As the moving truck inched along I-64—the highway connecting Missouri and Illinois— crossing the Poplar Street Bridge, the driver prattled on despite his passenger’s seeming disinterest. It was early summer and, but for the intermittent sheets of rain, everything about that morning in 1969 was perfect.

He wasn’t usually a man of many words, but today was different. Albert Ross, who was either 42 or 44 at the time—depending on who was doing the counting — had purchased a new home for his wife Geraldine and their brood.

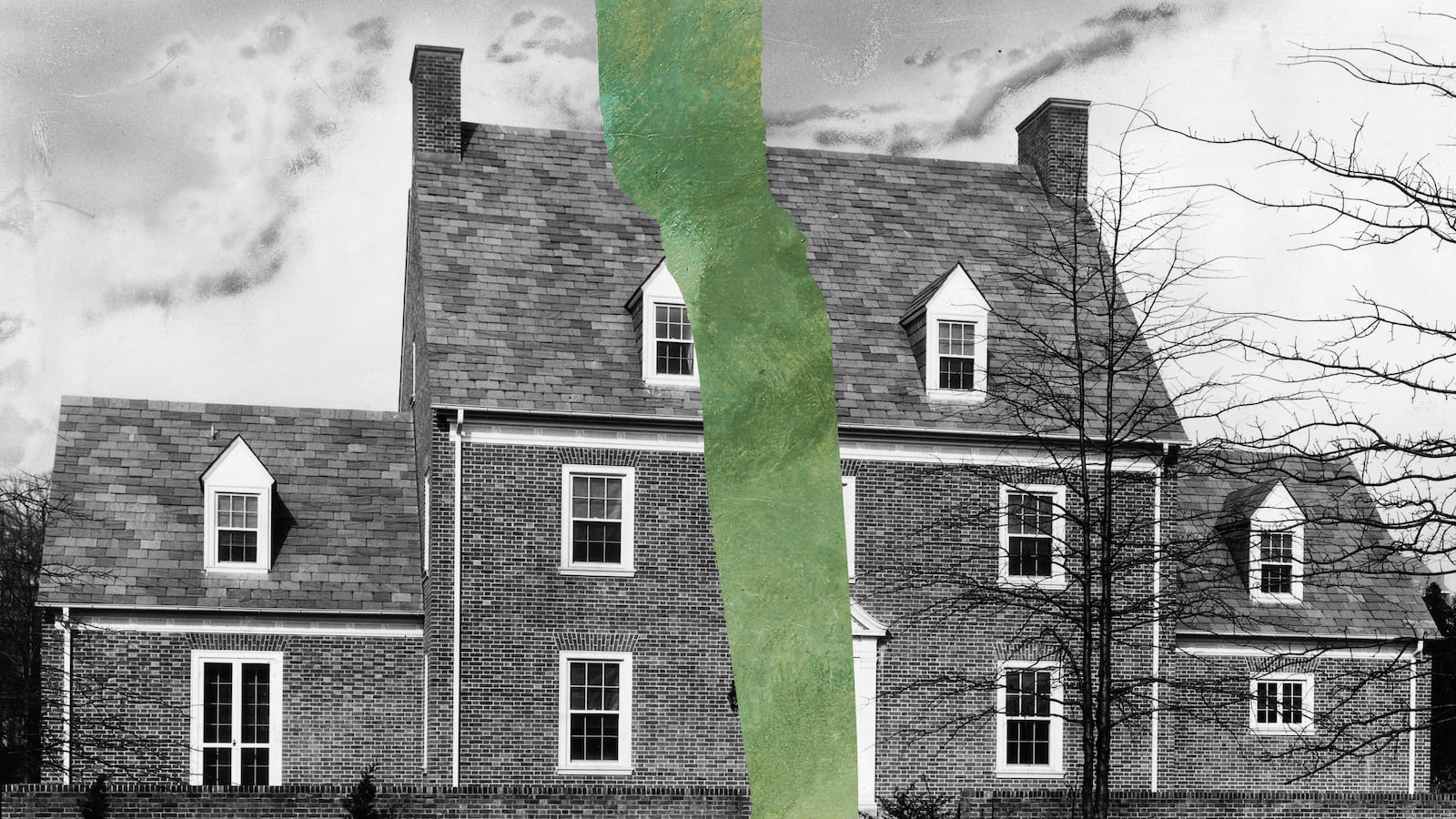

They weren’t his children by birth. The baby girl was 8 years old and her brother, a gangly fresh-faced boy, would be 10 that December. And the house wasn’t exactly new. The two-story frame structure, situated along 10th Street in East St. Louis, needed a fresh coat of paint and the expansive front porch could use a few well-placed nails. Albert did all the work himself.

Every Fourth of July, the Korean War veteran the neighborhood kids fondly called “Papa Ross” would proudly hoist an American flag into its place on the center porch pillar. Later, he would hang a wooden swing along the far left end, suspended by cast-metal chain-link hangers and s-hooks, and plant rose bushes along the front edge. There was an elementary school a few blocks away and a YMCA just up the street that offered ballet classes.

Over nearly 50 years, six generations of his family have come to live under that asphalt-shingle roof. Dozens of cousins and their minders have trampled the plush red carpet, shot fireworks in the backyard, and celebrated Thanksgiving in the oversized dining room. The house never changed hands in nearly five decades. One of Albert’s granddaughters lives there now, with her children.

Geraldine, the family matriarch, is 86 and in the health that one might expect. Albert passed on years ago. His beloved porch swing is gone, as are most of the other homes and apartment buildings that used to take up the block between Summit and Pennsylvania Avenues. The main hospital, St. Mary’s, shuttered some years back and two major grocery chains—Nationals and Schnucks—packed up and left.

