In the last year, Sen. Kyrsten Sinema (D-AZ) hasn’t missed many opportunities to stick it to her own party—becoming, quite literally, the embodiment of a thumbs-down to the most treasured agenda items for Democrats.

That maverick posturing has made a primary challenge to the Arizona centrist in the 2024 election more and more likely by the month.

Last week, however, Sinema did something that may have made a primary battle not just a likelihood, but a near-certainty.

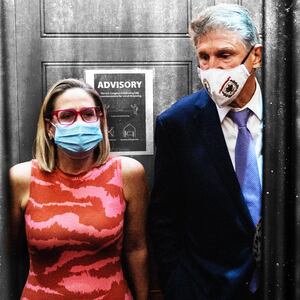

After Majority Leader Chuck Schumer (D-NY) and Sen. Joe Manchin (D-WV) announced a deal on a $700 billion climate, health care, and tax reform package, all eyes turned to Sinema to see if she’d lend her support and become the crucial 50th vote.

But as talks ramped up, Sinema made clear that she wouldn’t support the so-called Inflation Reduction Act—at all—if lawmakers didn’t take a sledgehammer to significant tax reforms included in the legislation.

In Sinema’s sights were two key measures in particular: one to establish a minimum corporate tax rate and another to close the so-called carried interest loophole, a break that allows many finance professionals to tax their incomes at a lower rate.

Virtually all Democrats, and President Joe Biden, saw this legislation as a long-awaited opportunity to compel an array of finance interests—from wealthy private equity barons to hedge fund honchos—to pay more in taxes, and in the process, raise hundreds of billions of dollars to help pay for the legislation.

Sinema, clearly, felt otherwise. She spent much of her considerable political capital to preserve a favorable tax structure for deep-pocketed special interests.

The dust had hardly settled before Rep. Ruben Gallego—the Phoenix progressive who has made moves toward primarying Sinema—explicitly threatened a challenge over Sinema’s maneuvering.

“Instead of using her power to help Arizonans by doing something like capping the cost of insulin in exchange for protecting her rich Wall Street friends, she threatened the entire bill unless those friends got to protect their tax loophole,” Gallego wrote in a fundraising email.

“We deserve better,” he said. “We deserve a Senator who prioritizes people ahead of private equity moguls.” (Gallego’s camp declined to make him available for an interview.)

Several Arizona Democrats said they believed Sinema’s stand for Big Finance is important not just because it makes a primary challenge more likely. It could also reshape that campaign by offering a challenger potent lines of attack that could resonate far beyond the loyal audience of progressive Sinema haters.

Sinema’s critics have been wary of allowing a primary challenge to be framed as a left-wing project, making it easier for the senator to discount it and giving Republicans ammunition for the general election should a challenger succeed.

But Sinema’s single-handed stymieing of an effort to close tax loopholes that even Wall Street veterans—and former President Donald Trump—wanted to address crystallizes the case against her to a broader audience, said Emily Kirkland, a progressive activist in Arizona.

“Any successful primary challenge was always going to be built on the idea that Kyrsten Sinema favors the richest people in the country over the needs of people in Arizona,” Kirkland said. “Her maneuvering just encapsulates that narrative so cleanly… There’s no question you can run a campaign against her that is not about progressive vs. moderate or left vs. right.”

In order to bolster her reputation back home, Sinema’s team appears to have turned to a novel tactic—one that may push the envelope on what constitutes acceptable and transparent campaign communication.

In recent months, pro-Sinema ads have been running on Facebook from a page called “The Desert Recap.” One typical ad shows a photo of a smiling Sinema and the message that she had secured a “‘once in a generation’ investment in wildfire mitigation, water security, and transport expansion here in Arizona.”

The ads include a disclosure that they are paid for by Sinema’s campaign, and the all-but-vacant Facebook page for The Desert Recap itself also says it is sponsored by Sinema’s campaign.

But the aesthetic and presentation of the ads are markedly similar to that of a local news outlet, according to Saurav Ghosh, an expert with the nonpartisan Campaign Legal Center, who said he has never seen a campaign do something similar.

“It’s obviously providing a disclaimer, but at the same time, it seems to be undermining the spirit of transparency by looking like, or trying to appear like, a media entity that’s providing a more objective reporting view of what’s happening in Arizona,” Ghosh continued.

“If you just passed this Facebook ad and are scrolling through, you’re not necessarily going to dig into whether that’s legitimate or not, so it definitely undermines transparency,” he said. “It’s not dealing fairly and squarely with the viewer.”

A spokesperson for Sinema did not respond to questions about the Facebook advertising tactic.

While Arizona politicos are focused on a historically contentious 2022 campaign in the top-tier battleground state, Sinema’s significant influence—and her willingness to draw intense criticism—are ensuring that questions about her political fate will remain on the front-burner before her re-election campaign begins in earnest in January 2023.

In response to questions from The Daily Beast, Sinema spokesperson Hannah Hurley said Sinema “makes every decision based on one criteria: what’s best for Arizona.”

“Through her negotiations, Senator Sinema successfully ensured the budget reconciliation package accomplishes two main goals: it helps Arizona's economy grow and compete and it boosts drought and climate resources for Arizona and the entire American West,” Hurley said.

Indeed, Sinema also insisted that $5 billion in drought resources be included in the Inflation Reduction Act, a significant investment that represents a win for her and other Western senators. And for all of the Democratic consternation around the senator’s record, she has also been a central player in some of the biggest bipartisan legislative achievements in recent years.

