President Trump’s nominee for a seat on the Federal Reserve Board is not an economist, but he has continually gotten key economic policy ideas wrong for 30 years and admits he knows nothing about monetary policy, which is what the Fed oversees and regulates.

Meet Stephen Moore, 59, the non-economist who plays one on television, and who, because of his loyalty to Trump, is about to dramatically fail upward.

“I’m kind of new to this game, frankly, so I’m going to be on a steep learning curve myself about how the Fed operates, how the Federal Reserve makes its decisions,” Moore told Bloomberg Television. “It’s hard for me to say even what my role will be there, assuming I get confirmed.”

Moore’s credentials include calling on Federal Reserve Board Chairman Jerome Powell to resign, or for Trump, who appointed Powell, to fire him because “he’s wrecking our economy.” When the Fed in December raised interest rates, Moore said its members should be “thrown out for economic malpractice.”

It should be an interesting first meeting of the Fed board if Moore is confirmed, which is more likely than not given the Republican majority in the Senate. A catalogue of Moore’s greatest hits includes his insistence that Trump’s corporate tax cut is paying for itself despite the administration reporting that tax revenue is substantially down. Before that, he insisted the Clinton-era tax increase would tank the economy. Instead, it balanced the budget and left a sizeable surplus.

Moore was the architect of Kansas Governor Sam Brownback’s “red-state experiment.” Deep cuts in income taxes and business taxes were supposed to spur the state economy. Instead, they resulted in a loss of hundreds of millions of dollars, forcing unpopular deep cuts as school districts resorted to a four-day week, and roads and bridges were left in disrepair.

“Nothing the Matter with Kansas,” Moore declared in 2014, when the fallout was becoming painfully obvious. Brownback was narrowly reelected in 2017, but left the following year to become U.S. ambassador-a-large for religious freedom, his legacy as a pro-growth tax-cutter in shreds.

An article Moore co-authored two weeks ago in The Wall Street Journal caught Trump’s attention, and may have directly led to his nomination. Titled “The Fed Is a Threat to Growth,” Moore called the body he’s now nominated to serve on “the last major obstacle” to economic growth.

