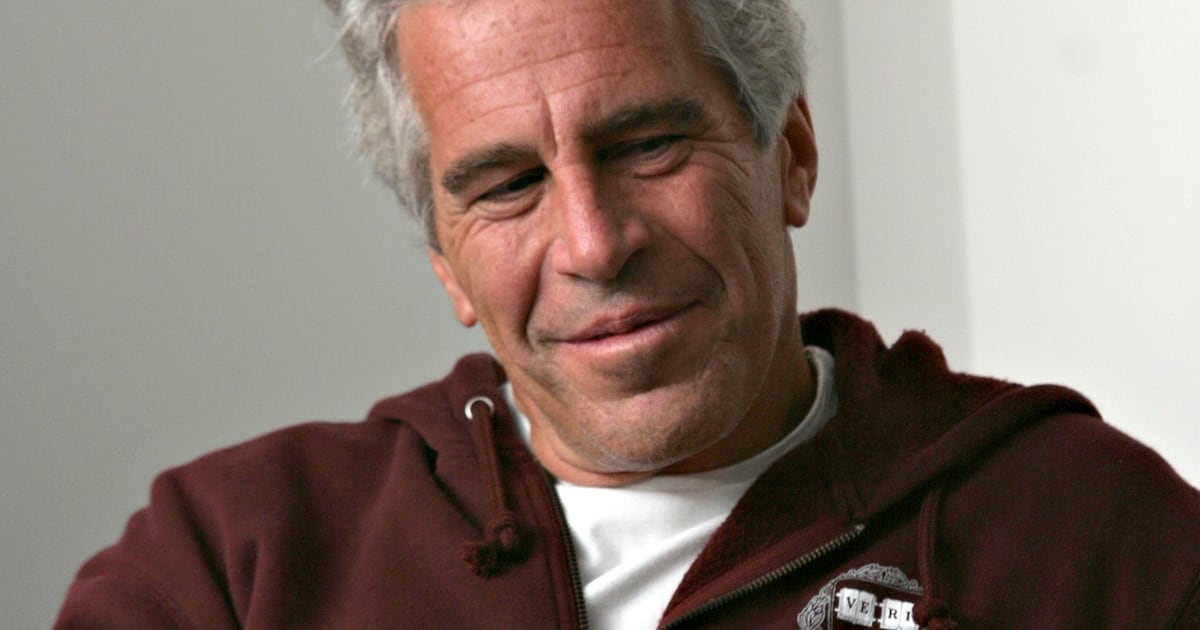

After Jeffrey Epstein’s death in 2019, the sex-trafficker’s former bank, JPMorgan, notified the Treasury Department of more than $1 billion in suspicious transactions from his accounts, according to lawyers for the U.S. Virgin Islands.

The revelation came Thursday in Manhattan federal court during oral arguments in the Caribbean territory’s lawsuit against JPMorgan, which it argues enabled Epstein’s trafficking of young women and girls for more than a decade.

Mimi Liu, an attorney for the USVI Attorney General, told the court that from 2003 to 2019, JPMorgan handled more than $1 billion in transactions related to Epstein’s sex ring.

“Epstein’s entire business with JPMorgan and JPMorgan’s entire business with Epstein was human trafficking,” Liu said during the hearing, adding that the bank was the “full service” financial arm for the late money-manager’s scheme.

When U.S. District Judge Jed Rakoff pointed out JPMorgan’s argument that convicted felons like Epstein can avail themselves of ordinary bank accounts, Liu answered that the evidence in the case shows that the bank’s relationship with Epstein went “beyond ordinary banking.”

Liu also highlighted other suspicious activities: Epstein’s accounts transferred $4 million to women and girls and had $5 million in suspicious withdrawals. She roughly broke down the total $9 million and divided it by the couple hundred of dollars that Epstein was known to pay both victims and recruiters, saying it amounted to JPMorgan “facilitating” more than 20,000 sex acts.

A spokeswoman for JPMorgan declined to comment.

Rakoff will soon decide whether to grant the Caribbean territory partial summary judgment on two counts in its second amended complaint: Participating in a sex-trafficking venture in violation of Trafficking Victims Protection Act (TVPA) and obstruction of enforcement of the TVPA. Rakoff said his ruling would arrive by the end of September.

