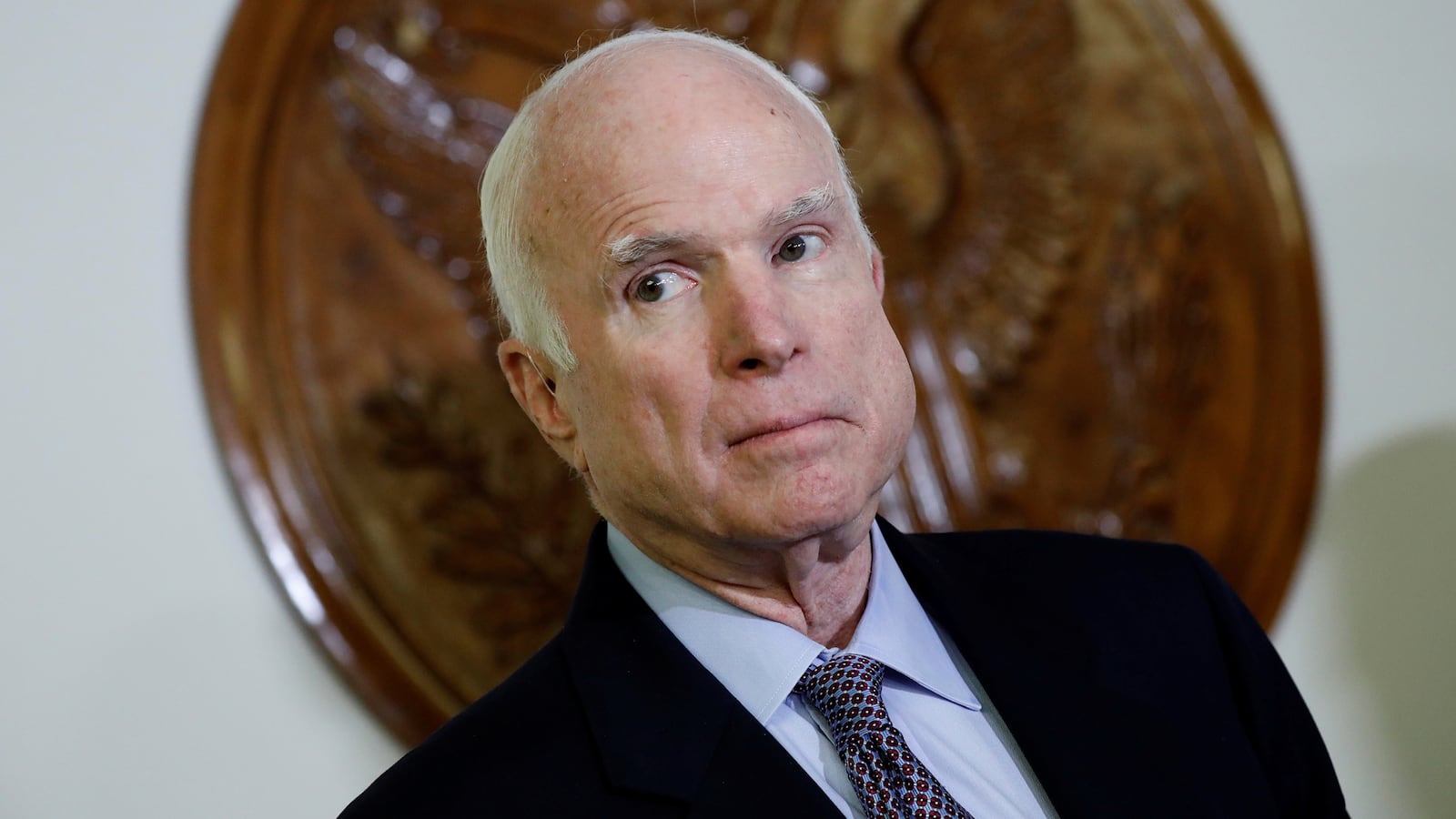

Thursday morning, John McCain announced that he’s a yes on the tax bill. That probably seals it. A lot of Republicans take their cues from McCain, and if he says he’s voting for it, the waverers will too.

