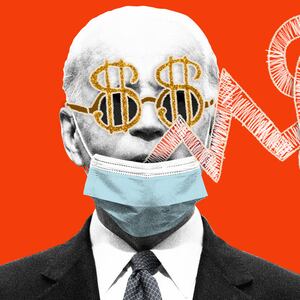

As the novel coronavirus began to tank the stock market in early March, President Donald Trump went on Fox News to assure the country that the economy remained strong. That same day, Trump’s chief of staff unloaded hundreds of thousands of dollars in publicly traded securities.

Mick Mulvaney, then the acting White House chief of staff and the director of the Office of Management and Budget, sold between $215,000 and $550,000 in holdings in three mutual funds on March 4, according to ethics paperwork he submitted late last month. Holdings in each of the three funds are made up almost entirely of U.S. stocks.

The trades, which represented the vast majority of Mulvaney’s holdings in publicly traded funds, suggested a less sanguine view on America’s financial outlook than Mulvaney’s boss and colleagues were projecting at the time.

“Our economy is doing fantastically,” Trump told Fox primetime host Sean Hannity, the day of the Mulvaney transactions. “Numbers are coming out very well. The consumer in the United States is unbelievably strong, stronger than ever before, I believe.”

By that point, markets had already started to tank on fears of the worsening coronavirus outbreak. But March 4 saw a surge in the Dow Jones Industrial Average that was attributed, in part, to Democratic presidential candidate Joe Biden’s strong showing in Super Tuesday primaries the day before. The day after Mulvaney sold those holdings, the values of all three of the mutual funds he offloaded plummeted, though they have since regained much or all of their lost value.

There’s no indication that Mulvaney, who now serves as the U.S. Special Envoy for Northern Ireland, used information gleaned through his official duties to inform those investment decisions. Indeed, by the time of the transactions, the dangers the coronavirus posed to America’s financial system were becoming widely evident. Mulvaney’s sales nevertheless show a striking divergence in the White House’s official position on the strength of the U.S. economy at the time and the private investment decisions of the president’s top aide.

Neither Mulvaney nor the State Department’s press office responded to requests for comment on this story. The White House did not respond to a request for comment.

As COVID-19 began taking its toll in early March, Trump touted his financial optimism at every turn. “The country is in great shape, the market is in great shape,” he declared on March 3. Three days later, he proclaimed that the ongoing stock slide was a fluke. "I think financially—I think the country is so strong. We’re so strong as a country now. We have never been like this,” he said on March 6, the same day that Trump announced Mulvaney’s departure from the White House in a Friday evening tweet.

Trump’s top economic advisers were pushing similar messaging. “We’re not going to panic over this at all, because the economy is sound, and we will get through this, and then the virus will end,” Larry Kudlow, the director of Trump’s National Economic Council, told Bloomberg on March 3.

Mulvaney, for his part, was playing down the threat of the coronavirus at the time—and accusing Democrats of weaponizing it in an attempt to damage the president politically.

"They think this will bring down the president," Mulvaney said in late February. "That's what it's all about." He was speaking at the annual Conservative Political Action Conference, where an attendee would later test positive for coronavirus, sending a number of the conference’s prominent speakers into quarantine.

The three funds that Mulvaney reported selling in March were the only three reported securities in a brokerage account he disclosed to federal ethics officials. He had purchased those holdings in 2017, according to previous filings with the Office of Government Ethics. In his latest filing, he disclosed that his holdings in each of the funds was between $0 and $1,001, indicating that those positions were entirely or almost entirely liquidated.

The transactions were a break from prior years. Mulvaney didn’t report selling any stocks or securities in 2019 in his annual financial disclosure filing.

According to his most recent filing, Mulvaney and his wife’s net worth was between $3.7 million and $7.7 million. But few of their assets were liquid, and included a number of real estate holdings, education trusts for their children, and retirement and life insurance accounts. The Mulvaneys also reported substantial debts of between $2.3 million and $10.7 million.

The Mulvaneys reported having far less in cash and more liquid assets, underscoring how consequential those trades were to his portfolio. Beyond the brokerage account that held those funds, those assets consisted of three bank accounts containing between $2,000 and $31,000, gold and silver bars worth between $16,000 and $65,000, and another brokerage account containing between $1,000 and $15,000 in cash.

Mulvaney’s wife also had holdings of between $4,000 and $60,000 in four mutual funds. He reported sales of those holdings in late March as well, though it wasn’t clear from his financial disclosure form whether they’d been liquidated entirely.

Public officials’ sales of securities amid coronavirus-induced market turmoil have come under scrutiny after The Daily Beast and others reported on U.S. Senators that unloaded millions of dollars in stock immediately prior to the market crash. The Justice Department is currently investigating Sen. Richard Burr (R-N.C.) over his stock sales this year.

Federal law prohibits members of Congress and other government officials from using information gleaned through their official duties to inform investment decisions. When he represented South Carolina in the House of Representatives, Mulvaney voted for the bill, dubbed the STOCK Act, that imposed that law.

More recently, though, Mulvaney appears to have skirted other provisions in the law. In 2018, as he led OMB, Mulvaney explored a potential post-government job as the president of the University of South Carolina. His office acknowledged that he had discussed the possibility with a member of the school’s board of trustees.

Under the STOCK Act, a senior political appointee “may not directly negotiate...any agreement of future employment or compensation” unless that official submits a signed, written notification of such a negotiation to his or her agency’s top ethics officer, disclosing the name and employer of the person on the other end of the negotiation.

The Daily Beast filed a Freedom of Information Act request seeking a copy of any such written notification provided by Mulvaney with respect to discussions surrounding that USC position. OMB wrote back last week to say that “no responsive records were located.”