Greg—and we’ll just call him Greg, because he’s a little unsure about having his full name out there, for reasons that will soon become apparent—knew nothing about bitcoin when a friend told him it could change his life. A 54-year-old ex-pat working for a major international company in Europe, Greg had generally played it pretty safe with his investments. But in the fall of 2018, a college buddy told him about a man named David Saffron, who he claimed could double his money in crypto in a matter of weeks. “I resisted, I said I didn’t understand it, I didn’t understand crypto currency at all,” Greg told The Daily Beast. “But he kept showing me screenshots of David’s platform, that he was accruing more and more.”

Greg followed the price of bitcoin for the next few months, and when it stayed relatively stable, he reconsidered his skepticism. His friend introduced him to Saffron, who told him he was a computer programmer who had invented an artificial-intelligence trading bot that could beat the market. If Greg bought three bitcoins from him, Saffron said—the equivalent of about $12,000—he would give him 7.5 bitcoins back in three months.

Greg called his bank and told them to wire the money to the bank account for a company in Wyoming. The bank was hesitant—the transaction seemed fishy—but Greg was insistent. They wired the funds.

“I said, ‘Geez, this seems exciting, it seems sexy,’” Greg said of the investment platform. “It felt like a magical world we were getting into, it felt like cutting edge stuff.”

“I was like, one time I’ll roll the dice,” he added. “And I crapped out.”

