Housing is back, Vol. IX, Part 62

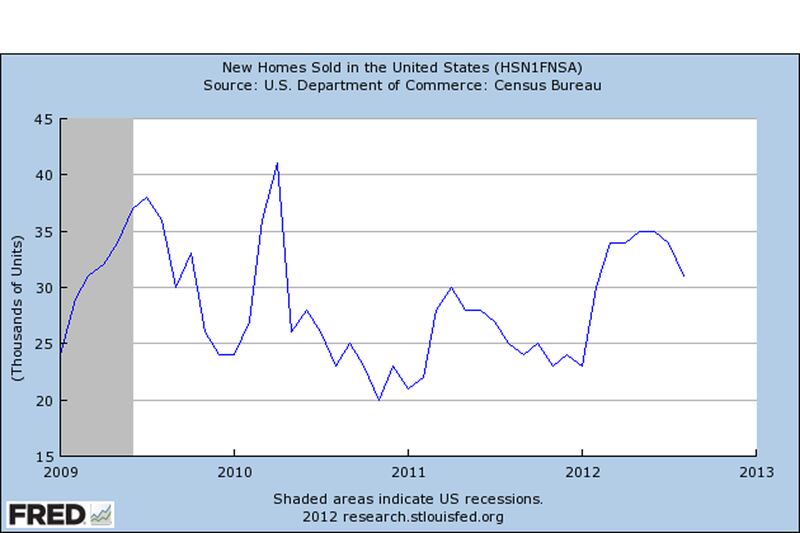

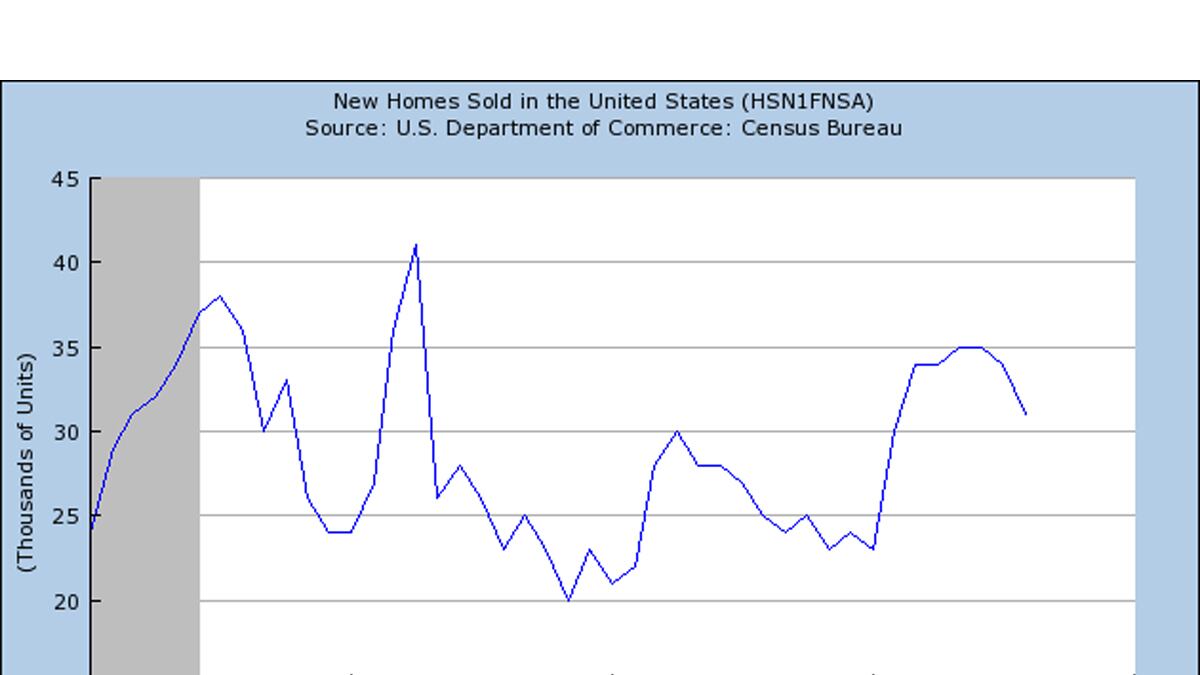

For several months now, we’ve been arguing that housing is back as an economic force. And with each passing month, the thesis becomes more clear. The level of housing-related activity – housing starts, new homes sales, existing home sales – has been on the rise all year. And in recent months, housing prices have started to rise.

Wednesday brought confirmation of the trend. The Census Department reported that in September, home sales came in at an annualized rate of 389,000. That’s an increase of 5.7 percent from the August rate of 368,000. But what really matters is how much September new 2012 home sales rose from September 2011. The answer? They were up 27.1 percent. Through the first nine months of 2012, new home sales are up 21.8 percent from the first nine months of 2011.

ADVERTISEMENT

As demand rises, supply seems to be shrinking. Builders have generally been cautious about putting up speculative homes in recent years. And who can blame them? But they’ve been caught off-guard to a degree by the surge in home sales. At the end of September, there were only 145,000 new homes for sale in the U.S. That’s down from 160,000 for sale at the end of September 2011. At the current sales price, there are only 4.5 months worth of inventory on the market. A year ago, there were 6.3 months worth of inventory clogging the market. In September 2012, the inventory as a function of the rate of sales was the lowest it has been since October 2005.

What happens when demand rises on a relative basis while supplies fall on a relative basis? Why, prices go up. The median price of a new home sold in September 2012 was $242,400, up 10.3 percent from $217,000 in September 2011.