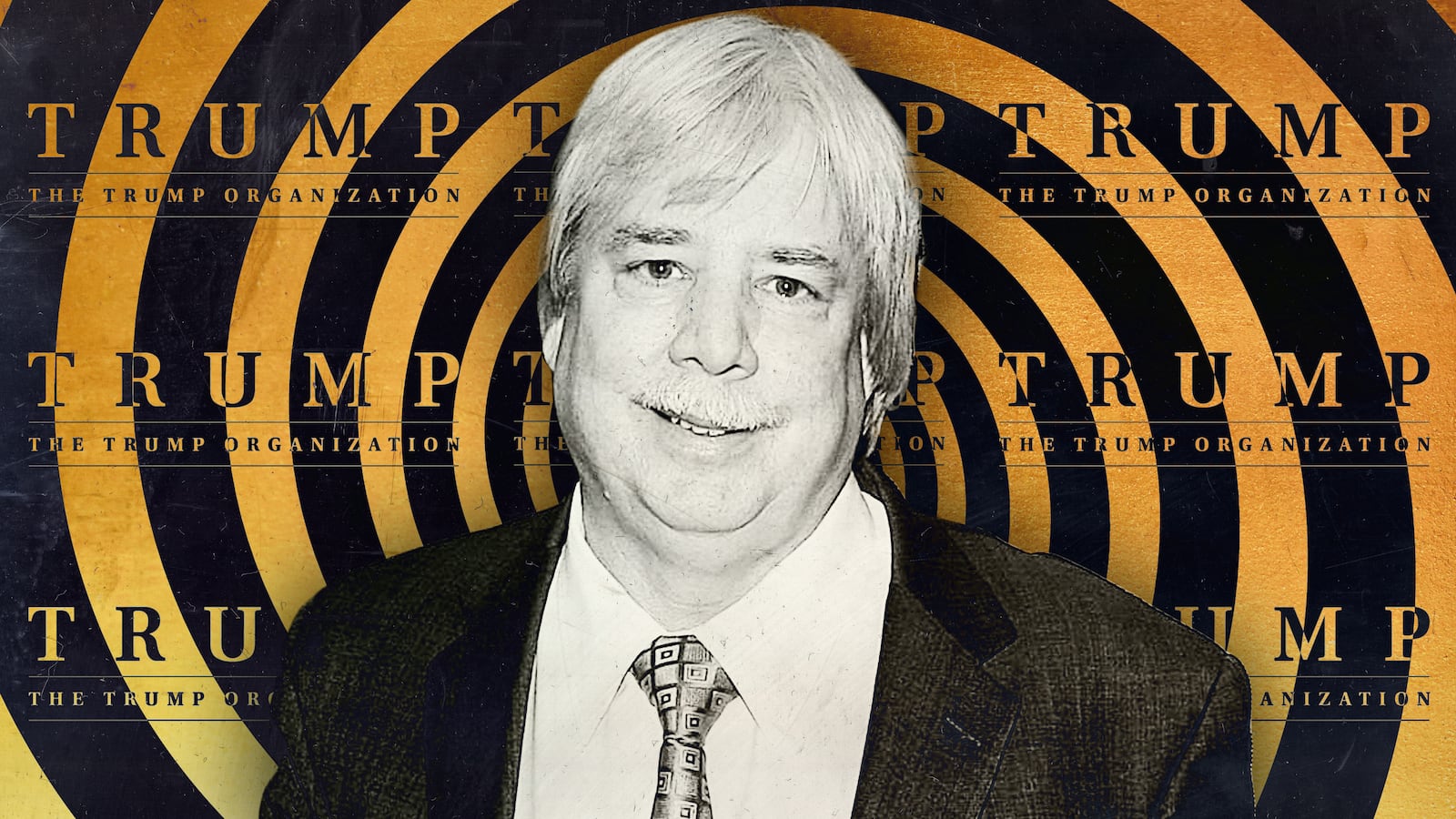

Jeffrey S. McConney, the company controller and right-hand man to former chief financial officer Allen Weisselberg, was indicted in June 2021. When McConney testified before the grand jury in the run-up to that indictment, he took the blame for any shenanigans with Weisselberg’s pay, according to court documents the company filed earlier this year.