In a legal memorandum, the USVI requested relief including an injunction preventing JPMorgan “from participating in trafficking ventures in the future and obstructing efforts to stop such ventures” and at least $150 million in civil penalties. The territory’s lawyers added that it defers its request for damages until trial, which is scheduled to begin Oct. 23.

In court on Thursday, JPMorgan lawyer Felicia Ellsworth told Rakoff the USVI presented “not a scintilla” of evidence that JPMorgan isn’t following the law when it comes to sex trafficking and lacked standing to pursue an injunction against the bank.

As for the USVI’s claim that JPMorgan obstructed a trafficking probe, Ellsworth said, “They have not put forth any evidence that there was any investigation to obstruct.”

Epstein was a client of JPMorgan from 1998 to 2013.

Since the lawsuit was filed last December, the litigation has exposed high-profile men in Epstein’s orbit including Google co-founders Sergey Brin and Larry Page, who he introduced to JPMorgan in one of the bank’s most lucrative relationships.

Emails released as exhibits in the case reveal that Epstein connected bank executive Jes Staley—who exchanged creepy emails with the trafficker—to Britain’s Prince Andrew, Dubai businessman Sultan Ahmed bin Sulayem, and Israeli Prime Minister Benjamin Netanyahu. (Staley is accused of sexually abusing at least one of his victims, an allegation he denies.)

Even after JPMorgan honchos cut Epstein off as a client, he continued to refer people to the financial giant, including former White House counsel Kathy Ruemmler. Epstein’s executive assistant had emailed Mary Erdoes, the CEO of the bank’s Asset & Wealth Management arm, about Ruemmler just months before his 2019 arrest for child sex-trafficking.

The bank “handled millions of dollars in payments from Epstein to known co-conspirators, recruiters, victims, girls and women until 2019, including payments to women in years that coincided with their trips to the USVI,” the territory’s memorandum states.

Meanwhile, internal JPMorgan records revealed that bank compliance officials sounded the alarm about Epstein repeatedly, including when he faced criminal charges in Palm Beach, Florida in 2006. That year, Staley spoke with Epstein after police charged him with abusing minors; the trafficker told Staley he had sex with young women for money but denied they were underage. “I went and saw him last night,” Staley wrote in an email to Erdoes. “I’ve never seen him so shaken. He also adamantly denies the ages.”

”At that time, JPMorgan could have immediately exited Epstein—but the Bank knew, from Douglas (Sandy) Warner, when he was head of JPMorgan, Epstein is ‘one of the most connected people I know in New York,’” the USVI argued in its memorandum.

One JPMorgan memo from October 2006 noted that Epstein’s cash withdrawals were “routinely made in amounts for $40,000 to $80,000 several times a month.”

“Several newspaper articles were found that detail the indictment of Jeffrey Epstein in Florida on felony charges of soliciting underage prostitutes,” the document continued.

“We will not proactively solicit new investment business from him,” the memo concluded.

Jane Doe, a survivor of Epstein’s sex ring, had also sued JPMorgan for facilitating the financier’s crimes. The class-action lawsuit settled for $290 million.

In its own legal papers, JPMorgan has argued that the USVI “created a haven for Epstein’s criminal activity” and that the territory had a “quid pro quo relationship” with the trafficker, one that resulted in “money, advice, influence, and favors” for island officials.

Indeed, the government granted Epstein $300 million in tax incentives and waived his “sex offender monitoring requirements,” JPMorgan has argued.

“Rather than account for its own failures to investigate and monitor this criminal under its jurisdiction and to protect its citizens and sovereign interests,” JPMorgan lawyers said in a legal memorandum, “USVI blames a third-party bank that did not have USVI’s authority to enforce any law, nor USVI’s knowledge of Epstein’s crimes in USVI’s territory, and seeks to pursue such claims at the expense of dragging Epstein’s victims through yet more litigation.”

The USVI, JPMorgan says, “can only sue to vindicate the interests” of its residents, and there’s “no proof that any victim was a resident … rather than a person trafficked to or from the Islands.”

“Even were USVI permitted to recover for itself damages suffered by others—it is not—JPMC should not pay those damages twice: first to actual victims, then again to the territory that failed them and protected Epstein.”

While arguing that the USVI had standing to pursue damages on Thursday, Liu said that “not all” of Epstein’s victims came forward to file claims with the victims compensation program. Liu suggested that the USVI could keep any proceeds from the legal battle in a fund for victims to later recover.

“Why shouldn’t the victims benefit from the awards?” she asked.