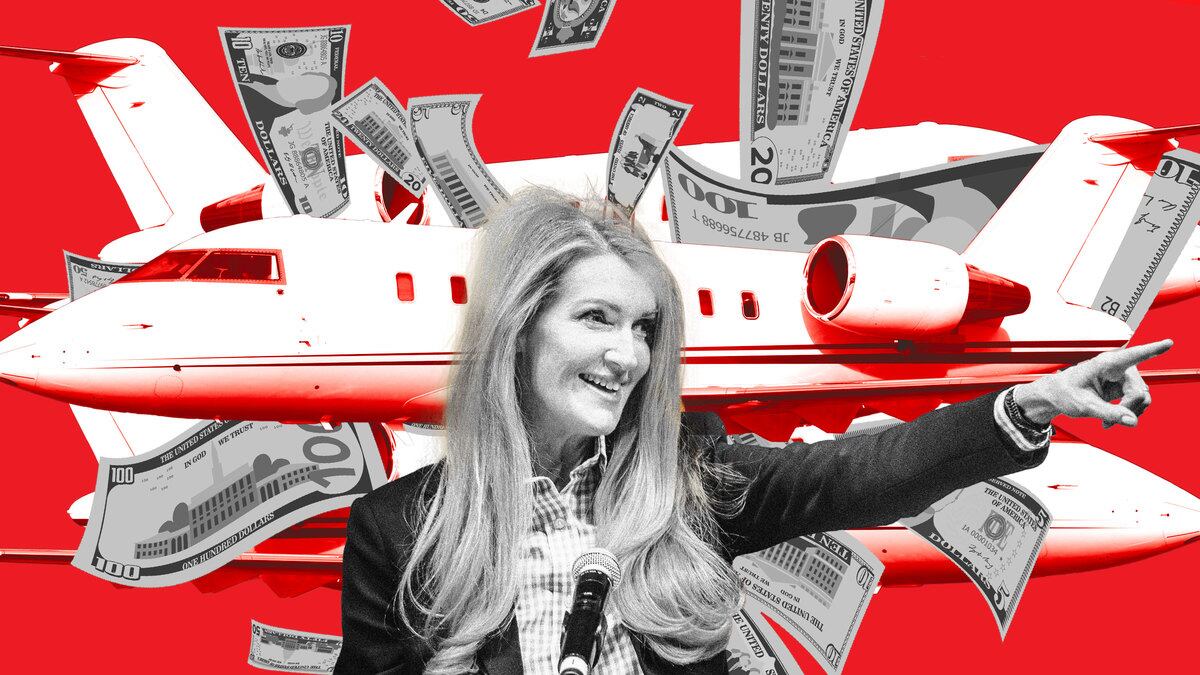

When former Sen. Kelly Loeffler (R-GA) was asked on the 2020 campaign trail about the recently purchased private jet she was flying around Georgia, the former CEO and multimillionaire senator defended the expense as saving taxpayer dollars.

But previously unreported corporate filings reveal something that Loeffler’s campaign disclosures did not: She was paying her husband’s company to operate the jet. And, according to experts, those campaign filings might not have been correctly reported, raising questions of whether she purposefully concealed the arrangement from the public.

It’s similarly unclear whether the private flights actually did save taxpayers money. That’s because the jet—a 2010 Bombardier Challenger 300, which goes for around $10 million—qualified for a huge tax write-off.

ADVERTISEMENT

Instead of saving taxpayer dollars on public flights, Loeffler was using an expensive private jet and, ultimately, saving money for her husband’s company.

In essence, Loeffler was paying herself to use the jet, billing taxpayers for the plane, and, at best, obscuring the payments—and, at worst, just lying about them.

The tangle of interests suggests the picture of a financial undertow, a replenishing cash flow hidden below the surface. Experts say it’s the kind of feedback loop that financial disclosure laws are specifically designed to reveal.

Jordan Libowitz, the communications director for government watchdog Citizens for Responsibility and Ethics in Washington, said that while it isn’t strange for Loeffler to own a plane, the reported payment structure is oddly opaque.

Loeffler on Jan. 6, 2021.

Alex Wong/Getty“It’s not unusual for candidates to have their own plane, due to the fact that many people both in and running for office are already millionaires,” Libowitz told The Daily Beast. “We’ve seen over the years quite a few different situations involving personal planes showing up in FEC reports, but we also always see the disclosure of it. That’s what the reports are for, disclosing how money is raised and spent.”

