To the dismay of Democrats and eager recipients nationwide, the 2021 expansion of the Child Tax Credit (CTC) is dead, at least temporarily, with payments set to expire next month.

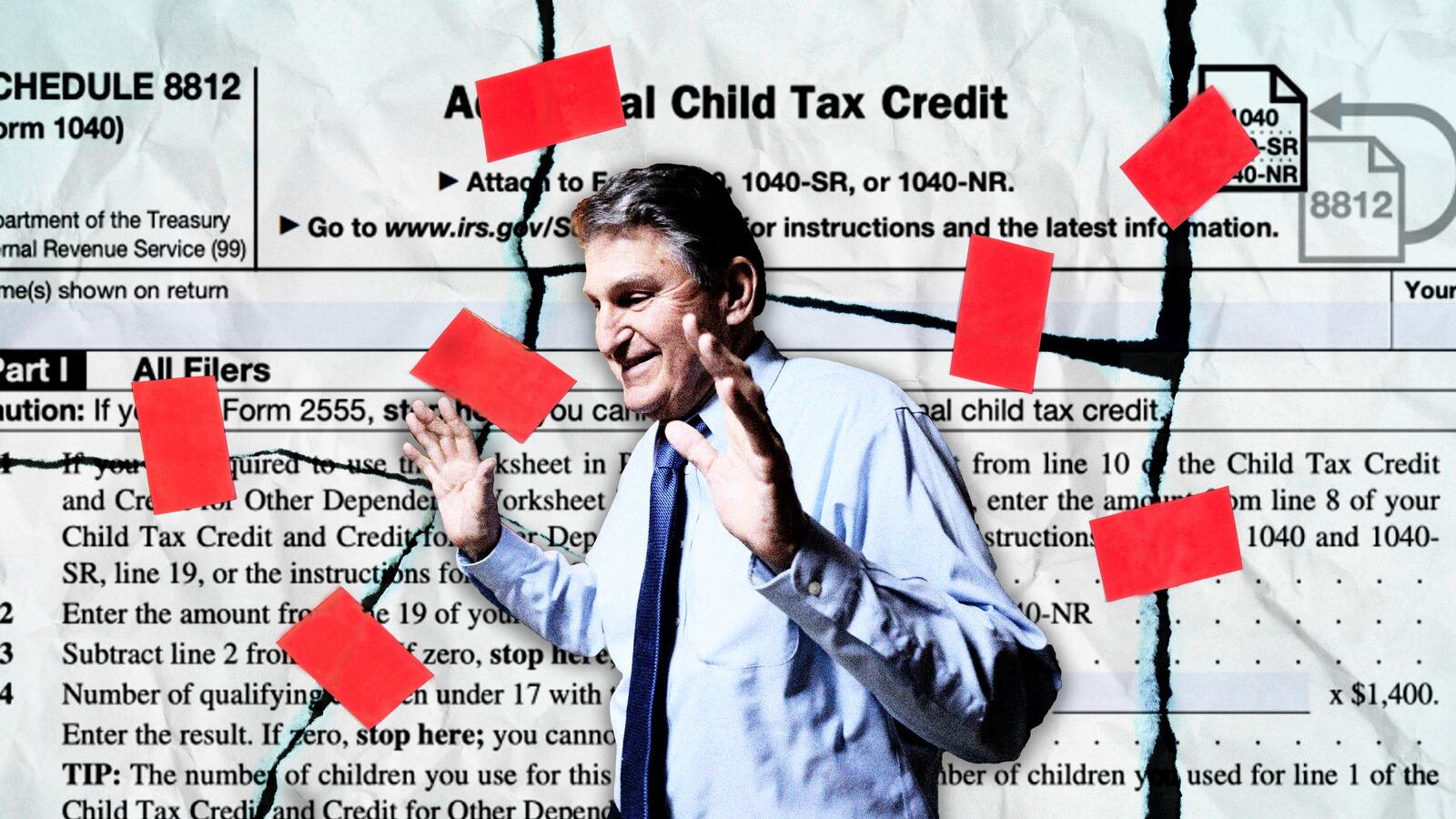

That’s because Congress failed to pass an extension of the new Child Tax Credit program before heading home for the holidays, after moderate Sen. Joe Manchin (D-WV) refused to vote “yes” on the Build Back Better Act. Democrats have been trying for months to include the Child Tax Credit extension in their signature social spending package, but Manchin kicked the bill to the curb over concerns of its $1.8 trillion price tag.

