The fossil fuel industry is fighting for its survival. Though it may not look like it—especially with Donald Trump in power—it is starting to lose.

At the moment, much of the world’s wealth is controlled by Baby Boomers. That’s quickly changing, however. As more and more members of this generation retire or pass away, their wealth—over $40 trillion globally—is being transferred to Millennials. With that transfer comes a completely different perspective on capitalism.

“This new socially conscious generation of 80 million strong,” a 2014 report from Brady Capital Research noted, “will be looking to invest in innovative companies that are disrupting the status quo and doing social good.” Many of its members desire an economic system that heals the planet rather than profiting from its demise. As Millennials ascend to positions of power in society over the next few decades, the Brady Capital report went on, their worldview will be “an influential force on corporate America and Wall Street.”

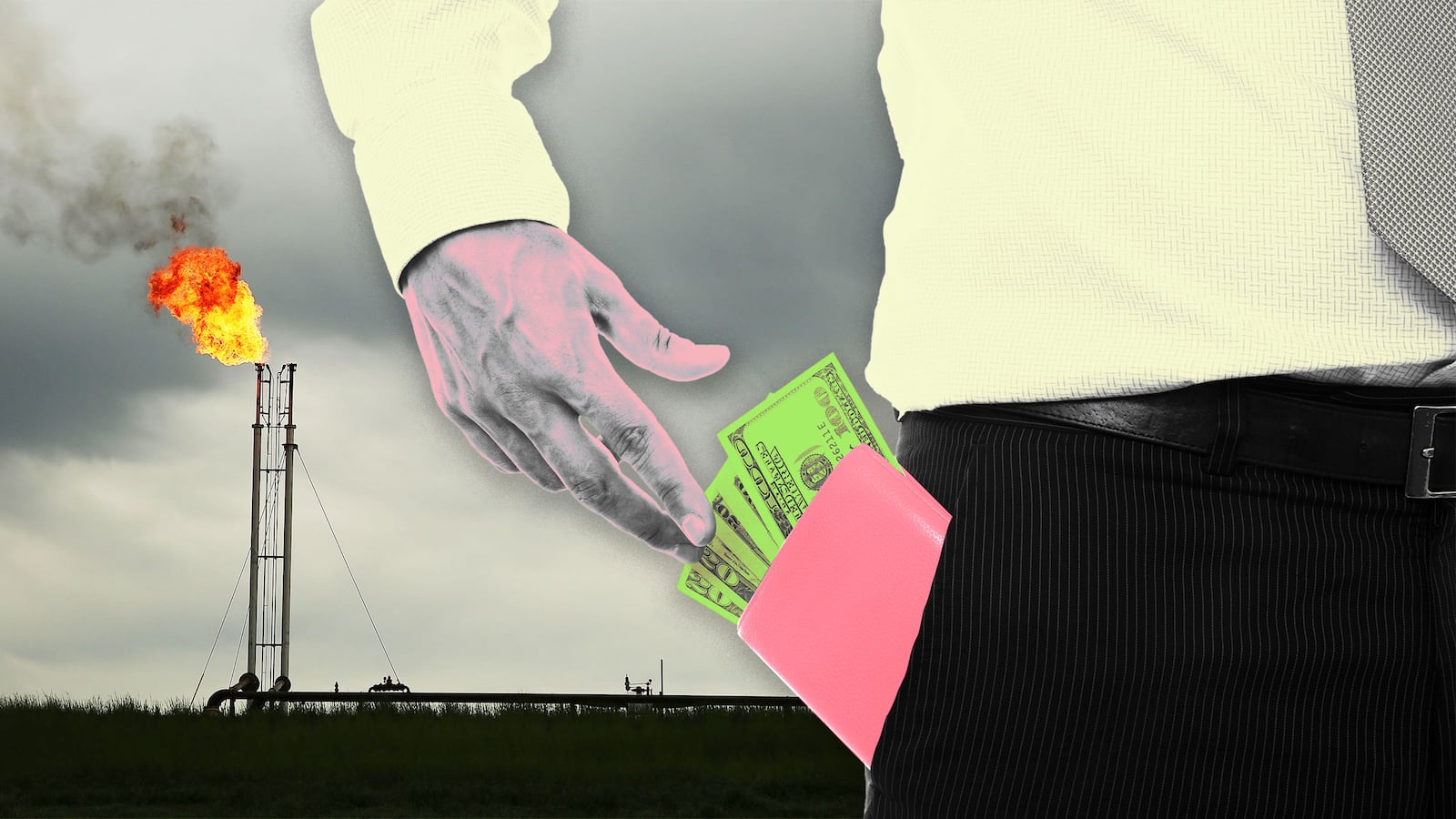

At the same time, the financial risks of destroying the planet are growing. Carbon Tracker has estimated that if and when governments take serious steps to limit global warming to relatively safe levels, more than $300 billion worth of oil, coal, and gas reserves could become effectively worthless. In the meantime, such investments are becoming less and less socially acceptable—a trend that Morgan Stanley, for one, has attributed directly to student-led fossil fuel divestment movements. “Though divestment has a mixed track record as an investment strategy, it often leads to increasing public pressure to take regulatory action,” the bank concluded. “It has sparked a robust debate among investors about how to address fossil fuel risk in their portfolios.”

The Divest campaign, started in 2012 at Harvard University by students like Chloe Maxmin, immediately forced school administrations into a debate about the morality of the fossil fuel industry. “It’s simplistic but it’s true: Are you going to keep investing in an industry that is literally destroying our planet, and everything we love and care about, or are you going to take a stand and chart a new course?” Chloe later explained. “The choice defines the person or institution.” All those local choices, and the student-led actions that caused them, were then amplified by the larger divestment movement. They became plot points in a developing story. “It’s an inherently empowering framework,” she said. Divestment provided a powerful outlet for young people’s frustration with the world’s political and corporate leadership. In an era of gridlock and polarization, it let students take direct action on their campuses against a very clear target: their school’s fossil fuel investments.

By 2015, Divest Harvard wasn’t only making a moral argument; it was making an increasingly strong economic one. In the final months of 2014, a global oversupply of oil caused the price to plummet from $100 a barrel to less than $50. In 2015 it would fall a further 30 percent. With it went the earnings of the planet’s largest oil companies. ExxonMobil, for one, saw its revenues drop by $26 billion. Its rival Chevron lost $14 billion over the same time period. Fortune magazine warned of “major disruptions in the oil industry in the near future.” At the same time, clean energy investment soared. A study called Tracking the Energy Revolution found that a record $367 billion was invested in clean energy in 2015, almost 50 percent more than in fossil fuels. “It’s clear that clean energy is going mainstream,” its authors concluded.

