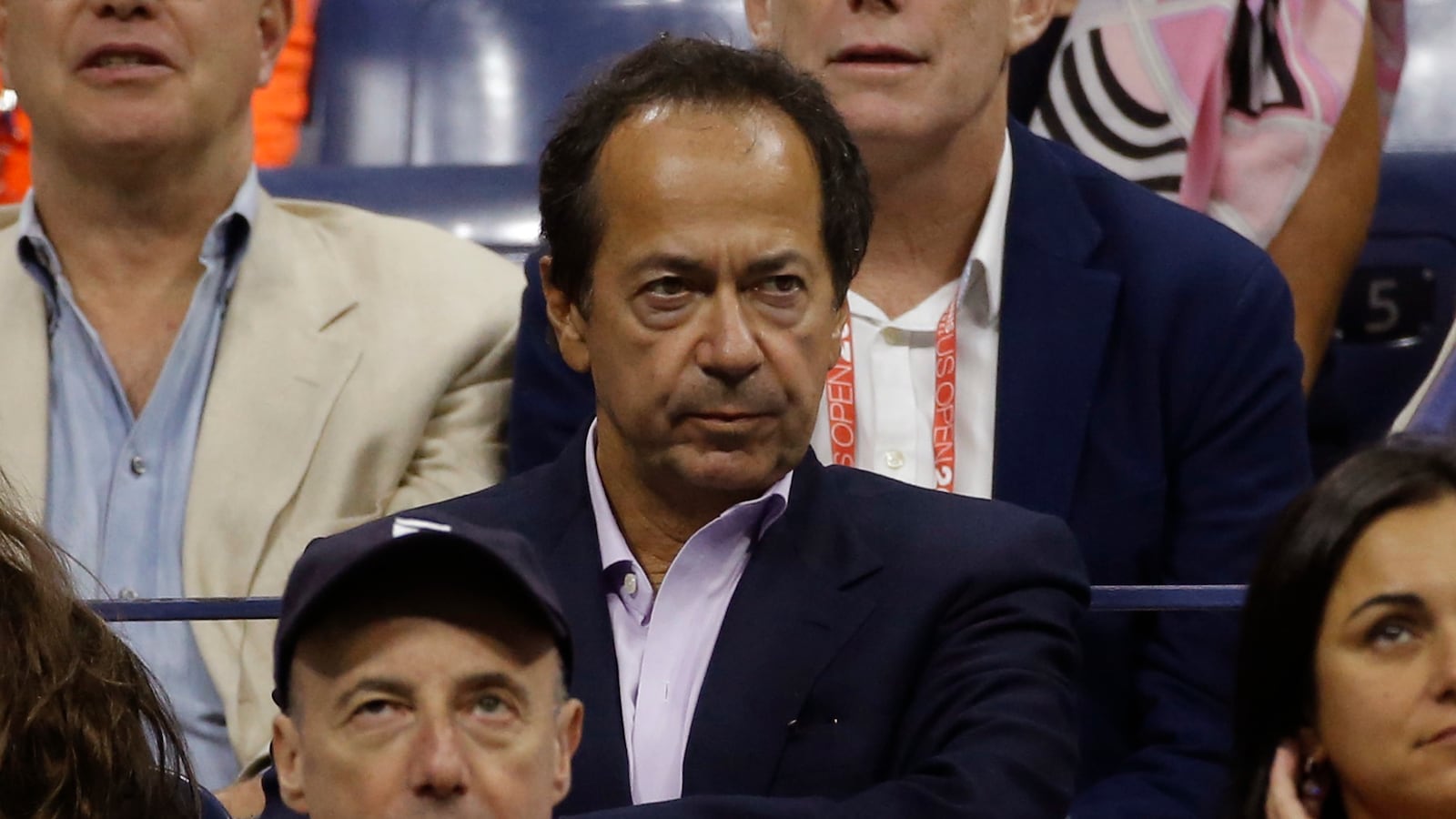

Billionaire John Paulson, who is already locked in a bitter divorce fight with his estranged wife, has a new legal fight on his hands: He’s suing a former business partner for allegedly defrauding him out of almost $200 million.

Paulson is a hedge fund manager famous for shorting the housing market in 2007. More recently, he’s been a fixture in the gossip pages for his ugly breakup with his wife and his romance with a much younger dietician.

In a federal complaint, Paulson claims that Fahad Ghaffar, a Puerto Rico-based business partner, used “criminality, deceitful machinations and underhanded self-dealing” to enrich himself and relatives at Paulson’s expense.

The lawsuit alleges Ghaffar regularly charged personal expenses to Paulson’s company as business expenses, such as a $20,000 night of clubbing in 2022. Paulson claims Ghaffar also charged his companies $8,000 for a night at Marquee nightclub in New York in 2019, and $4,000 for a single meal at Carbone in Miami in 2022. In total, the suit claims, he charged $3.4 million in personal expenses to his employer.