According to Federal Election Commission filings, Loeffler—whose husband Jerry Sprecher chairs the New York Stock Exchange—personally footed around $700,000 for campaign travel expenses in 2020. The campaign reported all of them, correctly, as in-kind donations from the candidate.

Those campaign filings, however, only show her personal expenditure. They don’t include the recipient. And that recipient turns out to be highly pertinent information; the payments went to her husband’s company—financial giant Intercontinental Exchange (ICE), which operated the aircraft and counted it among its corporate pool.

According to ICE’s official shareholder statement for FY2020, on file with the Securities and Exchange Commission, the company had that year entered a private agreement with the couple.

The document discloses “the inclusion of a private aircraft owned by Mr. Sprecher and his wife, Kelly Loeffler,” which the company incorporated to “the pool of aircraft managed by a majority owned ICE subsidiary.”

Over the course of 2020, the statement says, Sprecher and Loeffler—a former ICE executive herself—paid his company $650,000 to manage and operate the plane.

The filing also acknowledges that “Mr. Sprecher did have personal use of the aircraft and reimbursed the Company for the full value of this usage as permitted by the Corporate Aircraft Policy.” In addition to operating costs, the statement says, Loeffler and Sprecher also pay ICE “all fees and charges” for the use of a hangar, at commercial rates.

Sprecher, it turns out, owns a hangar.

“The annual amount that Mr. Sprecher and Ms. Loeffler paid to the management company in 2020 for operation of the private aircraft was $649,481,” the shareholder report says, adding that the couple also paid $52,045 for the hangar.

The fees are strikingly similar in size to Loeffler’s in-kind contributions.

Libowitz says the arrangement raises a “fairly large question.”

“It appears the Loeffler campaign is saying that because she used her own plane she didn't need to itemize an in-kind contribution,” Libowitz said. “But it also appears that she was in fact paying a vendor—one that was connected to her, but a vendor nonetheless—to use the plane. That vendor was managing it and operating its flights, and if that’s true, then she needs to disclose the vendor that received the money.”

The apparently incomplete reporting also caught the FEC’s attention.

The agency flagged the in-kind donations on the campaign’s first two reports in 2020, asking why Loeffler hadn’t disclosed whom she paid to use the plane.

Each time, the campaign replied that, essentially, Loeffler ate all the costs herself. Because the in-kind donations were made “using assets owned by the candidate,” the replies claimed, they were exempt from itemization requirements. After the second notice, the campaign appended clarifying notes to each filing, and the issue never came up again.

Brendan Fischer, a campaign finance expert at the watchdog group Documented, told The Daily Beast that while the reporting requirements may seem clear, they quickly get murky.

“So this is where the weird FEC regulations on private air travel come into play,” Fischer said. The reported value of non-commercial air travel is not based on the out-of-pocket cost, he noted, but on market rates—specifically, the “normal and usual charter fare or rental charge for travel on a comparable aircraft of comparable size,” according to federal rules.

“But those valuation rules can sometimes appear to apply in a funny way when the candidate owns the plane,” Fischer observed, explaining that candidates don’t calculate travel costs based on management and fuel payments, but on what it would cost to charter a similar private plane.

Trump and Loeffler on Jan. 4, 2021.

Mandel Ngan/GettyThat fact points back to the ICE corporate statement. It says the couple’s $650,000 payments were calculated as a “fixed” operational cost. Fischer said if that was indeed a flat number for the year—regardless of how many flights she and her husband took—then it would cancel out reporting requirements for individual flights.

But the shareholder statement indicates otherwise.

While the section about Loeffler’s plane doesn’t specify exactly what the company means by “fixed cost,” the statement does explain that formula elsewhere. According to that passage, the company calculates charges on a per flight basis.

Those “incremental” costs are “based on the variable operating costs to ICE for each flight hour attributed to personal use.” (Fees include fuel, parts and maintenance, landing and parking, on-board catering, and crew expenses.)

When Sprecher “reimbursed the Company for the full value” of his usage—the $650,000—that too was based on “incremental costs,” the statement says. In other words, separate charges for each flight.

Libowitz said Loeffler would have had incentive to obscure whom she was paying.

“When Loeffler was in the Senate there were some pretty serious questions involving her assets and stock trades at the start of the pandemic,” he pointed out.

