Lawyers for Sam Bankman-Fried, the FTX founder who has described himself as “one of the most hated people in the world,” unveiled their plan for defending him Wednesday, telling jurors that the former billionaire is just a hard-working “math nerd” who’d gotten in over his head.

Bankman-Fried faces decades in jail if convicted for his role in the downfall of the crypto exchange, which lost billions in customer money when it went belly-up in November. His criminal trial, taking place this month in a Manhattan federal courthouse, has far-reaching implications for the crypto industry at large.

A mass of reporters and self-styled “crypto influencers,” as well as Bankman-Fried’s parents and notorious former pharma executive and convicted fraudster Martin Shkreli, were on hand for opening arguments. Bankman-Fried, sporting a newly cropped hairdo and uncharacteristically formal suit, sat quietly in the third row, typing aggressively on his laptop as the government presented its case.

In the government’s telling, the Bankman-Fried who appeared on magazine covers and hobnobbed with movie stars was secretly a self-interested liar who funneled FTX customers’ money to his own hedge fund in order to enrich himself and burnish his image.

“When customers deposited dollars with FTX, he stole them,” Assistant U.S. Attorney Nathan Rehn told the jury. “And then when they deposited crypto, he stole that too.”

But Bankman-Fried’s attorney, the high-profile criminal defense lawyer Mark Cohen, attempted to portray his client as a sympathetic “math nerd” who went to MIT, “didn’t drink or party,” and “worked very hard”—a far cry from the “cartoon villain” he said the government made his client out to be.

The losses at FTX were not a result of Bankman-Fried's scheming, he argued, but of an inexperienced team that was “building the plane while flying it,” and just happened to chart a course through the perfect storm.

“Sam acted in good faith and took reasonable business measures,” Cohen said, adding later: “It is not a crime to be the CEO of a company that winds up filing for bankruptcy.”

At the heart of the case is approximately $8 billion dollars in FTX customer funds that disappeared when the crypto market crashed in late 2022. According to the government, Bankman-Fried stole these funds and diverted them to hedge fund Alameda Research for his own benefit. Rehn laid out the various purchases Bankman-Fried allegedly made, including beachfront Bahamas properties, political donations, and contributions to his brother’s charities.

The defense describes these transfers as loans and claims Bankman-Fried fully intended to make his customers’ whole. The fact that this didn’t happen was a result of poor business decisions, such as the failure to build out a full risk management team—a decision he said, in a slight understatement, “became an issue” later on.

Whether the jury believes that framing may rest on the testimony of three star witnesses: Caroline Ellison, the head of Alameda Research and Bankman-Fried’s on-and-off girlfriend; Gary Wang, the FTX co-founder and Bankman-Fried’s former MIT roommate; and Nishad Singh, the company’s former engineering director who is said to have taken tens of millions in personal “loans” from FTX for his own use.

Rehn focused on Ellison in particular, whom he promised would testify to how she and Bankman-Fried took FTX customers’ money “again and again” to spend and invest through Alameda.

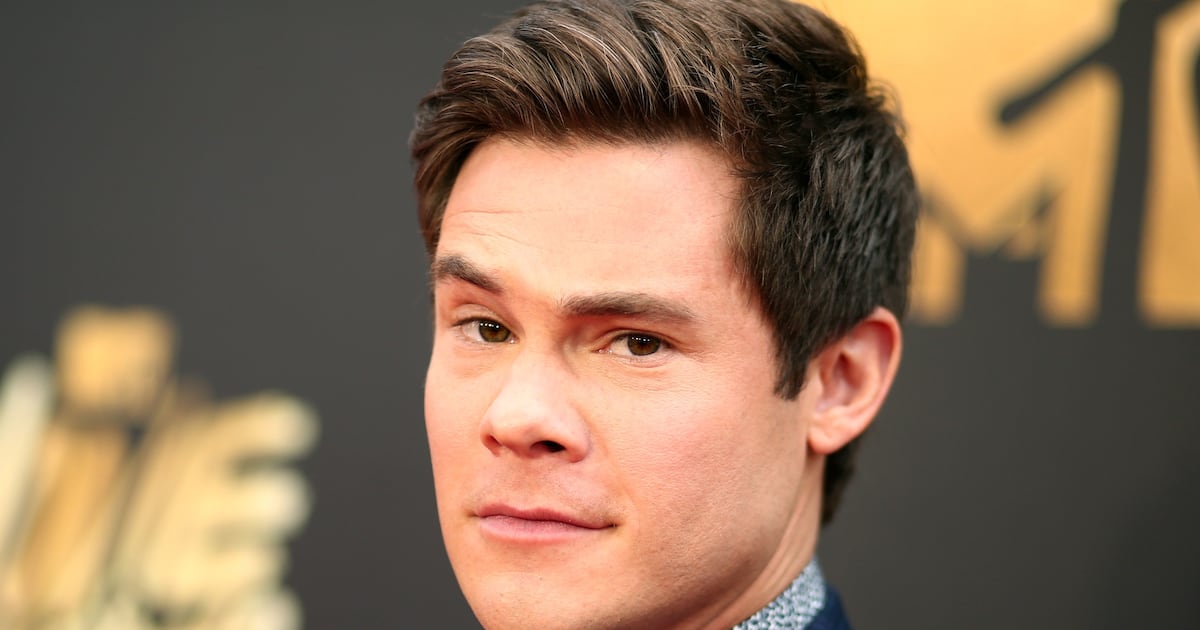

Two witnesses testified Wednesday: a former FTX customer who said he lost about $100,000 when the exchange crashed, and Adam Yedidia, a college friend of Bankman-Fried’s who worked as a software developer at FTX. Yedidia testified that he resigned shortly before FTX filed for bankruptcy, after another employee told him that Alameda had used FTX customer funds to pay back loans to creditors. Court adjourned before the defense could cross-examine Yedidia.

During its questioning, the government played clips of two advertisements FTX produced starring NFL star Tom Brady and comedian Larry David, emphasizing the lengths the company went to to portray itself as a safe, legitimate investment option. Both David and Brady are named in a class-action lawsuit from former FTX customers accusing them of improperly promoting unlicensed securities.

Despite the case’s high profile, several of the jurors seemed unexcited to participate. One juror asked when court would adjourn on Friday, saying he would have to rebook a plane ticket which was “now going to cost an extra $1,000.” Another said he worked night shifts, which could lead to a loss of focus during the daytime trial. Judge Lewis Kaplan seemed frustrated, but ordered the juror to stay. “That would have been nice to know,” he groused.

\