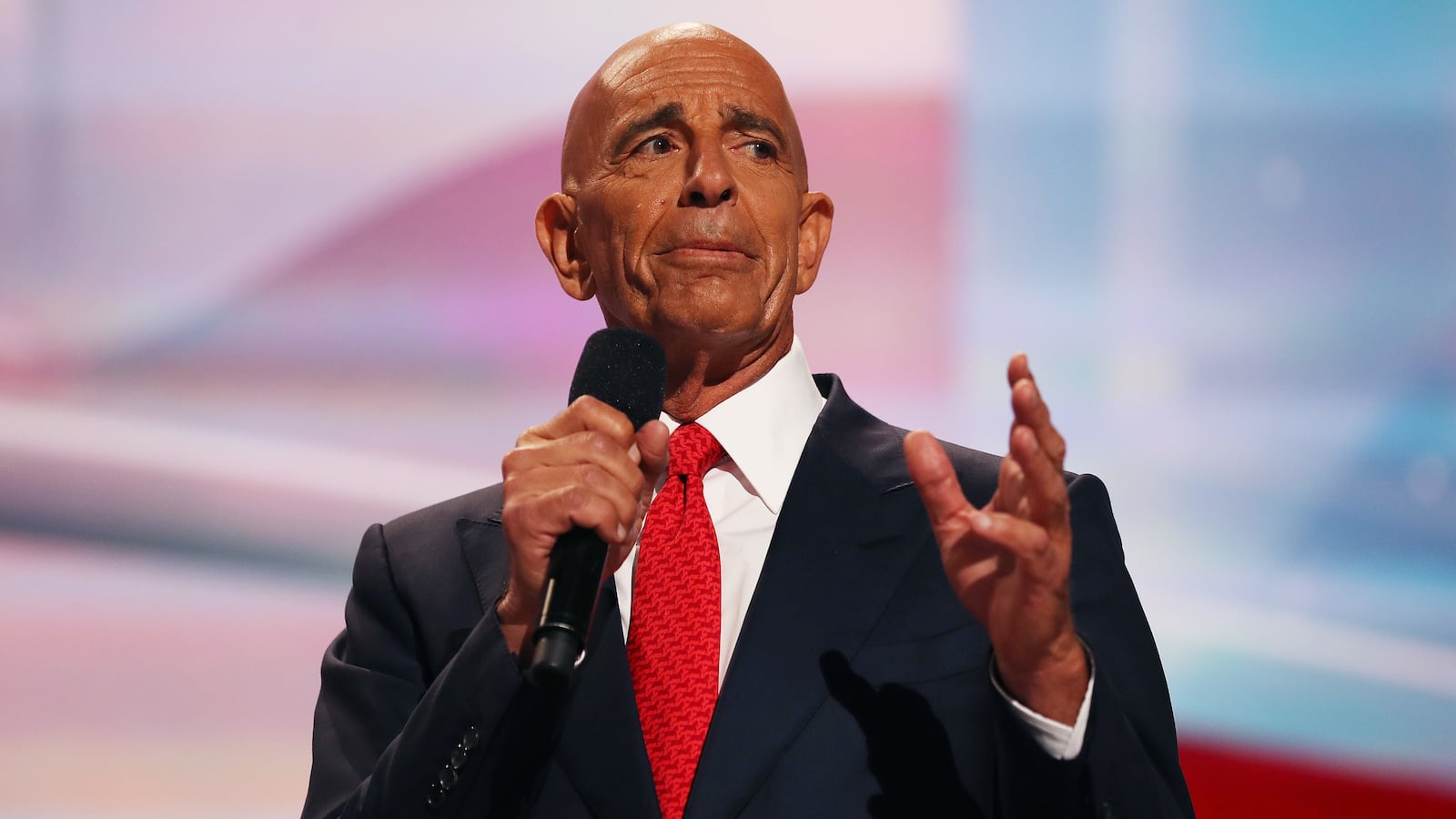

The chairman of former President Donald Trump’s 2017 inaugural fund has been arrested on federal charges for illegally lobbying on behalf of the United Arab Emirates, the Department of Justice announced Tuesday.

A seven-count indictment accuses billionaire real-estate investor Thomas Barrack, 74, Aspen resident Matthew Grimes, 27, and UAE national Rashid Sultan Rashid Al Malik Alshahhi, 43, of “acting and conspiring to act as agents of the UAE” in an attempt to influence the policy positions of the Trump administration. Barrack, the founder of investment firm Colony Capital and a longtime Trump ally, was also charged with obstructing justice and making false statements.

