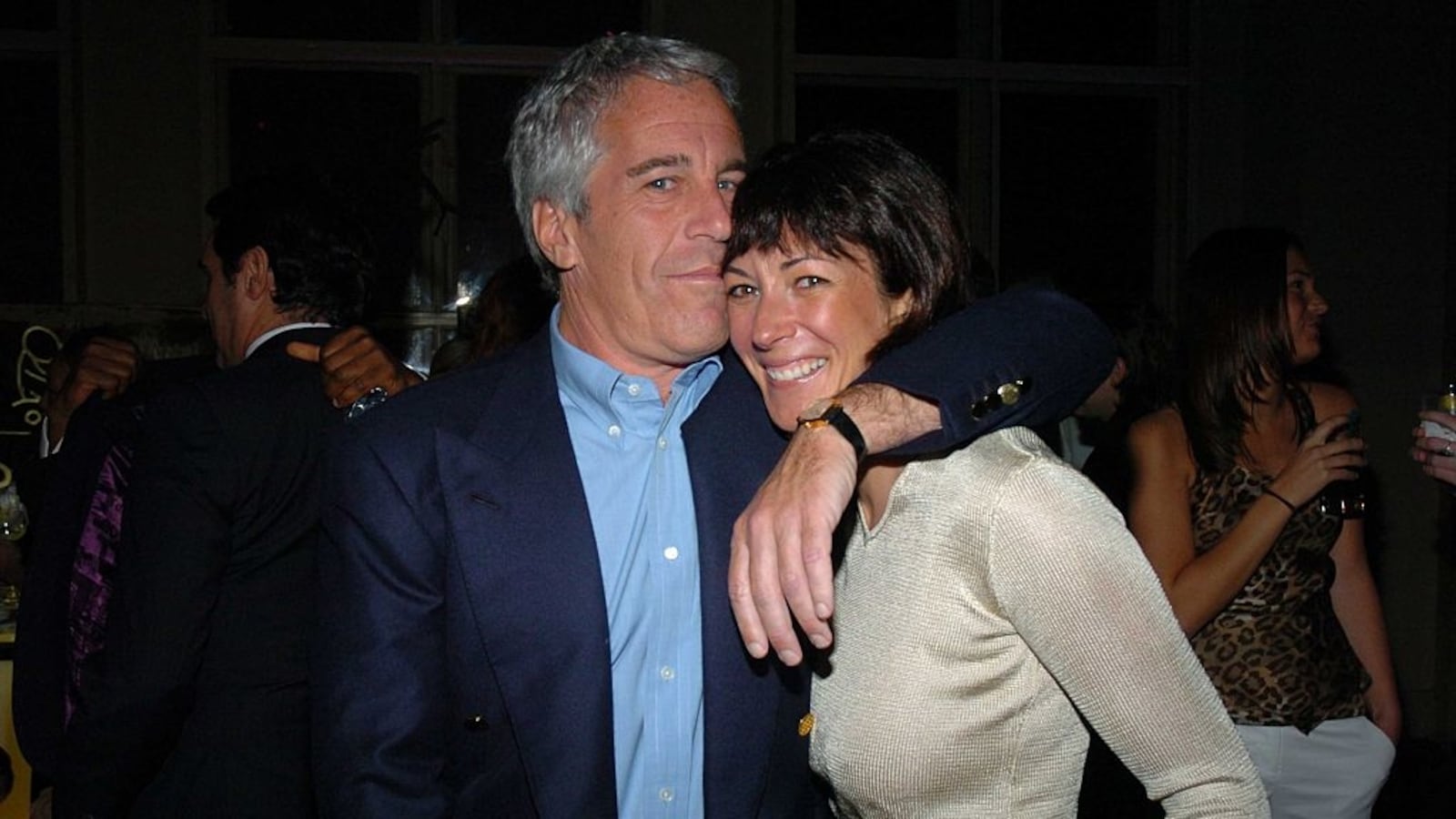

JPMorgan raised red flags about its banking relationship with Jeffrey Epstein as early as 2006 and held meetings with former executive Jes Staley—who is accused of sexually abusing at least one woman in Epstein’s orbit—about his friendship with the multimillionaire sex-trafficker, new court exhibits reveal.

