At the heart of Madoff, ABC’s two-night miniseries about notorious money-managing crook Bernie Madoff, are two fundamental truths. The first is that if something seems too good to be true, it generally is. The second is that people will often ignore that first truth and accept any lie, or set aside any moral principles—be it by committing a crime, or simply by looking the other way—if they stand to benefit from doing so.

Inspired by ABC News Chief Investigative Correspondent Brian Ross’s book The Madoff Chronicles, Madoff illustrates how those two realities formed the basis for Madoff’s stratospheric rise to the heights of the financial industry, and his vertiginous fall in 2008, when he was arrested for operating a $50 billion Ponzi scheme—the largest in American history. It’s a story of rampant greed, stunning incompetence, willful blindness and unthinkable betrayal. And it’s told with enough compelling suspense and detail by director Raymond De Felitta, and led by a sturdy enough headlining turn from Richard Dreyfuss, to mostly make up for the fact that, in the end, it has no great insight to impart about its real-life villain.

That’s not, however, for lack of trying. De Felitta does his best to get up close and personal with Madoff—the embodiment of Wall Street avarice, and the shame of all Jews—who’s front-and-center in the vast majority of this three-hour series’ scenes, and whose interior-monologue narration helps propel the story toward its inevitably enraging conclusion. The man it reveals is a self-made millionaire who, determined to avoid receiving the sort of public pity that was showered upon his failed-businessman father, discovered that the key to long-lasting investment success was to cover clients’ losses with his own—or other clients’—money. In other words: to lie to them and cheat the system.

That formula helped Madoff get by as a kid navigating the 1987 stock market crash, and it led to the creation of an empire that, at its peak, had tens of billion in cash reserves. Unlike The Big Short’s humorous attempts to make complicated financial instruments and regulations easily digestible, Madoff avoids the true nitty-gritty particulars of its protagonist’s scheme. Instead, it takes a big-picture view of how the asset management arm of his Bernard L. Madoff Investment Securities firm—located in smoky, crowded rooms on a floor below his main offices—was really nothing more than a front run by gangster-ish Frank DiPascali (De Felitta’s longtime favorite leading man, Michael Rispoli), whose job it was to create records of phony trades and returns for both existing and prospective clients. As long as money came in, the operation’s wheels kept turning.

Aside from a few unnecessary instances of showy slow-motion, De Felitta and writer/creator Ben Robbins’s straightforward approach to their material is Madoff’s greatest asset, affording a sharp behind-the-scenes look at how Madoff got away with his scheme simply because with enough cash on hand (from whatever source), he could always show investors the money. It conveys Madoff’s canny gift for gaining the trust of both the rich and powerful and the middle class (including grandmothers interested in providing for their grandchildren’s college education). His arrogant charm, when coupled with his sterling track record and reputation—which eventually nabbed him a three-year post as a NASDAQ chairman—meant that there was no reason for anyone to suspect that Madoff was a fake, much less to look into his books.

Much early energy is spent focusing on the (largely ignored) attempts by securities executive and would-be whistleblower Harry Markopolos (Frank Whaley) to make the SEC pay attention to the fact that Madoff’s crime was not only vast, but obvious to anyone who was paying attention. In that narrative thread, as well as in sequences involving the SEC’s audit of Madoff’s business, Madoff reveals how his entire charade could have crumbled had anyone made even the slightest of efforts (in a crucial moment, even a single phone call would have done the trick). That no one did is astonishing and, as presented by De Felitta and Robbins, a byproduct not of overt institutional corruption, but of incompetence and unjustified assumptions about the general above-the-board behavior of the super-rich.