“The defendants repeatedly capitalized on Barrack’s friendships and access to a candidate who was eventually elected President, high-ranking campaign and government officials, and the American media to advance the policy goals of a foreign government without disclosing their true allegiances,” said acting Assistant Attorney General Mark Lesko of the Justice Department’s National Security Division.

“The conduct alleged in the indictment is nothing short of a betrayal of those officials in the United States, including the former President. Through this indictment, we are putting everyone—regardless of their wealth or perceived political power—on notice that the Department of Justice will enforce the prohibition of this sort of undisclosed foreign influence.”

Federal prosecutors allege that the trio conspired to act as agents of the UAE between April 2016 and April 2018, using Barrack’s connections with the Trump administration to push for the country’s interests. Barrack informally advised Trump’s campaign between April and November 2016, then served as chairman of Trump’s inaugural committee until January 2017. After that, he continued to informally advise senior government officials on foreign policy in the Middle East.

The three communicated secretly with senior UAE officials using a dedicated cell phone and “a secure messaging application,” according to the indictment.

“As alleged in the indictment, the defendants used Barrack’s status as a senior outside advisor to the campaign and, subsequently, to senior U.S. government officials, to advance the interests of and provide intelligence to the UAE while simultaneously failing to notify the Attorney General that their actions were taken at the direction of senior UAE officials,” a DOJ press release states. “Barrack—directly and through Alshahhi and Grimes— was regularly and repeatedly in contact with the senior leadership of the UAE government.”

Grimes worked directly under Barrack at Colony Capital, and together they frequently met with Alshahhi, a UAE agent, whom Barrack once referred to as the UAE’s “secret weapon” in advancing its foreign policy goals in the U.S., the indictment states.

Prosecutors describe in court documents the breathtaking lengths the trio went in their attempt to sway the Trump White House’s Middle East agenda. In one example from May 2016, Barrack allegedly slipped positive language about the UAE in one of Trump’s 2016 campaign speeches about U.S. energy policy—and then “emailed an advance draft of the speech to Alshahhi for delivery to senior UAE officials.”

After Trump was elected president, Barrack allegedly sat down with UAE officials and told them to come up with a “wish list” of policy items they wanted to accomplish at various points of the Trump administration.

Barrack regularly “sought and received direction and feedback, including talking points, from senior UAE officials in connection with national press appearances [he] used to promote the interests of the UAE,” prosecutors allege. “After one appearance in which Barrack repeatedly praised the UAE, Barrack reportedly emailed Alshahhi, ‘I nailed it...for the home team.’” The “home team,” in this instance, being the UAE.

Barrack and Grimes also “solicited direction from senior UAE officials in advance of the publication of an op-ed authored by Barrack,” which Fortune magazine published in 2016. He allegedly “removed certain language at the direction of senior UAE officials, as relayed by Alshahhi,” prosecutors say.

Text messages and emails between Barrack and former Trump campaign chairman Paul Manafort obtained by the House Oversight Committee in 2019 shed additional light on the exchanges recounted in the indictment.

After Alshahhi sent Barrack a draft of Trump’s planned energy policy speech in May 2016, Barrack forwarded the edited copy to Manafort with the cryptic warning that “This is probably as close as I can get without crossing a lot of lines.”

The edits allegedly had originally singled out Saudi Crown Prince Mohammed Bin Salman and UAE Emir Mohammed Bin Zayed, referred to in the indictment as “Emirati Official 1,” for praise by name but Trump’s final version included only a more general pledge to “work with our Gulf allies”

“Neither Mr. Barrack nor Mr. Al-Malik appear as registrants in the Department of Justice’s Foreign Agents Registration Act (FARA) database,” House Oversight committee staffers wrote of the interaction.

Barrack stepped down in May from his role as executive chairman at Colony Capital Inc., the Los Angeles private equity firm he founded in 1991. The company was reportedly in the midst of a strategic shift away from a real estate portfolio that included holdings such as a fleet of industrial warehouses in New Jersey and Nevada, numerous hotels, and an ownership stake in Michael Jackson’s Neverland Ranch, to one focused on digital investments.

Barrack’s exit came on the heels of a campaign by activist investor Blackwells Capital to oust him from the business as his political connections and role in Trump’s 2016 inauguration came under increased scrutiny.

“Colony’s board has given Tom Barrack too much deference and too much latitude for too long,” Blackwells founder Jason Aintabi wrote to Colony executives in a November 2019 letter. “His continued, imperial reign over the company damages its credibility and business prospects, and creates a tremendous overhang on the stock.”