According to internal emails published as exhibits as part of an Epstein victim’s lawsuit against JPMorgan, Staley even went as far as suggesting that bank brass meet with Ken Starr, Epstein’s high-powered lawyer who helped him dodge serious charges in Florida. (Starr is most known as the independent counsel who investigated President Bill Clinton’s sexual misconduct and whose probe led to his impeachment.)

The litigation against JPMorgan includes three related lawsuits in Manhattan federal court and has unearthed new revelations about the Wall Street titans who allegedly facilitated the financial arms of Epstein’s international sex-trafficking scheme.

The complaints also revealed that Staley, a former executive at JPMorgan, had a close bond with Epstein and exchanged cryptic emails with the sex-offender about women in his circle, referring to them by the names of Disney princesses. The related civil cases—including one filed by the U.S. Virgin Islands government—are scheduled for trial in October.

One new email even indicated that JPMorgan continued doing business with Epstein “due to Jes’s personal relationship” with him.

The latest round of emails was released as part of the plaintiff Jane Doe’s legal memorandum requesting the judge grant class-action status to the case. If Doe succeeds, more than 100 victims of Epstein could join the litigation.

JPMorgan is facing backlash from public officials, too.

On Wednesday, Sen. Tina Smith (D-MN) published an open letter to JPMorgan Chase CEO Jamie Dimon demanding answers on why JPMorgan kept Epstein as a client despite his history of suspicious transactions. “If JPMorgan failed to identify, report, and address Epstein’s human trafficking for more than a decade, despite his notoriety and what appear to be glaring red flags in his account activity, what should provide confidence that JPMorgan is carrying out its responsibilities to address trafficking in cases that are less high profile or less visible?” Smith wrote.

The exhibits reveal that JPMorgan knew Epstein was radioactive for years.

In a June 2013 email, JPMorgan directors discussed a previous bank probe into news reports of Epstein’s sexual abuse and his ties to Staley. The rundown stated that in July 2008, JPMorgan’s private bank risk team referred Epstein to its anti-money laundering (AML) branch “for excessive cash activity” and articles about Epstein’s involvement in “the prostitution/underage sex trade.” The bank’s risk managers, the email revealed, “documented his negative background” and “marked him high risk.”

This email referred to a January 2011 call between Catherine Keating, the CEO of JPMorgan’s private bank, and then Global Head of Compliance William Langford, who agreed to “explain to Jes Staley how the existence of the Epstein relationship could undermine the Human Trafficking Project currently underway within AML investigations.”

When they met with Staley, he “referred the others to speak with Ken Starr,” the email says, adding that, “William advised that call was made and was uneventful.”

That month, a JPMorgan employee named Maryanne Ryan emailed the managing director for the bank’s Financial Intelligence Unit, Phillip DeLuca, stating that there was a “rapid response meeting on Epstein, the sleazy PB client” scheduled. She appeared to note that Epstein was a client of PB, or JPMorgan’s private bank.

“This is the guy who likes young girls, correct?” DeLuca replied. “Hope that they do not cave!!”

Ryan emailed DeLuca a summary of the rapid response meeting and noted, “Jeffrey Epstein is a friend of Jes S and Catherine feels that PB along with William should meet with him to explain the HT project and explain the banks recognition on the project and whether Epstein if further exposed could have a potential serious impact.”

Ryan added that “Epstein was released in July from house arrest and the Palm Beach Post carried two articles saying DOJ may be investigating for child trafficking via a modeling agency he is part owner in.”

“I think Catherine believes that after the briefing on HT that Jes would need to point blank ask Jeffrey the status of any criminal investigations,” Ryan added. “Catherine made sure we knew that no one on today’s call was in favor of having retained him as a client.”

“Seems it all is due to Jes’s personal relationship,” Ryan wrote. “Note he has about 212 mil in the bank and some in JPMS (old Bear PCS).”