I’ve been writing about American politics for a quarter century now, and I have read in considerable detail about every major tax bill that Congress has passed in probably the last 80 years. And I can tell you that nothing remotely like this has ever happened. In terms of both process and substance, it’s utterly without precedent.

The process, I’ve written about before. To push through legislation like this with literally zero hearings in the House and one in the Senate, which took testimony from one witness, is a mockery of democracy. No one can defend this. It’s a disgrace.

And as for the substance—well, it’s dreadful, and it’s tied to the process, of course, because a package of lies and giveaways like this could never survive a transparent legislative process.

This bill goes far beyond what all past Republican tax bills have done. In the past, Republican plans took care to ensure that the middle class got a tax cut, too. The rich got far more of course, but as long as the middle class got something they could sell it as a middle-class tax cut.

Now, even that thin pretense is dead. This will raise taxes on millions of middle-class people, as earners making $40,000 to $50,000 will by 2027 be paying $5.3 billion more while millionaires will pay $5.8 billion less. Republicans just no longer give a crap. They’re like the family alcoholic who used to at least try to hide it, sneak his nips in the attic, but now no longer even bothers trying to hide.

It’s a downward-mobility tax bill. Eliminating the deductibility for state and local taxes will kill homeowners and discourage people from buying homes. The repeal of the individual mandate on Obamacare, snuck in at the eleventh hour without telling Democrats, will mean more uninsured. The automatic spending cuts that will be triggered by the $1.5 trillion the law would add to the deficit will slam Medicare to the tune of $25 billion.

And what this bill will do to make inequality worse we can’t yet measure in full. Aside from the cuts to the rich and to corporations on rates, there’s the scandalous near-elimination of the estate tax and the total elimination of the Alternative Minimum Tax, which is designed to ensure that filers at the high end can’t deduct their way down to a miniscule tax bill.

I could go on for pages like this. But you’ve read it all anyway. It’s a shocking bill. This will sound absurdly naive, I know, but I’ll write it. Once upon a time, tax policy was designed to encourage growth, investment, creating a robust middle class, and creating incentives for people to do things like pursue higher education (the Senate version doesn’t have the obscene anti-higher-ed measures the House version did, but it still does have a few higher-ed taxes; and more than that, the end of state-and-local deductibility will strain state budgets, which will mean higher-ed cuts in many states).

But this bill does none of those positive things. It’s pure supply-side snake oil. The rich are just going to pocket their lucre. CEOs aren’t even pretending that they’re going to “invest” their windfalls. They’re just going to do more stock buybacks, which will prop up the market, at least for a while, and fool people, at least for a while.

But this bill isn’t even really for them. At bottom, it’s being passed entirely for their donors, to make sure that their rich donors keep bankrolling their campaigns.

This is a moment of shame for this country. It’s a moment of shame for McCain and the other Republicans—there are a few of them—who know better.

It’s shameful on the merits, and it’s double-shameful that they’re handing this victory to Donald Trump. On the very week that he retweeted a noted white supremacist; and the week we learned that he’s now trying to deny that it was him on that Access Hollywood tape; and the week after Trump essentially endorsed Roy Moore for the Senate.

And here’s the thing. There is no reason on Earth they couldn’t have taken six months, have a few hearings, give the Democrats one or two small things, get four or five Democratic votes, and still get 90 percent of what they wanted. Doing that would have preserved the fiction that there was still some semblance of respect for the institutions of the House and Senate. That they chose not to tells us, again, that they just don’t care.

George Washington University political scientist Chris Warshaw recently tallied up the approval ratings of all major pieces of congressional legislation at the time of their passage or failure over the past 30 years. You should give it a look. At the high end: the Brady bill on guns, around 86 percent, and the 2007 minimum wage increase, at 84 percent (these are all average support numbers from 15 polls he counted). Also quite popular: the Clean Air Act amendments of 1990, the assault-weapons ban, and Dodd-Frank. (Hey, what do all those have in common? They’re all liberal bills). The Clinton health-care plan, at 40 percent, was at bottom (and of course it did not pass).

At the bottom until this year, that is. Obamacare repeal was at 22 percent, and this tax bill is at 30 percent. And yet, it’s on its way to being law. The will of the people? More like the triumph of the will.