In 2021, Sinema helped to broker the $1 trillion bipartisan infrastructure law, a key priority for Biden. And earlier in the summer, she was part of a small bipartisan group that fashioned a compromise bill on gun safety reforms, breaking a historic impasse on the issue.

Both achievements are poised to be powerful assets to Sinema in any primary or general re-election campaign.

But Sinema was already in trouble among Democratic voters even after her negotiations to pass the infrastructure bill—and well before leaving her mark on Democrats’ reconciliation bill. A Jan. 2022 poll from Morning Consult found that only 43 percent of Democratic voters approved of Sinema’s job performance—12 percentage points lower than her approval rating among GOP voters.

Shortly after Democrats took control of Congress in 2021, Sinema rejected an amendment to raise the federal minimum wage to $15 per hour with a breezy thumbs-down on the Senate floor, resisted the party’s efforts to abolish the chamber’s 60-vote threshold in order to enact voting rights and other reforms, and persistently objected to aspects of the Build Back Better agenda that Democrats failed to enact last year.

In particular, Sinema was never a major obstacle to plans to spend heavily on addressing Democratic priorities like climate change—unlike Manchin—but no Democrat was more opposed to changing the tax code to compel big businesses and wealthy individuals to pay more.

So when talks around a party-line Democratic bill were revived from the ashes of Build Back Better in July, many Democrats were bracing for her to wield significant influence over the revenue-raising side of the bill. Few expected her, however, to predicate her support for the Inflation Reduction Act on diluting tax provisions targeted at the wealthiest interests.

The so-called carried interest loophole, for instance, allows hedge fund and private equity professionals to tax investment gains, the main source of their true wealth, at a lower rate after three years—about 20 percent instead of 37 percent.

Addressing that discrepancy has been on the agenda for Presidents Obama, Trump, and Biden. The Schumer-Manchin deal did not close the loophole, but it would delay the implementation of the lower tax rate for capital gains by five years instead of three, resulting in an estimated $14 billion in additional revenue over a decade.

Sinema objected, and Schumer later revealed she told him she would “not even move to proceed unless we took it out.”

“We had no choice,” Schumer concluded.

The reconciliation bill also proposed a corporate minimum tax to ensure that large companies—ones with annual revenue of over $1 billion, like Amazon—are unable to use various breaks and incentives to totally eliminate their tax burden. It was projected to raise over $300 billion for the federal government over a decade.

But Sinema objected to this provision as well, and demanded that subsidiaries controlled by private equity firms be exempt from the 15 percent corporate minimum tax if those companies make less than $1 billion. The concern from Democrats was that private equity firms—many of which have assets far surpassing $1 billion—could simply shift money around among their subsidiaries to avoid the minimum tax.

To justify her stances, Sinema argued that such measures were needed to protect private equity because they direct capital toward smaller businesses—a view that puts her out of step with basically the rest of her party, which views private equity as a job-killing force that has looted the U.S. economy for profit.

Even some Wall Street bigshots weren’t sold. In response to news of the bill’s changes, Lloyd Blankfein, the former CEO of the investment giant Goldman Sachs, sarcastically tweeted, “hats off to the P/E lobby!”

“After all these years and budget crises, the highest paid people still pay the lower capital gains tax on earnings from their labor,” Blankfein said.

As negotiations were unfolding, Sinema’s views were—true to form—inscrutable to the public, and to many of her colleagues. However, the senator met with business groups to hear their concerns and ask their feedback about the legislation.

Reportedly, Sinema asked leaders of the Arizona Chamber of Commerce—traditionally a bedrock of the GOP establishment in the state—if they thought the corporate minimum tax was a “bad” idea. One source familiar with the talks, who requested anonymity to speak candidly, expressed a belief among Senate Democrats that the senator showed far more deference and attention to these interests than she did to her colleagues.

Groups opposing Sinema, such as a new PAC set up to fund a primary challenge against her, have pointed out that finance interests have in the past been generous donors to her campaigns. HuffPost reported that groups who have lobbied for keeping the carried interest loophole have donated over $170,000 to Sinema’s campaigns.

Still, many observers ended up being baffled that Sinema chose to advocate so conspicuously for an industry that is synonymous with corporate elitism and job-killing practices.

“It’s sort of inexplicable,” said another source, outside Congress, who tracked the legislation’s development closely, and was not authorized to speak publicly on the matter. “It seems like politically self-destructive behavior. If you’re going to go to bat for carried interest, why do it in the most dramatic way possible?”

A savvy politician, Sinema has long thrived in tough contests, consistently winning reelection to a purple U.S. House seat in the 2010s and ending a long drought for Democrats in 2018 by flipping this Senate seat. It’s that background that gives some longtime observers of the senator some pause in considering what, exactly, her political endgame may be.

“She is a polling nut—she is constantly measuring the public attitude, has always been, throughout her political career,” said Chris Herstam, a former Arizona state legislator who used to be a friend and supporter of Sinema’s.

But Herstam was baffled by her moves on the reconciliation bill. “You wouldn’t use all the leverage in the world that you have on the reconciliation bill,” he said, “and make the most important issue providing continued tax relief and tax loopholes for fabulously wealthy hedge fund managers.”

“It plays right into the hands,” Herstam said, “of a Ruben Gallego.”