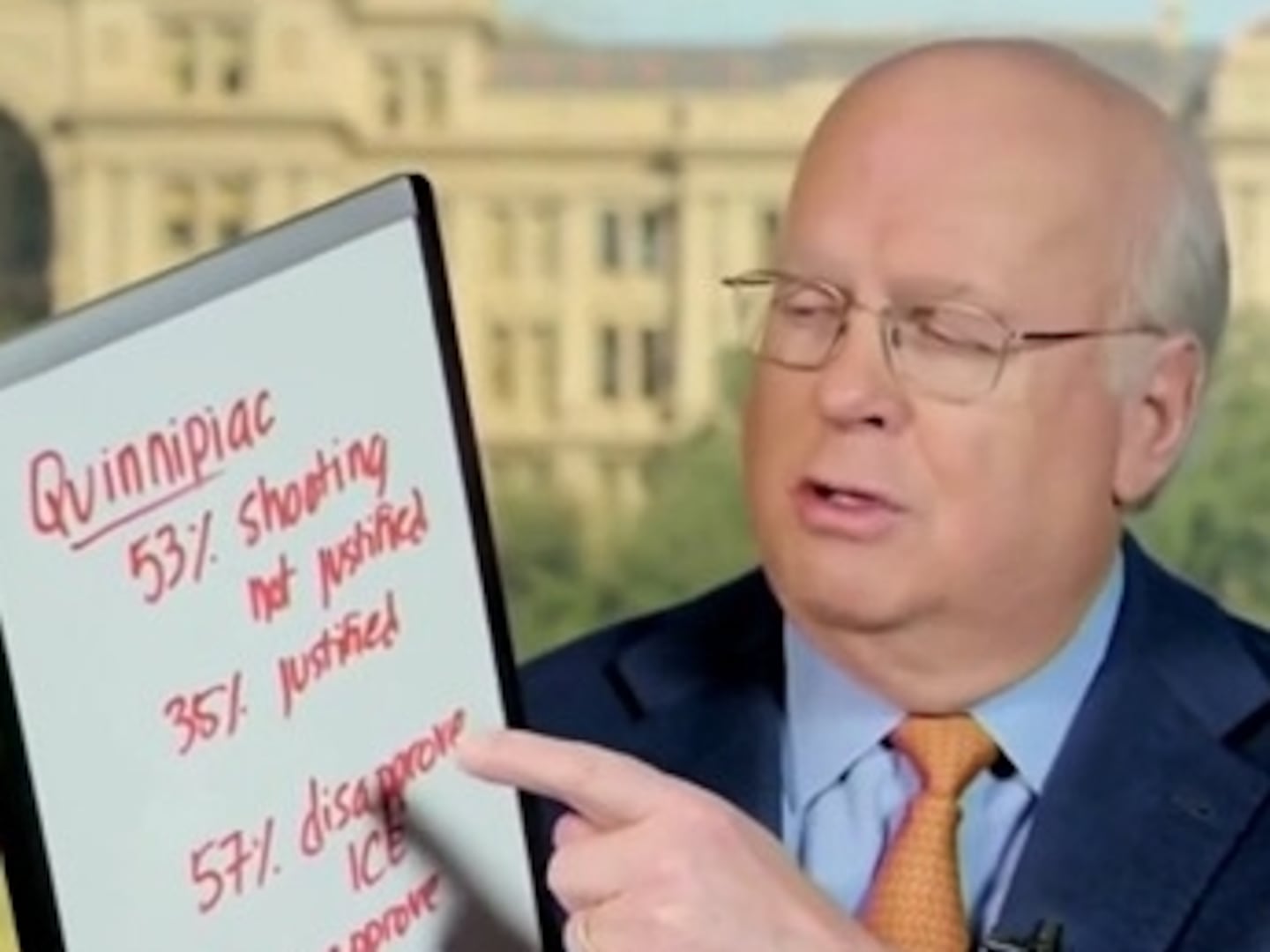

This is the kind of magical thinking that Trump—who’s convinced the Fed helped President Obama win reelection by holding off on raising interest rates—wants leading up to his reelection. Trump is installing a loyalist on its board to ensure that he really does get a thumb on the scale in 2020.

Moore worked on Trump’s 2016 campaign, where he developed the candidate’s tax plan. It built on two simple premises that Moore never deviates from, no matter the evidence: that tax cuts pay for themselves by spurring growth, and, conversely, that tax hikes cost more than they generate because they suppress growth.

When Trump announced Moore’s nomination, he called his non-economist pick a “very respected Economist.” Moore then tweeted his thanks for the opportunity to serve & for your zealous commitment to freeing the American economic engine from government overreach & oppressive taxation!”

Bloomberg News reported that Trump is also considering Herman Cain, former CEO of Godfather’s Pizza, to fill a second opening on the seven-member Fed board. Cain, who ran for president in 2012 before dropping out of the race amidst allegations of sexual misconduct, supported Trump in 2016. Cain is a former director of the Federal Reserve Board of Kansas City, so he is not without experience, but should Trump nominate him, the deciding factor would be loyalty not experience.

The importance of having someone loyal in key positions in government was driven home this past weekend when Attorney General William Barr took it upon himself to render the judgment in a four-page letter to Congress that Trump had not been found guilty of obstruction of justice.

“He’s running the country like a mob boss, picking his Capos for loyalty to him, not to the country,” says Matt Bennett of Third Way, a moderate Democratic group. “If Democrats had sat around with a white board blue-skying the worst people for these positions, they could not have outdone Trump.”

The Fed operates under the radar, as its members are supposed to dispassionately assess the economy and take steps to insure its stability. They aren’t on social media the way Moore is, with the freedom to say what he pleases. “If he goes on Twitter and complains about the chairman, it could crash the markets,” says Bennett. It’s on Twitter where much of the blowback about Moore’s potential confirmation is being voiced, and it’s coming from all sides, from ideological allies to more mainstream economic traditionalists.

Monetary economist George Selgin with the libertarian Cato Institute, where Moore has worked, eventually deleted a tweet calling Moore “unfit to serve on the Fed board.”

Greg Mankiw, who chaired the White House Council of Economic Advisors for President George W. Bush, wrote in a blog titled, “Memo to Senate: Just Say No” that while he’d supported Trump’s previous Fed appointments, that Moore is a different story:

“Steve is a perfectly amiable guy, but he does not have the intellectual gravitas for this important job. If you doubt it, read his latest book, ‘Trumponomics,’ or my review of it.”

In that review, titled “Snake Oil Economics,” he calls Moore and his co-author, Arthur Laffer, recognized as the father of supply-side economics, “rah-rah partisans,” whose “over-the-top enthusiasm” for Trump’s “sketchy economic agenda is not likely to convince anyone not already sporting a ‘Make America Great Again’ hat.”

Moore’s right about one thing: the “steep learning curve” he’ll be up against in trying to convert the bankers and economists of the Federal Reserve Board to Trump’s sketchy economic agenda.

One thing Moore has in his favor: he’s never been accused of losing faith in his side of the argument as evidence against it mounts up.