That’s a blow to families who have become accustomed to the additional $250 to $300 each month provided by the expanded CTC, particularly those operating on limited incomes. October Census data showed 35 million families in the U.S. receive the new monthly Child Tax Credit payments, with many using those dollars for school supplies and child care. And skyrocketing cases of the COVID-19 Omicron variant will likely add to Americans’ economic uncertainty.

Frustrated on a national level, some lawmakers are shifting their focus to state-level child tax credits to offer families a safety net.

Seven states already have their own CTCs: California, Colorado, Idaho, Maine, Maryland, New York, and Oklahoma, per the National Conference of State Legislatures. Another nine states have proposed child tax credits over the past two years: Connecticut, Hawaii, Illinois, Iowa, Kansas, Michigan, Missouri, Oregon, and Manchin’s beloved West Virginia.

While these state-level tax credits can’t offset the loss of the federal expansion, proponents of state-level programs argue they are better than nothing.

Connecticut last year came close to enacting a state-level child tax credit during its legislative session. State Rep. Sean Scanlon (D) told The Daily Beast the proposal was put on hold due to an expectation that Congress would make the federal CTC expansion permanent.

“I really cautioned my colleagues and the governor, at the time, that we can’t take for granted that this is going to happen. And I think their side sort of weighed in and said, ‘Hey, you know, let’s just sort of see what happens. I’m sure it’ll get worked out and we won’t have to deal with this,’” Scanlon said on Tuesday.

“And, obviously, it didn’t work out and we’re now three days away from 600,000 children in my state being denied something that is lifting them out of poverty,” he added.

Headed into Connecticut’s 2022 legislative session, Scanlon says enacting a state-level child tax credit will be his top priority, since the federal expansion is now far from guaranteed.

Even if Build Back Better or an extension of the federal Child Tax Program does happen next year, enacting state policy could be “a backstop,” Scanlon said.

“We should be doing this regardless of whether the feds continue it, because the needs are still there,” he said.

A 2019 report from the Institute on Taxation and Economic Policy suggested state-level CTCs are also a means for reducing “a myriad of inequities that are exacerbated by the tax codes in many states,” including by rectifying existing racial inequities in state tax policy and lifting tax burdens off of the poor.

“State lawmakers… do not need to wait for congressional action to make major strides in lifting thousands to millions of children within their states out of poverty,” the report read.

There are limitations to state-level CTCs, however, with their value simply unable to match the loss of the federal Child Tax Credit expansion.

States can’t spend at the same rate as the federal government—and any state child tax credits would likely be targeted toward specific parent populations, said Jared Walczak, vice president of state projects at the Tax Foundation.

“Trying to make up the difference with the expiration of the American Rescue Plan Act expansion of the Child Tax Credit would be almost impossible for most, if not all states,” Walczak told The Daily Beast. Connecticut, for instance, can’t compete with the value of the federal CTC expansion “simply because Connecticut’s income tax is only a fraction of the size of the federal income tax,” he added.

Walczak said it’s unclear whether many states will pursue the option of a state-level child tax credit, with limited state budgets and tax-cut proposals having to “compete with other state resources.”

“States have to balance their budgets and simply aren't operating at the scale of the federal government. So, they tend to be more focused on either limiting or means-testing benefits in tax codes,” he said.

The limitations of state child tax credits create a wide spectrum of impact. In California, families with earned income of anywhere between $1 and $25,000 a year that have a child under the age of six can receive up to an additional $1,000 tax credit annually. In Maine, families receive an annual $300 tax credit per qualifying child.

But in Maryland, for instance, their $500 per child credit is only available to families with children under the age of 17 who have a disability and are the dependent of a taxpayer making less than $6,000 in gross income annually—a narrow subset.

Nonetheless, Jean Ross, senior economic policy fellow at the Center for American Progress, told The Daily Beast she believes the now-proven benefits for families who received the federal CTC expansion will inspire states to consider such policies for themselves. While those credits might be smaller, Ross said “they’re also important.”

“Seeing all the data come out about how families use it, we’re seeing the research come out about the benefits of credit, so I do expect to see a lot of interest as state legislatures go back into session in the new year,” she said.

Scanlon also hopes his fellow state legislators will come aboard the child-tax-credit train ahead of 2022 sessions.

“If we aren’t focused as a people on lifting children out of poverty, what the hell are we going to be focused on?” Scanlon said. “…and at a time when Washington is so broken, states really have the possibility to lead the way.”