“For years he and his co-conspirators siphoned off value from the Paulson Entities at every turn, betraying Paulson’s trust and biting the hand that had fed them,” the suit states. “[His] greed corrupted the business decisions he was supposed to make for Paulson’s benefit, betraying the confidence Paulson had placed in him with shocking ease.”

Monday’s filing comes six weeks after Ghaffar sued Paulson for allegedly cheating him out of a 50 percent stake in his luxury car dealership. Martin Russo, an attorney for Ghaffar, called Paulson’s complaint a “publicity stunt.”

“The fact that Paulson leads with Civil RICO indicates the weakness of his allegations and inability to prove any real misconduct,” Russo said in a statement. “We look forward to dismantling their lawsuit and vindicating Mr. Ghaffar and his family.”

Both sides have hired public relations firms to represent their attorneys in the legal battle; on Tuesday, Puerto Rican reporters received bankers boxes containing popcorn, champagne, and a copy of Paulson’s complaint.

Relations between the two men are reportedly so tense that Paulson banned Ghaffar from his luxury hotels in Puerto Rico, after a video surfaced of Ghaffar breaking glasses and a chair at Paulson’s La Concha Resort. “Such reprehensible behavior, as demonstrated by Fahad, will not be tolerated by anyone at our properties,” Paulson wrote in a memo to employees last month, according to Page Six.

A spokesperson for Russo told The Daily Beast that Paulson has been aware of the video since it was taken in 2019. “He thought, ‘That’s nothing,’ at the time and then he held it and used it against [Ghaffar] now only because they’re in litigation,” spokesperson Warren Cohn said.

Ghaffar started working at Paulson’s hedge fund, Paulson & Co. Inc, as a junior analyst in 2013, according to the suit. When Paulson expanded his hotel and real estate operations to Puerto Rico, Ghaffar moved to the island to help manage the business. According to the suit, he quickly gained Paulson’s trust and eventually became the manager of all of Paulson’s Puerto Rican investments, including La Concha, the Condado Vanderbilt Hotel, and the St. Regis Bahia Beach Resort.

Along the way, Ghaffar met his wife, Glenda, whom Paulson says conspired with Ghaffar to enrich themselves, her father, and his siblings.

Along with the fraudulent personal charges, the suit claims Ghaffar entered Paulson’s hotels into deals with shell companies set up by his family members, including a company run by his wife that allegedly sold furniture to the hotels at a 55 percent markup and a similar company owned by his sister that sold marked-up rugs, art, and LED lights. He is also accused of loaning friends and family members luxury cars from Paulson’s rental business and providing them weeks of free stays at Paulson’s resorts.

Ghaffar’s charity, the F&G Family Foundation, was also a scam, Paulson claims. According to the suit, the foundation was never legally established and instead served as a funnel for Ghaffar’s personal expenses, including a $360,732 down payment on a friend’s apartment and a $100,000 to his father-in-law for purchasing homes.

Ghaffar maintains it is Paulson who is the scammer. In his September suit, he claims the billionaire convinced him to invest $17 million in his luxury car business for a promised 50 percent stake, but failed to provide proper documentation of the agreement and suddenly removed him from all positions in the company in August—shortly after Paulson says he discovered Ghaffar’s fraud fired him from the hotel businesses.

In a motion to dismiss filed last month, Paulson deemed the suit “utterly without merit” and claimed Ghaffar filed it only to deflect attention from the fraud he had uncovered.

“There has been no fraud, no deceit, no misconduct and no misrepresentations made on the part of Paulson,” Paulson’s attorneys told The Daily Beast in a statement. “If Ghaffar’s complaint is not immediately withdrawn, his senseless refusal will be met with our motion for sanctions.”

The legal smackdown has even bled into Paulson’s high-profile divorce proceedings, which started in 2021 when he filed for divorce from Jenica Paulson and shacked up with 35-year-old Instagram influencer Alina De Almeida.

Jenica Paulson sued her ex-husband, claiming he was hiding money from her in trusts ostensibly set up for their children but actually created to shield his assets. The parties were set to hear Paulson’s motion to dismiss in September, but Ghaffar’s complaint prompted Jenica to look into her estranged husband’s dealings in Puerto Rico more thoroughly, her attorneys told Bloomberg.

On the day of the hearing, she filed an updated complaint claiming Paulson purchased an apartment at the St. Regis Bahia Beach Resort owned by the family trust at an artificially low value, effectively swindling the trust out of some $10 million. An attorney for John Paulson told Bloomberg the apartment was “not a sham purchase” and that his client had paid the full list price. The hearing on the motion to dismiss was postponed until December.