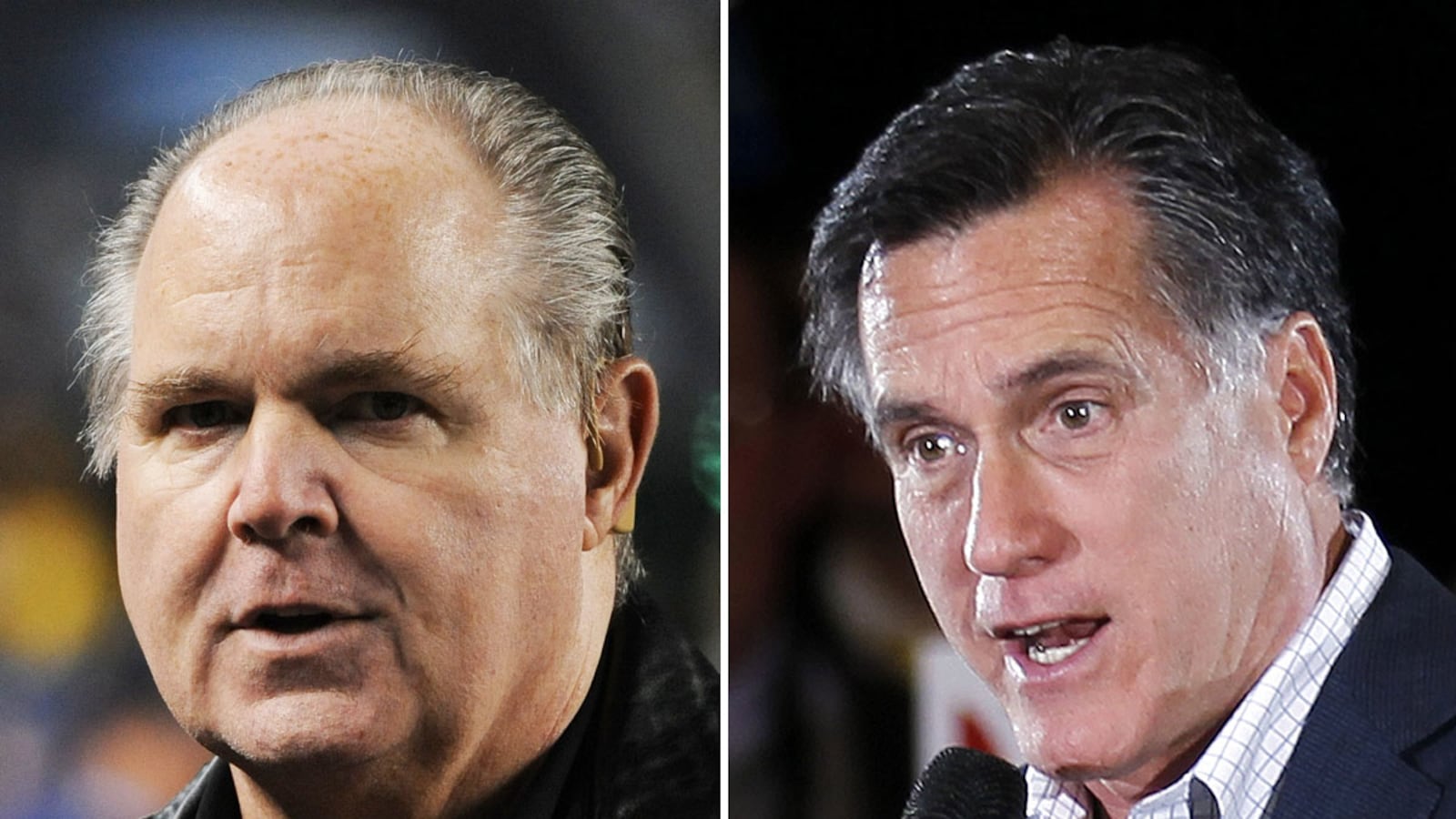

Fourteen directors of Clear Channel, the company that hosts the Rush Limbaugh show, have contributed $726,400 to Mitt Romney since 1994, most of it in the current presidential campaign. Romney has come under attack for refusing to criticize Limbaugh’s comments about Georgetown University law student Sandra Fluke, other than to say that calling her a “slut” and a “prostitute” was “not the language I would have used.”