For Chloe and other student activists, the irony was hard to miss. The Harvard administration had argued for years that divesting from fossil fuels would threaten financial returns. But in the spring of 2015, an investment firm called Trillium Asset Management determined that the reverse was true. Plunging oil prices had wiped an estimated $21 million from the school’s endowment.

In the meantime, divestment continued to gain global momentum, and it surged even higher in the lead-up to the international climate talks in Paris that December. In early fall the state of California passed legislation requiring its two largest pension funds to sell off investments in coal mining firms. A month later the London School of Economics divested its $140 million endowment from coal and oil sands. Halfway through the climate talks, 350.org calculated the value of these commitments. Since divestment began, institutions worth $3.4 trillion had joined the movement (a number that’s now surpassed $5 trillion). Though it represented only a fraction of global economic activity (about 3 percent), 350.org believed “investors are reading the writing on the wall and dramatically shifting capital away from fossil fuels.” A new status quo was quickly emerging. The Swiss bank UBS agreed. This was “a social movement with legs,” it argued. “Time, youthful energy, and stamina are on the side of the fossil fuel divestment campaign.”

**

Not long ago I was invited to a three-day gathering of global elites in New York who are trying to build this new economic system. They believe it can be done with the right combination of market forces and government incentives. By the end of summit, though, I realized it would never succeed without people like Chloe.

The summit was hosted by Bloomberg New Energy Finance, one of the world’s top trackers of our transition to a less destructive economy. Over its three days more than 1,033 world leaders, CEOs, investors, academics, activists, journalists, and other delegates from over 40 countries gathered in the dimly lit ballrooms of New York’s Grand Hyatt hotel. Its A-list included Secretary of Energy Ernest Moniz, General Electric chairman Jeff Immelt, former New York mayor Michael Bloomberg, and European climate commissioner Connie Hedegaard. The men and women who I saw streaming into the Hyatt were for the most part wealthy and privileged. Some had even made fortunes in fossil fuels. But these weren’t your typical one-percenters. For one reason or another, they’d come to the conclusion that our current means of generating wealth was hurtling us toward destruction.

Everyone in the room seemed to share in common a belief that market forces would be the main driver of this transition. They were aware of the immense political and economic power invested in the fossil fuel industry. They knew that it was worth $5 trillion. They knew that 90 percent of the planet’s electricity came from it, as well as the fuel for almost every vehicle, boat, and plane. Yet they believed the fossil fuel industry would ultimately wither and die, because the new economic system they were building was more profitable in the long run. “[It] will require an enormous amount of investment” to shift off oil, coal, and gas, said Maria van der Hoeven, executive director of the International Energy Agency. “But it is precisely that . . . an investment, and one that will pay out.”