Investigators assert that Weisselberg got a plethora of untaxed company perks, like a swanky apartment, luxury car, and expensive private school tuition for his grandkids. But McConney—who’s been a corporate accountant for decades—swore he wasn’t even aware they counted.

“I didn’t think or know they had to be reported,” he told grand jurors. “Until recently, I never thought [the apartment and tuition] had to be income—included as income.”

And while investigators have maintained that Weisselberg’s decision to drop his on-the-books salary showed that this was a ploy to dodge taxes, McConney instead rationalized it as merely “a generous gesture to Mr. Trump.”

The Trump Organization and Weisselberg are seizing on McConney’s testimony behind closed doors to argue there couldn’t possibly be a criminal conspiracy. Their reasoning: a conspiracy would require at least two people—Weisselberg and McConney—who knew what they were doing was wrong.

“Mr. McConney testified over and over before the grand jury that, at the time of the alleged events in question, he did not think he was doing anything wrong,” wrote Susan R. Necheles, a lawyer representing the corporation.

“And,” she continued, “to the extent that certain alleged fringe benefits did not get reported as taxable income, that was an error on his part. This means that Mr. McConney did not act ‘willfully,’ an essential element of a criminal tax offense.”

Necheles, who made the assertions in an attempt to dismiss the indictment against the company, did not respond to a request for comment. Neither did McConney.

McConney’s long history at the Trump Organization and his central role in the company’s accounting department put him in a perfect position to take it down. But there were obvious signs that McConney wouldn’t turn on the company that had given him lifelong employment.

He’s been the fall guy before.

As The Daily Beast previously reported, McConney refused to play ball during a confidential interview with New York attorney general investigators. In that testimony, McConney claimed he “probably didn’t know” that it was wrong for the company to use its donor-funded charity to settle a lawsuit.

“Anything and everything that could go wrong… did go wrong” when Trump gifted $25,000 to reelect Florida’s Republican attorney general just months before she decided to not investigate his fraudulent Trump University—then mislabeled it as a legal payment to a similarly named nonprofit.

One source who knows about investigators’ experience with McConney told The Daily Beast they found him “less than forthcoming.”

The rest of McConney’s extensive testimony before a Manhattan grand jury remains secret, so it’s unclear if the accountant slipped up and revealed incriminating information that could be used against Trump, Weisselberg, and others. But he remains a central figure in the larger investigation, as recent court documents also revealed that McConney was indeed the “unindicted co-conspirator #1,” the person who allegedly underreported Weisselberg’s income and helped him dodge taxes.

It’s all the more notable, then, that McConney got what amounts to a sweet deal. Unlike other states or even federal courts, New York has a unique rule called “transactional immunity” that completely protects witnesses. In essence, a person cannot be charged for any crime they reveal in their testimony to a grand jury. So, McConney is now likely off the hook for any role he had in the Trump Organization’s alleged business crimes. (Although if he lied about anything, the Manhattan DA could go after him for perjury.)

In the run-up to Weisselberg’s scheduled trial for criminal tax fraud this summer, he and the Trump Organization are trying to get a state judge to dismiss the case—and revealing more details about the investigation in the process.

In a similar filing in February, Weisselberg’s lawyers claimed that Manhattan prosecutors tried to pressure the CFO to dish on Trump to no avail. They pointed to a virtual meeting on June 1, 2021. in the final weeks before he got indicted, when prosecutors “explained their intent to seek charges against Mr. Weisselberg and [made] a pitch that his only ‘way out’ was to cooperate with DANY’s investigation into Mr. Trump and his business.”

When that didn’t work, prosecutors “threatened to prosecute Mr. Weisselberg’s son as the consequence of Mr. Weisselberg’s decision not to cooperate.”

The CFO’s son, Barry Weisselberg, is yet another Trump Organization employee who ran the suspiciously all-cash Wollman ice skating rink in Central Park. Although prosecutors discovered that the younger Weisselberg had also received untaxed corporate perks in the form of a luxury apartment next to the park—an enviable location for almost every New Yorker—investigators have apparently decided to cut him loose.

Prosecutors made the “eventual decision not to charge his son,” attorney Mary Mulligan wrote in a footnote near the end of the 140-page court filing.