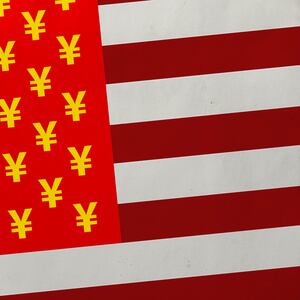

HONG KONG — What does victory in the Trump trade war with China look like?

For the American president, the target is clear. Donald Trump wants to diminish the trade imbalance between the two countries, and for Beijing to address intellectual property theft by Chinese entities.

Xi’s objectives in the trade war are less clear. The picture of “winning” hasn’t really been painted by the Chinese leader, and that may be because his goals are so much more ambitious.

For nearly two years, he has been sending signals offering Beijing as an alternative to the current Washington regime in hopes he can establish a new order of allies with China as its heart. This will surely continue in Buenos Aires when the Group of Twenty world leaders, the G20, meet at the end of this week.

As Trump harps on at home about “America first,” Xi has branded himself as the paragon of free trade, one who will uphold a balance in the global order—and maybe propel China ahead of the United States.

That message has been a constant for almost two years, with Xi reminding his listeners in Hainan in April this year, then in Vladivostok during a meeting with Japanese Prime Minister Shinzo Abe in September, during a public appearance in Beijing in October, in Shanghai in early November, in Papua New Guinea during the APEC summit in mid-November, and during other public appearances.

China—or, more specifically, the Chinese Communist Party—as the world leader is the stuff of dreams for Xi. But while some, like the Philippines’ Rodrigo Duterte, have deferred to the Chinese autocrat’s authority, Xi hasn’t amassed yet the following that he wants.

And he isn’t likely to achieve that any time soon. Leaders of other nations are observing the trade war intensely, scrying tweets, gauging who might be ahead, and probing whether there could be an end to the regressive absurdity. But it has been impossible thus far to determine who has the advantage in the trade war.

A group of economists and researchers in the European Union known as EconPol Europe have concluded that Chinese entities carry 82 percent of the additional cost that stem from Trump’s trade war. (The other 18 percent falls on consumers and companies in the United States.) By that measure, Trump is, as he promised, making China “pay.”

Yet in September, China’s trade surplus with the U.S. reached a new record at over $34 billion (though October’s figures failed to meet the expected $35 billion). If Trump’s goal is for America to buy less from China and more from domestic producers, then his war effort is breaking down.

Consider also the fact that no major American company has shifted its operations out of China since Trump became the 45th president. American businesses haven’t been on board with the overtly nationalistic message from the White House, sensing that it is, well, bad for business.

During the recent APEC summit, Xi and Vice President Mike Pence took turns sniping at each other from the podium. History tells us, Xi said, that “to take the road of confrontation—whether it’s in the form of a cold war, open war, or trade war ... will produce no winners.”

Pence fired back by needling China’s takeover of the South China Sea, Xi’s Belt and Road Initiative, and what Pence has characterized as debt-trap diplomacy. “Know that the United States offers a better option,” Pence said. “We don’t drown our partners in a sea of debt. We don’t coerce, compromise your independence. The United States deals openly, fairly. We do not offer a constricting belt or a one-way road.”

Xi apparently didn’t take the barbs so well, and there was further humiliation for the Chinese delegation after reports of Chinese officials forcing their way into the office of Papua New Guinea’s foreign minister, Rimbink Pato, and attempting to retool a statement to be made by him.

Just as frigid relations and the pissing contest between Washington and Beijing cast a shadow over the APEC summit, the same is expected to happen at the G20 meeting in Buenos Aires.

Already, Trump is planning another blow for Beijing. The White House is considering tighter restrictions on high-tech exports, which would impact the growth of many industries in China, including electric vehicle production, artificial intelligence, and robotics. This would hamper Xi’s “Made in China 2025” grand strategy, which has the goal of shaking off Chinese dependence on foreign technology, but still requires tech from the West before reaching that final stage.

As Beijing attempts to surmount Trump’s chaotic battle tactics, other nations have reason to worry. The friction between the U.S. and China is edging toward “you’re with us, or you’re with them and against us.” This was recognized by Singapore’s Prime Minister Lee Hsien Loong, who pointed out two weeks ago that Southeast Asian nations may soon have to “choose one or the other.”

The time might come for G20 nations to each pick a team, too, splitting the world’s major nations into defined camps.