A long-simmering uneasiness between densely populated Democratic states and more sprawling Republican states has turned into open contempt, with national Republicans refusing more aid for cash-strapped states, and local and state Democrats seeing anything less than 100 percent funding as a betrayal.

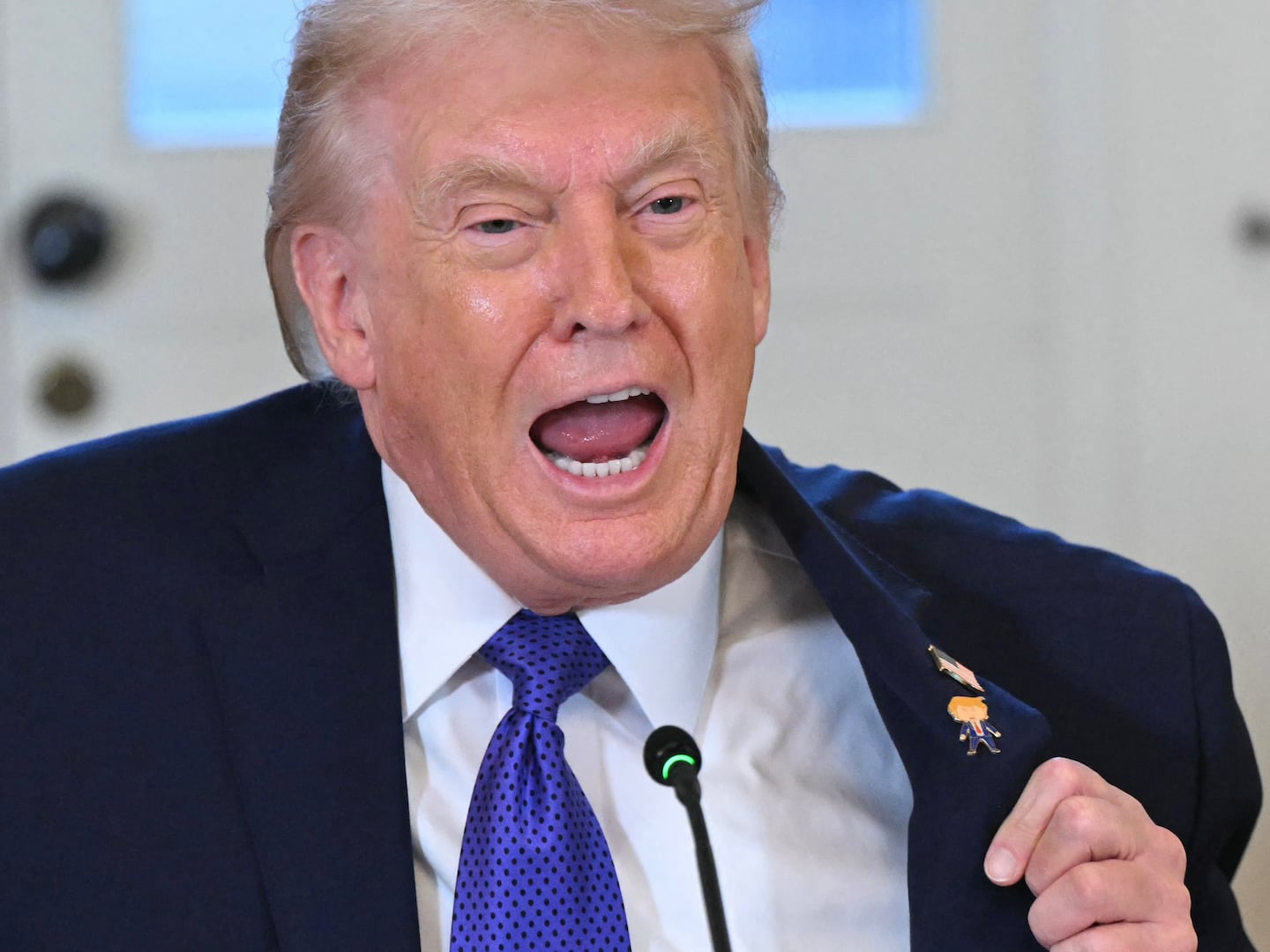

As New York, New Jersey, Michigan and Illinois, in particular, struggle with the economic consequences of locking down their states to contain COVID-19, some national Republicans are pointing to them as parables of Democratic profligacy with President Trump saying that “all the states that need help, they’re run by Democrats” and Majority Leader Mitch McConnell suggesting at one point that they go bankrupt.