Romney’s former company, Bain Capital, acquired Clear Channel in 2008 with another Boston-based investment firm, Thomas H. Lee Partners (THL), so five of the entertainment company’s directors that have given to Romney come from Bain, while three are affiliated with the Lee firm. Three other directors are members of the Mays family that founded the company and continued to run it until 2011, when CEO Mark Mays stepped down. The remaining three donor directors come from other investment firms.

The $26 billion merger, which was launched simultaneously with Romney’s first presidential candidacy in late 2006 and placed Limbaugh, Sean Hannity, and much of the talk-show right under Bain/Lee control, also involved Romney’s longtime law firm, Ropes & Gray, whose managing partner is the trustee of the family’s blind trust. David C. Chapin, a lead Ropes lawyer on the merger, has also given $12,700 to Romney, and five other partners who worked on it added another $10,400.

While Bain partners, employees and family members, including the Clear Channel directors, have given a combined $4.7 million to Romney’s two presidential campaigns, THL also has a long history of Romney support, with some donations dating back to Romney’s first, unsuccessful run against Massachusetts Sen. Ted Kennedy in 1994. THL tallies $180,300 including its Putnam affiliate and led by its co-chairs, Scott Schoen, Anthony Dinovi, and Scott Sperling. With Sperling’s wife and son contributing as well, Sperling has donated $25,100 to Romney, starting in 1994. In The Real Romney, the recent biography written by Boston Globe reporters Michael Kranish and Scott Helman, Sperling is credited with spearheading “the biggest investment of Romney’s career,” the highly lucrative purchase and quick sale of a credit company named Experian. Sperling is a Clear Channel director, and THL and Bain are deeply invested in the company, one of the largest deals ever done by either equity firm.

Clear Channel director Steven D. Barnes and his wife, Deborah, have given $346,200 to Romney, also starting in 1994. John Connaughton, also a Bain partner on the Clear Channel board, and wife Stephanie have contributed $296,300 since 2002, when Romney was elected governor in Massachusetts. Other directors with Bain ties who donated to Romney include Ian Loring (with Isabelle, $10,600), Edward Han ($4,800), and Blair Hendrix ($4,800). In addition to Sperling, THL partners on the Clear Channel board include Charles Brizius (with Kathleen, $8,200) and Kent Weldon ($2,600).

The three Mays directors and their families that gave were Lester Lowry Mays, the founder, and Mark and Randall, all of whom combined for $18,800. The other directors that gave were David Abrams of Abrams Capital ($4,500), Jonathan Jacobson of Highfields Capital ($2,500), and Thomas Shepherd of T.S.G. Equity Partners, who is only a director of Clear Channel Outdoor Holdings, the advertising affiliate of the company. Like so many others on the Clear Channel board, Abrams and Shepherd began giving to Romney in the 1990s.

The timing and size of these donations demonstrate Romney’s continuing close ties to those at the helm of this media giant, which has so far taken a hands-off policy about Limbaugh. “We respect the rights of Mr. Limbaugh, as we respect the rights of those who disagree with him,” Clear Channel’s Premiere Networks said in a statement. While media companies, including Clear Channel, have terminated or suspended hosts for over-the-top comments, the company appears as unwilling to take on Limbaugh as Romney has. Clear Channel awarded Limbaugh an eight-year, $400 million contract when the Bain/Lee acquisition closed.

Research assistance was provided by Jillian Anthony, Irina Ivanova, Clarissa León, Nicole Marsh, and Kyle Roerink.