The financial data seemed to back her up. Ever since Germany and China started pumping out wind turbines and solar panels on a massive commercial scale in the mid-2000s, the price of renewable energy has plummeted. It’s now over one hundred times cheaper to produce a solar panel than it was in the ’70s—and it continues to get cheaper all the time. In the United States, solar prices have dropped more than 70 percent since 2009. Those market forces, along with generous federal tax credits, have caused new U.S. solar installations to expand tenfold from 2011 to 2015. The solar industry expects that growth to double in 2016. If these trends continue, it’s plausible that by 2050 clean energy will provide over 80 percent of America’s electricity, a Department of Energy–funded study recently predicted. As wind and solar accelerated over the past decade, Europe’s top 20 coal- and gas-burning utilities lost over half a trillion dollars in value. According to the Economist, those utilities are now faced with “an existential threat.”

These trends are playing out across the globe. The first fossil fuel to fall victim to them will likely be coal. After surging over the past decade, global coal demand is now in a precipitous free fall, thanks in part to cleaner and cheaper alternatives like wind and solar. Worldwide consumption declined by up to 180 million tons in the first nine months of 2015 alone. Greenpeace deemed it “the largest drop on record.” It wasn’t long before Wall Street took notice. In September, Goldman Sachs advised its clients that “peak coal is coming sooner than expected.” And Moody’s Investors Service later estimated that in North America the coal industry’s earnings fell 25 percent in 2015. So when Peabody, the largest and oldest U.S. coal company, filed for bankruptcy in 2016, many took it as a sign that the end of coal was near.

Even retired fossil fuel executives now believe the sun makes more financial sense. At the Bloomberg summit, James Rogers, the former CEO and chairman of the coal-burning utility Duke Energy, explained that small-scale clean energy is rapidly becoming more efficient, reliable, and affordable than fossil fuels. “Fossil fuels just lost the race against renewables,” read a story in Bloomberg at the time. “And there’s no going back.” Deutsche Bank, for one, predicts that solar energy will soon become cost-competitive with coal and gas power across the entire world. In 2015 investment in clean energy reached a record high of $328.9 billion. All this is starting to finally have an impact on our climate. The International Energy Agency (IEA) has calculated that global emissions have stayed flat for the past two years while the economy has grown. “This is yet another boost to the global fight against climate change,” said IEA executive director Fatih Birol.

But the simple fact remains that unless 80 percent of the planet’s oil, coal, and gas reserves stay in the ground, none of it will make any difference. That was the warning that Bill McKibben delivered midway through the Bloomberg New Energy Finance summit. “There’s no way to finesse the future,” he said. The Arctic is melting, sea levels are rising, and oceans are acidifying. “We’re producing the beginning of real chaos,” he said. Either the Exxons of the world stop extracting fossil fuels immediately, “or the planet burns up.” Beside me several delegates shifted uncomfortably in their seats. This was the brutal reality of our economic system: that even as a safe, stable, and prosperous future is taking shape, the status quo still threatens to destroy it.

At that moment I realized that market forces alone can’t ensure the survival of my generation. The elites gathered in this Hyatt ballroom lent deep financial credibility to an economic system where protecting the planet was just as important as earning profits. But they couldn’t offer the moral urgency needed to defend it. The same market forces that are making this new system economically viable are also making it vulnerable to fossil fuel industry attacks. That is why this new system will never succeed without the shift in generational values expressed by people like Chloe Maxmin. We need them to remind us that a status quo where the profits of a wealthy few put the rest of us in mortal danger isn’t just broken—it’s immoral.

What the divestment movement proved is when enough young people come together to demand that their survival be taken seriously, our economic leaders are forced to listen. The reason banks like UBS and Morgan Stanley are paying such careful attention to people like Chloe is that they know that the frustration and anger that divestment channels isn’t going away. That it’s the reason a small youth-led revolt grew into a $5 trillion movement in only a few short years. And that when her generation takes control of society, it will bring this desire for radical change with it. Our system isn’t run by market forces, after all. It’s run by people. Their values decide its shape and form. It was clear to me as I left the Bloomberg summit that a better world can be attained by changing those values. Indeed, it’s the only option we have.

From Are We Screwed?: How a New Generation is Fighting to Survive Climate Change, copyright 2017 Geoff Dembicki. Used by permission of Bloomsbury Publishing.