The Daily Beast first reported those trades, which later drew investigations from the Senate, the SEC, and the Justice Department. Loeffler eventually announced that the Senate and DOJ probes cleared her, but has never remarked on the SEC investigation.

“She was in a tight election, so it makes sense that after that reporting came out she would want to hide anything about her personal wealth and businesses from her constituents,” Libowitz said. That’s not a legal reason to withhold information, he noted—“that’s the entire point of having public disclosures to begin with.”

The campaign first acknowledged the private plane in early 2020. At the time, a spokesperson told The Atlanta Journal-Constitution that Loeffler personally paid for the jet in Dec. 2019, just after Georgia Gov. Brian Kemp appointed her to replace former Sen. Johnny Isakson. According to the spokesperson, the private craft would save public funds, because taxpayers foot the bills for commercial flights.

However, Salon previously reported that despite owning the jet, Loeffler still took a number of taxpayer-funded commercial flights.

Further, the ICE shareholder statement actually inverts the campaign’s claim about saving taxpayer dollars. The plane, ICE says, actually saved money for the company.

According to the SEC filing, the couple’s payments helped “offset the fixed cost that ICE and the other members would otherwise incur for operation of their private aircraft.”

And, as has been previously reported, the 2017 Trump tax cuts created astounding loopholes for executive jet owners, effectively turning private aircraft into flying tax shelters. While it’s impossible to know how Loeffler and Sprecher treated their purchase without seeing their tax returns, one of the law’s carve-outs offered a 100 percent write-off for private jet buyers.

If that weren’t enough, the plane’s ownership and operational structure raise even more questions about Loeffler’s financial reporting habits more broadly—as well as who was paying whom and for what.

According to the former senator’s 2020 financial disclosure, she and her husband didn’t own the plane directly. She listed it as a jointly owned asset of a shell company called MW23 Holdings, which the couple also counts as a joint asset.

FAA registration records, however, indicate that the 2020 owner was TVPX Aircraft Solutions, a company that provides jet owners with anonymity and renders flights virtually untraceable. But that contradicts still other Federal Aviation Administration records, which listed the plane under a company called Descante Capital Holdings in both Oct. 2020 and March 2021.

That entity, named after Loeffler and Sprecher’s Atlanta mansion, doesn’t appear anywhere in Loeffler’s financial disclosures. But those disclosures do include a company called Descante Capital LLC, first registered at the couple’s home address. Still, that company didn’t own the plane—MW23 Holdings did.

Both Libowitz and Fischer say that Loeffler should have at minimum disclosed paying that holding company, as is the practice of other candidates—such as Sen. Patrick Toomey (R-PA).

In Oct. 2020, months after Loeffler filed her first personal financial disclosure, the couple bought a second plane. That only became public in her 2021 termination report, months after Loeffler left office. The filing values the jet—“Airplane 2”—between $5 million and $21 million, and it is also an asset of MW23 Holdings. The filing also reveals that Loeffler turned around and sold “Airplane 1” in Dec. 2020, weeks out from her run-off election and almost exactly a year after the purchase.

FAA flight records from March 2021 still list the owner as the ever-evasive Descante Capital Holdings.

There are no corporate records available for DCH. And it’s unclear whether the name is a mistaken variation on Descante Capital LLC, which does have records. They show that the registered agent at the time of the plane’s purchase was Anna Ford—a Loeffler associate who has been identified as a member of ICE.

Ford also provides a link to a cost that’s equally mysterious, but has so far gone unaddressed: The $52,000 Sprecher and Loeffler paid ICE to use a hangar.

Again, as luck would have it, Sprecher owns a hangar.

Loeffler’s financial statements value the hangar at more than $1 million. It’s an asset of Sprecher’s Fulton County Hangar Services LLC—which Ford registered—and which in 2020 generated between $100,000 and $1 million in rent.

But ICE also says that Sprecher and Loeffler paid a jointly owned subsidiary for hangar space. Curiously, The Daily Beast previously reported that an ICE subsidiary, “ICE 4165 LLC” (the hangar’s street address), rents hangar space as part of a bizarre arrangement between Sprecher and a U.S. Marshals surveillance program.

Sprecher is an officer and manager of ICE 4165 LLC, according to SEC filings. In 2020, according to Loeffler’s final disclosure, Sprecher’s hangar company, Fulton County Hangar Services, opened a new bank account. He stuffed it with between $500,000 and $1 million.

Neither ICE nor Loeffler replied to a request for comment.