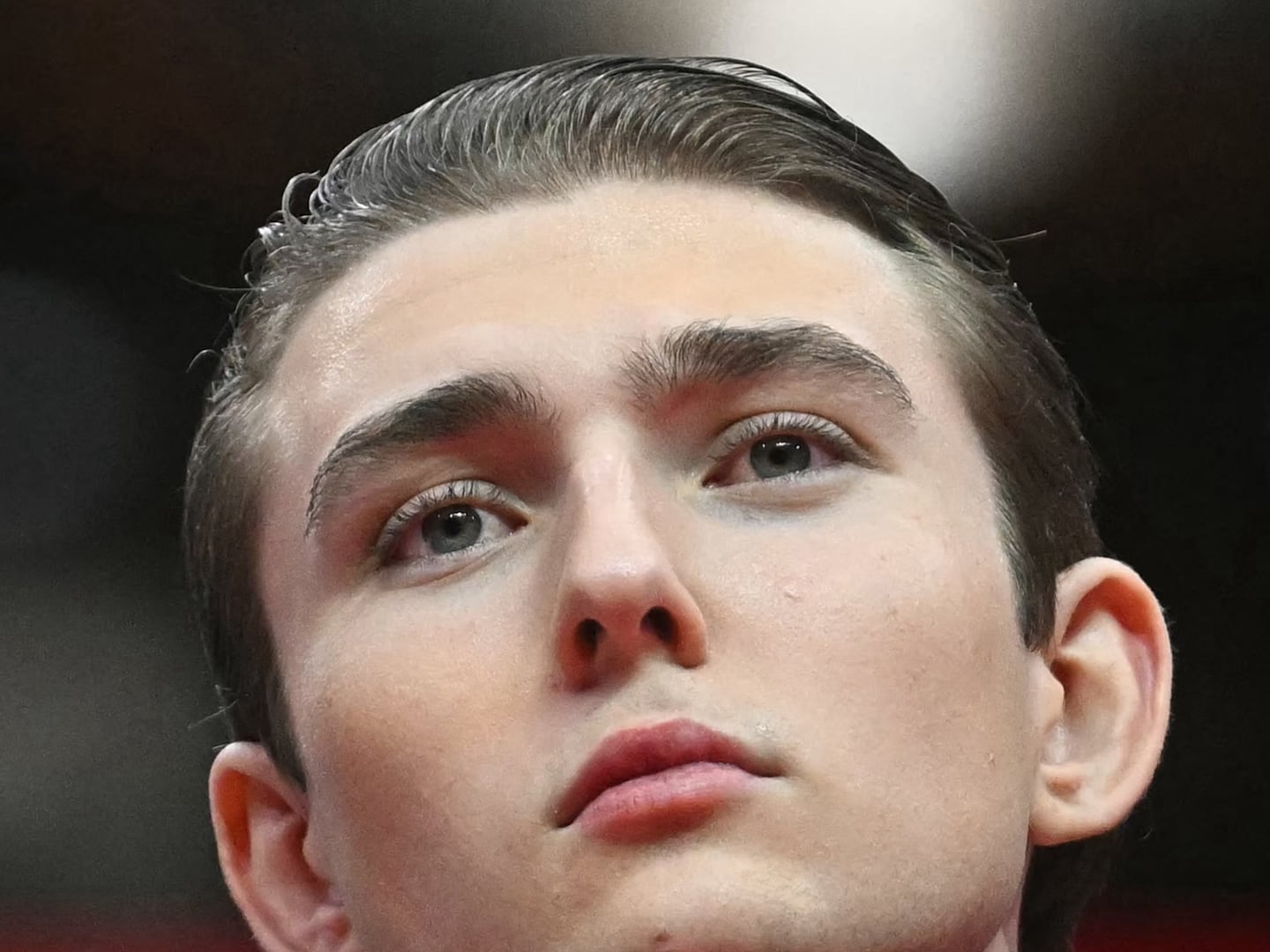

David Saffron presented himself as a kind of computer programming progeny, a whiz kid who had invented a bot that could make 17,500 crypto transactions an hour.

Photo Illustrations by Luis G. Rendon/The Daily Beast/GettyThe man Greg wired the money to, David Saffron, was a 49-year-old Australian living in Nevada. Before starting an investment company, Saffron was perhaps the least infamous member of his family: His immediate family all appeared on a 2011 episode of the Gordon Ramsay show Kitchen Nightmares in which his father, Alan, admitted to taking $250,000 from his son to keep his restaurant afloat. (David does not appear in the episode, the son in question is his brother, Daniel.) His grandfather was a notorious Sydney underworld figure known as “Mr. Sin,” who started a network of underground clubs selling prostitutes and illegal booze, and served time for federal tax evasion.

Saffron’s career was less remarkable. One LinkedIn page lists him as the CEO of “A9 models,” which has one post and nine followers on Instagram; another lists him as the marketing manager for “WizKidsNow.” California business records list him as the owner of an S&M performance venue in Los Angeles called Master D’s Academy of Sin, whose Facebook page features videos of Saffron spanking women and pouring paint down their naked backs. His own Facebook page refers to him as “Master D” and features a photo of him in a bright red suit and matching fedora.

To potential investors, however, Saffron presented himself as a kind of computer programming progeny, a whiz kid who had invented a bot that could make 17,500 crypto transactions an hour. According to a federal indictment unsealed this month, he falsely claimed to have been the lead developer for the Uber and Snapchat apps, and to have written the security software used by most U.S. banks. (According to a separate CFTC complaint, he also claimed to have invested for Mark Cuban.)

He lived lavishly, using rented mansions in the Hollywood Hills with pools and private chefs to host opulent parties, according to investors interviewed by The Daily Beast. He posted on social media about eating at expensive steakhouses and traveled with a team of personal security guards. One investor, Scott Freeman, said he had to submit a background check just to get into Saffron’s house.

According to investors who spoke to The Daily Beast, Saffron’s glamorous lifestyle helped convince them to trust him with their money. If he was this rich, they thought, he must be doing something right. One investor said he put in $300 to start, but was still skeptical about Saffron’s business, so he asked one of Saffron’s security guards whether the guy was legit. The security guard told him that he had been suspicious, too, until his co-worker invested and saw great returns on his money. The investor kept his money in.

Saffron’s pitch was simple, according to the indictment: Investors gave him cryptocurrency, or the money to buy it for them, and he used his trading bot to make returns of 500-600 percent. Investors got 150-300 percent of those returns, and Saffron kept the rest for his trouble. To prove that it worked, he ran “tests,” in which he took a small amount of money from potential investors and then delivered them returns within hours or days.

“I know who to call, and I just know how to do things, but I don’t know this town because I’m integrated in Los Angeles,” he told potential investors at an out-of-town presentation in 2018, according to the CFTC. “So you guys know this town. Perfect. Now I can make you all damn rich.”

Saffron called the investment program the “Circle Society” and maintained message boards where he posted frequent updates—as well as memes, music videos, and predictions about various doomsday events, according to chat records reviewed by The Daily Beast. He offered various packages, with elaborate names like “Trip The Light Fantastic Plan” and “BTC Star Trek ‘The Motion Picture’ Double Plan,” according to chat records. The plans were said to generate returns in anything from 22 to 90 days, and came with taglines such as “Stare down the endless void But come out a winner.” Investors said savvy users realized quickly that the daily plans, which paid out 3 percent per day directly into users’ crypto wallets, seemed to be the most lucrative.