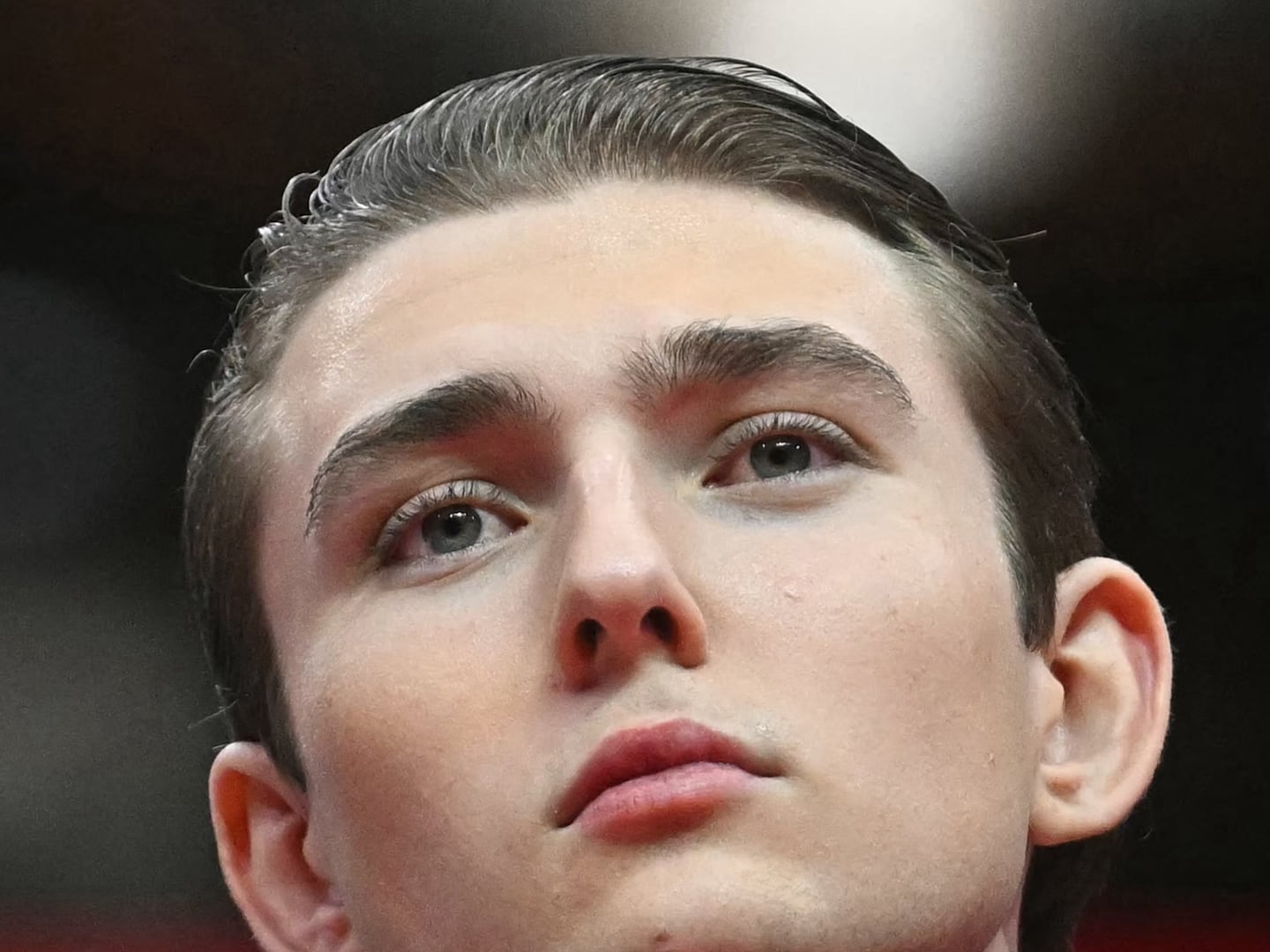

Madoff is less interested in casting its character’s crime as symptomatic of the global financial system than in concentrating on the particulars of his story. In that regard, it proves a reasonably compelling depiction of white-collar treachery whose tragedy is underlined by Madoff’s relationship with his sons Mark (Tom Lipinski) and Andrew (Danny Deferrari), as well as his brother Peter (Peter Scolari)—all of whom worked in the “family business,” albeit with apparently little-to-no knowledge of Madoff’s Ponzi scheme. Through their bonds, Madoff is shown to be a man who, though claiming to prize his clan’s interests above all others, was in reality a domineering, egotistical prick and phony who relished his position at the head of the table, and who used money and influence to buy whatever loyalty he needed.

Dreyfuss leans heavily on Madoff’s infamous smirk but nonetheless evokes how the investor fooled others by preying on their materialistic needs and dreams, as well as how he fooled himself into believing he was a good guy through self-justifications regarding the industry’s corruption, and the idea that he was breaking the law in order to provide for his family. Unlike the passable, perfunctory turns from the supporting cast, it’s a big, showy performance of creepy grins, nefarious cackles and outsized gestures, and it often holds the proceedings together even when the action bogs down in mundane developments and ham-fisted symbolic gestures (the worst: Madoff lying on the floor to ease his back pain while his fortunes plummet). Eventually detailing his infidelity to loyal wife Ruth (Blythe Danner) and his betrayal of devoted clients like Carl Shapiro (Charles Grodin)—and, in a jaw-dropping moment, Nobel Laureate and Holocaust survivor Elie Wiesel (David Margulies)—the series makes clear that Madoff was a bullshitter extraordinaire without an ethical bone in his body, and a cretin undone not by pangs of conscience but merely a 2008 financial crisis that rendered his lies unsustainable.

Unfortunately, what the series can’t do is expose any sort of underlying depth to Madoff. There are no revelations to be discovered here about why he did what he did, because ultimately, the series is forced to accept that Madoff’s behavior stemmed solely from his own insatiable hunger for wealth, power, and respect, and from others’ willingness to believe that he was, as he dubbed himself, “a magician.” As captivating, infuriating and superficial as its protagonist, it’s a portrait of a reprehensible monster who stole until he couldn’t steal any more, destroyed thousands of lives in the process (including those of his own wife and kids), and then went to jail, unrepentant to the bitter end.