“I asked legal and asked on the call about if we were ever subpoenaed and seems it is NO which I find very interesting,” she continued.

She then referred to banking transactions from a woman in Epstein’s circle.

“I also spent a good deal of time looking at his assistant or young lady he brought over from Prague (or some place like that) account,” Ryan wrote. “She was involved in some of the detailed escapades. She opened accounts in PB sponsered [sic] by him. Oh my were her debit transactions enlighting [sic] as compared to countless stories related to his escapades.”

“Lots of salon, lingerie shops, drug stores ny palm beach and in st thomas (his places of residence). Plus lots of video like girls gone wild and some other shops not fit for my good catholic upbringing!”

“The transactions are old 05 to 08. Besides frequent frequent spa like charges it has died down. Surprised she was never subpoenaed.”

Ryan wrote that “one new concerning thing” was an article about a possible DOJ investigation into MC2, the modeling agency of Epstein’s friend, Jean-Luc Brunel (who last year killed himself in a Paris jail while awaiting trial on rape charges).

“Turns out the banker said today we extended Epstein a loan in relation to this modeling agency,” Ryan wrote. “It appears to be a legit modeling agency. If girls were exploited via their contract or arrangement it would be hard for us to tell.”

Meanwhile, one October 17, 2006 memo attached to court documents stated that Epstein had banking, asset and credit accounts with balances totaling $32 million. “Cash withdrawals are routinely made in amounts for $40,000 to $80,000 several times a month, which total over $750,000 year to date,” the document read.

“After internal discussions with Jes Staley, Mary Erdoes, Catherine Keating, John Duffy and Mary Casey, it was decided that we will keep Mr. Epstein solely as a banking client and on a ‘reactive’, client service basis,” the memo stated. “We will not proactively solicit new investment business from him.”

In September 2006, a managing director at the bank, Philip Schlakman, emailed executives Mary Casey, Mary Erdoes, and Phil Di Iorio and shared an article from The New York Times that raised questions about Epstein’s lenient plea deal in Florida for raping and molesting dozens of minors.

“Did you see this article in the NYT this weekend?” Schlakman wrote. “Lovely guy to work with.”

A December 2007 email from a JPMorgan employee to Staley also listed messages the banking honcho had received, including from Landon Thomas of The New York Times, a journalist who was friends with Epstein and solicited a $300,000 charitable donation from him. “Jeffrey told him to call you,” Staley’s assistant wrote.

As The Daily Beast reported, JPMorgan has filed a third-party complaint against Staley and argues that he should be liable for damages should Doe win her case.

The new emails show that JPMorgan executives shared concerns about Epstein as early as 2006 but failed to cut him as a client.

“JPMC ignored all the allegations about Epstein’s sex trafficking and instead continued to facilitate the venture,” a legal filing from Doe’s legal team states, adding that the bank “deliberately failed to file reports in the face of red flags because the reports might result in government intervention in the sex-trafficking venture.”

In November 2006, the exhibits show, private bank director Ann Borowiec emailed Staley with a subject line reading, “Epstein-please call me.”

Borowiec said she had “concerns on risk mgt with this client,” though it’s not entirely clear whether she was referring to Epstein or a potential Epstein was bringing to the bank.

“We have a bad track record internally on risk…as you know,” Borowiec wrote. “Is Jeffrey going to stay involved here? How are we managing risk here? Please call.”

Four years later, a JPMorgan employee named James Dalessio emailed Paul Morris, a former Epstein relationship manager at the bank, and private bank managing director Mary Casey with news stories about Epstein’s sex crimes and lawsuits from victims.

One article from the Palm Beach Post said that “Epstein may be under new sex crime scrutiny from feds.”

“Hi Paul / Mary, See below new allegations of an investigation related to child trafficking — are you still comfortable with this client who is now a registered sex offender?” Dalessio wrote, before asking whether a rapid response meeting should be scheduled.

Casey replied that a meeting “would be helpful” and asked, “Is there an actual Fed investigation or just speculation of one?”