In return, state and local figures are equally as extreme in demanding that the federal government fund years’ worth of pre-corona mistakes. Illinois’ state Senate president has asked for a $40 billion bailout, including $10 billion for pension funds that were insolvent before the pandemic.

New York City Mayor Bill de Blasio has said that without federal funds to make New York whole, the state will have to lay off “the exact people who have been the heroes in this crisis.” This ignores the fact that with the city’s public sector workforce having grown by nearly 10 percent on his watch, there are plenty of new administrators—2,000 new back-office staff in the department of education alone—to pare back before the city fires nurses.

There has to be a middle ground. Republican must understand that starving blue states harms red and purple states. Florida, for example, depends on New Yorkers to flock to its beaches and resorts, buy or rent second homes, and spend their pension money there. New York is Florida’s single biggest origin market for tourists, accounting for nearly 11 percent of visitors in 2017. More than 5 percent of Nevada’s tourists—nearly a million people annually—come from New York.

Even far-away Alaska is suffering from dense cities’ travails, as the record plunge in demand for oil has harmed its tax revenues, spurring bond downgrades.

Slower-than-necessary recoveries in blue states will hurt red states. Forcing these states to severely cut back on essential services or to raise taxes, or both, slows recovery.

New Jersey, New York, and Illinois are among the nation’s highest-income states, in part because their population density makes them more productive. In turn, states such as Nevada and Florida are in the bottom half of the income tier—meaning they need wealthier states to recover quickly and resume exporting their tourism and retirement dollars.

Yes, blue states should have saved more for a rainy day, but, as previous post-hurricane rescues of Florida and Texas have shown, nobody can prepare for a deluge. It is not realistic to expect states and cities to withstand months-long public health shutdowns of their economies, and attendant falls in sales, income, and other taxes, without catastrophic budget impacts.

On the other hand, leaders in states such as New York, New Jersey, and Illinois must be realistic; they cannot expect the federal government to bail them out of decades’ worth of fiscal complacency. The country has just come off a record economic boom. Why, then, in turn, does New York have so little in its reserves—only $2 billion out of a nearly $100 billion budget—that it must immediately threaten to cut frontline workers? Illinois and New Jersey have long ignored chronic pension underfunding.

What would a compromise look like? Congress should consider funding a full-year sales-tax holiday across the country. That is, Congress could transfer to states the money that they and their localities would have taken in in sales-tax collections this year, if it weren’t for the pandemic.

This would be expensive, yes, at about $400 billion. But that’s less than half the $1 trillion House Speaker Nancy Pelosi’s new bill would earmark for state and local governments. It would be no more expensive than the federal tax revenues lost from a severe, long-lasting recession.

It satisfies a key Republican goal: cut taxes to spur the economy. This direct tax aid would help out the industries hardest hit by public-health shutdowns: restaurants and retail stores, whose returning customers would enjoy a substantial discount via tax-free purchases.

It also satisfies a key Democratic goal: substantial tax-revenue replacement. State and local governments get one-fourth of their revenues from sales taxes, and, with retail and restaurant businesses shut, sales taxes have suffered the steepest, most immediate decline. (Congress could provide equivalent aid to the five states with no sales tax—which, combined, have a population less than that of New York City.)

That would not make states whole. States with income taxes— including most of the blue states—would still see income-tax shortfalls.

To that end, to round out a larger rescue package, Congress should ask states and major cities to draw up a budget of essential services, and offer additional aid proportionate to the percentage of the state or local budget that these essential services comprise.

Washington could make up the budget shortfall only for frontline sanitation, police, fire, public-health, safety-inspection, education, and other key workers, and only for current costs, not for pension benefits. Wages should be frozen at this year’s levels, as the Empire Center’s E.J. McMahon suggests. States and localities with administrative inefficiencies would have reason to pare back padded budgets without harming key public services.

As the saying goes, we’re all alone, together. Nevada cannot successfully reopen if Illinois’ economy remains crippled, and Illinois cannot recover without basic public services to support businesses and individuals or even higher taxes in a recession. Everyone will have to bend a little on a core belief.