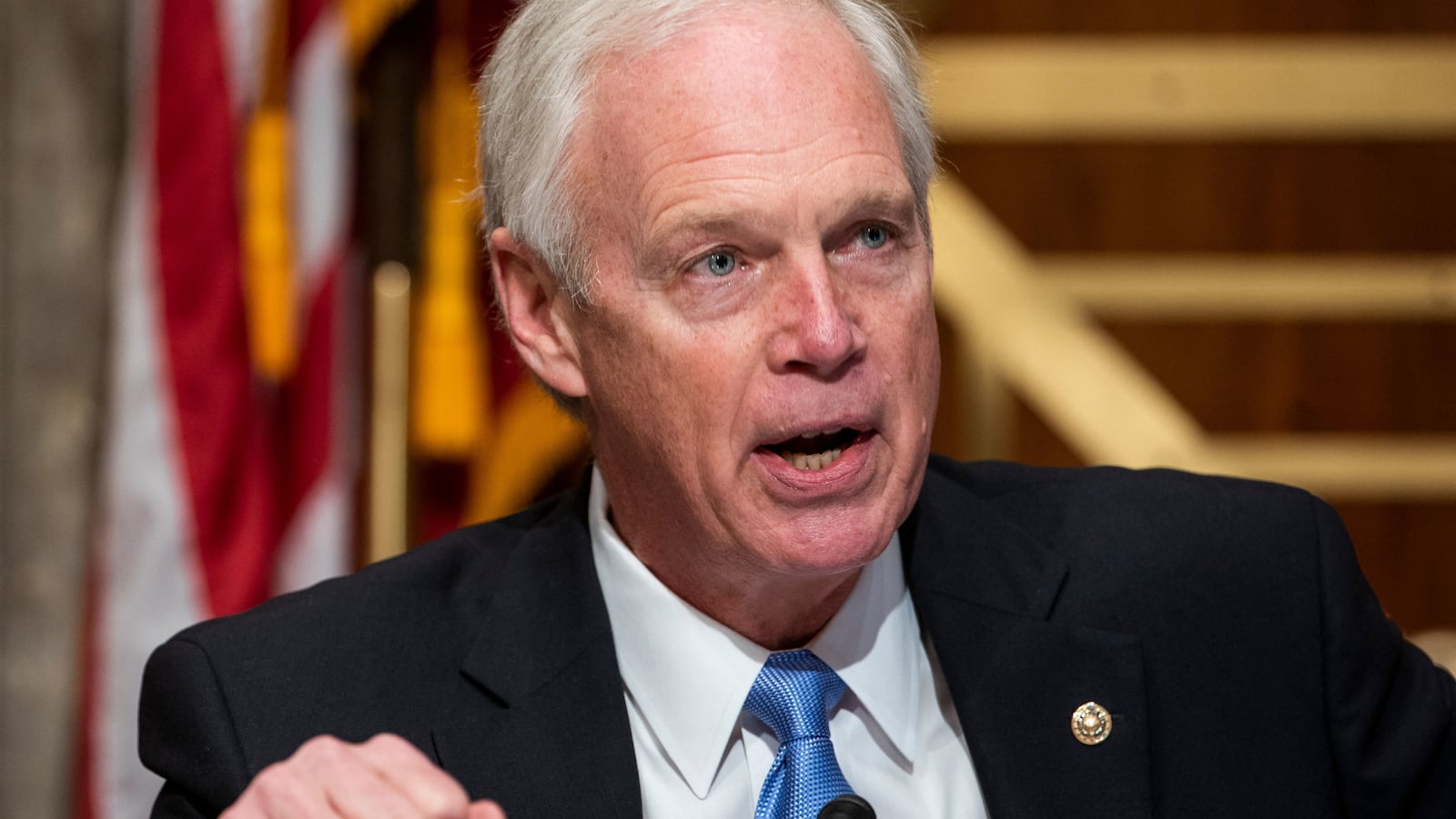

Sen. Ron Johnson (R-WI) helped push through an even larger tax break for the megawealthy, a ProPublica investigation found. As former President Trump’s 2017 tax cuts were being finalized, Johnson publicly stated his disapproval, pushing for a tax cut for “pass-through” corporations. Those businesses, which are taxed through their owners’ personal taxes, make up many of the nation’s companies, but the outlet’s reporting found that Johnson’s demand benefited two families the most: Richard and Elizabeth Uihlein and Diane Hendricks, both among his largest donors in Wisconsin.

The “pass-through” tax measure allowed them to claim a combined $215 million in tax deductions in 2018, and they’re expected to save about half a billion in taxes over the tax cut’s eight-year time span. In a statement, Johnson defended his measures while declining to specify if he spoke to his donors. “My support for ‘pass-through’ entities—that represent over 90% of all businesses—was guided by the necessity to keep them competitive with C-corporations and had nothing to do with any donor or discussions with them,” he wrote to ProPublica, urging a more simplified tax code. The two families either declined or did not respond to requests for comment.