That’s what Greg signed up for shortly after joining in February 2019. He was still skeptical of the program, he said, but the money kept showing up in his wallet every day, “like clockwork.” At Saffron’s urging, he reinvested all his earnings back into the program. Over time, Greg invested a total of 8.5 bitcoins in the program, and his Circle Society account said he had earned 96 coins—the equivalent of nearly $2 million today.

“It seemed too good to be true,” Greg recalled, “but I shut my brain off and said, ‘Let’s just roll with it.’”

Saffron maintained message boards where he posted frequent updates—as well as memes, music videos, and predictions about various doomsday events. When he couldn’t send payments to investors he once claimed he was being held hostage and sent a video of himself tied up with rope to the group as evidence (right).

Photo Illustrations by Luis G. Rendon/The Daily Beast/GettyOne day, in March 2019, the money dried up. Investors said there were no more daily payments, just increasingly bizarre excuses: Payments were suspended because of too many unverified transactions on the blockchain; investors had hit the “payout” button too many times and locked their accounts; a solar flare required Saffron to shut down the website for several days. At one point, two investors told The Daily Beast, Saffron claimed he could not send payments because he was being held hostage. He sent a video of himself tied up with rope to the group as evidence.

As the excuses multiplied, some investors became suspicious. A few, like Nevada-based attorney Brett Marshall, started calling out Saffron in the group, asking whether they would ever get paid, according to those who spoke to The Daily Beast. Saffron responded by threatening the detractors with legal action and making new promises to the group: big-time outside investors, a coming payout he deemed the “June balloon.” (When the promised payout failed to materialize, his detractors deemed the next month “Ju-lie.”)

Greg was one of the investors growing skeptical, and he urgently needed his money back to pay for the refinancing of his house. He says he told Saffron at least 10 times that he would walk away if Saffron just returned his initial investment. Every time, he said, Saffron promised to pay up the next day; every time, the money failed to materialize. Eventually, Greg stopped asking.

After a few weeks of this, a few other investors decided to take things into their own hands. They pulled the contact information of everyone in the chat and reached out to them individually, asking them if they wanted to join a private chat. Some declined, afraid that Saffron would sue them or refuse to give their money back. But many more agreed, and the group eventually swelled to over 150 members. Together, they began piecing together what had happened.

“Everyone had their own little facet, their own little story,” said Marshall, the Nevada attorney. “And we were able to pull it together and say, ‘Wow, alright, this is what he’s done.’”

The full scope of the scheme would not be revealed for months. But the group members took what evidence they had to the Commodity Futures Trading Commission—the government agency that regulates derivatives markets—and begged them to take the case. They even created a form that investors could fill out and send directly to the CFTC, identifying themselves as victims, and pinned it to the top of their chat. When the case started, the CFTC had six or eight victims, Marshall said. When it ended, they had 179.

Even as the case progressed, Saffron was enticing other investors into yet another scam, according to the indictment. In September 2020, despite a preliminary injunction barring him from soliciting or accepting funds for trading pools, Saffron allegedly encouraged an acquaintance to invest in a company called Cloud9Capital, an outside wealth management fund in which he claimed to have invested 200 of his own bitcoins. The indictment claims the acquaintance immediately transferred 4 bitcoins, or about $44,000, into the wallet for Cloud9Capital—unaware that Saffron controlled the wallet himself. The investor ultimately pledged 14 more bitcoins toward the fund, according to the indictment. He never got them back.

Saffron also continued posting defiantly in the Circle Society Telegram group, threatening his detractors with lawsuits and something called the “the Kraken.” Between warnings that an asteroid was coming for the Earth and memes about Joe Biden, he mocked the naysayers by superimposing their faces on videos of The Spice Girls and referring to them as “the angries.” Shortly after the CFTC opened its case, he announced the launch of a new package called the “Coin Funding Trading Commune Plan,” or “CFTC Plan.”

“YOU angry Messed it up for everyone. You shot yourselves in the head,” he wrote in an October 2020 post about the CTFC case that was reviewed by The Daily Beast.

“The amazing thing is YOU still have a CHOICE to do the right thing,” he wrote in another. “LEAVE the FIGHT and wait for the mana to be handed to you on a silver plate.”

Even after the CFTC handed down its official judgment in 2021—a default judgment ordering him to pay $32 million in restitution and other fees—Saffron remained defiant.

“It has been a long road getting from there to here, it’s been a long time but our time is finally here,” he wrote in a July 2021 post in the Circle Society group. “Legal has been a nightmare of bills and stress but fear not, I stand strong and will toe the line till the end!!”