It’s sometimes hard to imagine now that there had been a time when the block and all that surrounded it was solidly middle class—an era when the stores downtown bustled with customers and the city itself was something of an urban paradise. “If you cannot get a job in East St. Louis, you cannot get a job anywhere,” went the old adage.

Of course, that is no longer true. East St. Louis is now one of the most impoverished communities in the country.

It is worth noting that the township, situated along the easterly banks of the Mississippi River in central Illinois, was once a predominantly white city. There had been a riot in the summer of 1917—ignited by labor disputes, when white people feared they would be forced from their well-paying jobs in nearby factories by black migrants who emerged from the south beginning in the 1800s. In the end, an estimated 250 black people were killed and approximately 6,000 were left homeless—burned out of their brick bungalows and rooming houses.

“Between five and six o’clock we noticed a house nearby burning and heard the men outside,” recalled 70-year-old Narcis Gurley, who had lived in her home for 30 years. “We were afraid to come outside and remained in the house, which caught fire from the other house. When the house began falling in we ran out, terribly burned, and one white man said, ‘Let those old women alone.’ We were allowed to escape. Lost everything, clothing and household goods.’’

She had been "afraid to come out till the blazing walls fell in," according to the caption of the photo showing her terribly burned arms in The Crisis’ report later that year on The Massacre of East St. Louis.

Other photos included “Frank Smith, Burned,” “Amos Davis, Age 84, Shot,” and “The Refugees.”

Another, about a chambermaid newly arrived in the city, reads: “Mineola McGee. Shot by soldier and policeman. Her arm had to be amputated.”

When it was over, the town picked up the pieces. The city would go on about its business as one of the nation’s most important stops along rail lines and barge routes. Commerce would continue to boom, and it would endure the civil-rights movement.

However, white people began to abandon the city—first in trickles, then in droves as more African-Americans were drawn to its seemingly boundless economic opportunities. Between 1967 and 1970, nearly every remaining white family uprooted for the suburbs. Driven by anti-black bias, city lines were redrawn so that the smoke-stacks and factories at the edge of town were de-annexed. In 1969, when Albert bought the house at 623 N. 10th Street with a contract-for-deed mortgage, redlining was prevalent. Despite paying every bill he ever had on time and proudly serving his country in the U.S. Army, Albert was black and could not qualify for traditional bank financing. At the time, only one white family remained on 10th Street.

That was the Sanders siblings—a white judge, lawyer and librarian who lived directly across the street, developed a close relationship with Albert and his wife, and would stay until their deaths in the house each of them had been born in. The crime rate was low in 1969, there were quality schools in every sector of the city, and the homes—now all owned by black people, except for the Sanders'—sat majestically on leafy green lots on well-maintained streets.

Today, the entire St. Louis metropolitan area—which straddles the state line—is largely black. While East St. Louis represents one of the most extreme cases of wealth stripping, until now, one measurable impact of re-segregation had been mostly missed. The actual devaluation of homes in black neighborhoods is pervasive, according to a damning new study from the Brookings Metropolitan Policy Program. It found that “housing prices are systematically lower where neighborhood black population share is higher,” with prices “just over 50 percent lower in neighborhoods where the black population is 50 percent compared to neighborhoods with no black residents”

That means that if one could have picked up Albert’s house and haul it up the highway in Belleville, Illinois—then an all-white enclave and sundown town—it would likely be worth twice as much. That is the history, but racial self-segregation and its resulting economic inequalities persists today.

Even after controlling for the most common causes of the pricing disparity-- lower-quality schools and homes and higher crime rates—the study found that deflation of black neighborhoods, writ large, “reduced home values by an average of $48,000 per household,” for a cumulative loss of $156 billion in total wealth. The paper, released Tuesday morning, suggests that “anti-black beliefs” are, in large part, driving that “segregation tax.” The distortion in home values continues to have significant financial ramifications.

The authors—Andre Perry, Jonathan Rothwell, and David Harshbarger—found a correlation between segregation and home devaluation in metropolitan areas across the country.

Albert and others of his time chose to purchase in East St. Louis because, frankly, the homes were selling for well under their value. There were bargains to be had because white families chose flight over integration. However, with that came an erosion of tax-bases, the very dollars that fund infrastructure, city services, schools, libraries and other public amenities. In time, the city would go bankrupt.

More than 50 years after Jim Crow, self-segregation remains not only a fissure between liberal-leaning cities and markedly more conservative suburban and rural areas, but a significant factor in public or private economic investment. Public policy is seemingly designed to be one of divestiture and containment rather than connecting communities and increasing the quality of life in predominantly black metropolitan areas.

It always starts with the housing, as author Ta-Nehisi Coates laid out in his expansive piece, published in 2014 by The Atlantic, making the case for economic reparations pegged to segregation.

“Until we reckon with our compounding moral debts,” he wrote, “America will never be whole.”

Albert was my uncle, married to my mother’s sister. I can tell you that he was never whole after a massive stroke in 1983. He died the following year on January 31, 1984 when I was 15. Over the years, I’ve written a lot about the man who raised me and our emotional attachment to that house. The pale green house with white trim that he once treasured, where some of his grandchildren and great grandchildren still live, is in such disrepair that it should be condemned. What seemed like a good bargain in 1969 was actually the beginning of widespread home devaluation and wealth-stripping that left neighborhoods debilitated.

Those communities and housing values, like my Uncle Ross, never recovered.

Harry Siegel contributed reporting.