Saffron appealed the CFTC decision, and according to a June order by a Nevada district court judge, has been “cagey about his whereabouts in order to complicate the government’s enforcement efforts.” (He is currently representing himself, after his lawyers pulled out when he failed to pay them.) But the “angries” had another trick up their sleeve.

On June 30, the Department of Justice announced charges against six people accused of running four different cryptocurrency schemes, in an action the department said reflected its “ deep commitment to prosecuting individuals involved in cryptocurrency fraud and market manipulation.” One of the six was David Saffron.

The indictment claims Circle Society and his other companies, like Cloud9Capital, were nothing more than an “illegal Ponzi scheme,” designed to manipulate investors into relinquishing vast sums of money—more than $15 million in total. It claims Saffron and four unnamed co-conspirators—including the chief operating officer of a contract security company and the CEO of a Hollywood fashion and media company—worked together to present the Circle Society as a legitimate investment vehicle, when it only served to enrich Saffron.

The “tests” Saffron ran for potential investors were fraudulent, paid out not by market returns but by funds taken from earlier victims, the indictment claims. The excuses he provided for not paying out dividends were equally untrue, the feds allege. (At one point, the indictment states, he claimed he had not been able to pay out investors because he was in a medically induced coma. In fact, he was in police custody.) He even went so far as inventing a fake agency, the “Federal Crypto Reserve,” to “investigate” one of his own companies when a potential investor seemed skittish, the indictment alleges. He hired the fashion CEO to pose as the agency director.

Saffron was charged with seven counts of conspiracy to commit wire fraud, wire fraud, conspiracy to commit commodity fraud, and obstruction of justice. If found guilty, he faces 115 years in prison. He has pleaded not guilty.

The attorneys listed as representing Saffron in the criminal case did not respond to multiple requests for comment. But Michael C. Van, an attorney who represented Saffron in other dealings, told The Daily Beast he was a good person, and that the case was the result of some misunderstandings.

“We’re prepared to work with the AUSA, with the government, and get everything out there,” he said. “It’s just gonna take some time.”

The “angries” responded to news of the indictment with elation. On Telegram, one suggested showing up en masse at the sentencing and having pizza delivered to the courtroom. Another changed the profile picture on the group chat to a black circle with the number 115 in the center. Another wrote simply: “Prison, bitch.”

Saffron, too, responded to the indictment, taking to Telegram for what he said would be his last official post. He claimed he had “never committed a crime” and that his case would be defended by “the best criminal lawyers.”

“For the last 4 years I have been fighting militant radical Angry people lead by a lawyer who believes in a terrorist cause and is literally running an organization of hate!!!” he wrote, adding that he would keep the Telegram open so others could provide legal updates.

“To all those that I care about,” he wrote in closing, “Happy 4th July weekend.”

In the face of allegations, Saffron remained defiant, threatening his detractors with lawsuits and “the Kraken.”

Photo Illustrations by Luis G. Rendon/The Daily Beast/GettyNone of the investors who spoke to The Daily Beast ever received their promised funds, or even got their initial investment back. Greg ultimately convinced Saffron to hand over one of his bitcoins, meaning he is still out a total of 7.5. Marshall said he invested approximately $32,000 in the program and only ever got back less than $1,000. Freeman managed to claw back 4 of the 8 bitcoins he invested from Saffron, but turned around and reinvested most of it in one of the Circle Society’s Ethereum packages.

These aren’t even the most extreme examples. According to a declaration submitted in court by a CFTC agent, one pair of investors put in 1,000 bitcoin, or the equivalent of about $8 million, into Saffron’s purported investment plan in 2018. They never got any of it back. Another pledged more than $333,000 and was left similarly empty-handed.

Several of the investors suggested Saffron was able to grow his enterprise so swiftly and successfully because of the relative novelty of cryptocurrencies. The stratospheric rise in the price of bitcoin and other assets convinced them that remarkable gains like those Saffron promised—the CFTC calculated the promised annual return rate of one of his plans at 186 million percent—could actually be possible. “The term is FOMO,” Greg said of what pushed him to finally invest. “Fear of missing out”

Most of the investors who spoke to The Daily Beast have given up on getting their funds back, regardless of how the court rules., Marshall, like many of them, said he just wants Saffron to serve time—and to never be able to do something like this again.

“I know he’s not going to pay anything back,” he said. “So he can just sit in jail and think about whether it was worth it.”