A grand jury in New York City indicted the Trump Organization and a top executive Wednesday night, the first slew of criminal charges stemming from a three-year investigation by the Manhattan district attorney.

The indictment charges former President Donald Trump’s family conglomerate with undisclosed crimes and will remain sealed until Thursday afternoon, a source with knowledge of the matter told The Daily Beast. (The indictment was first reported by The Washington Post.)

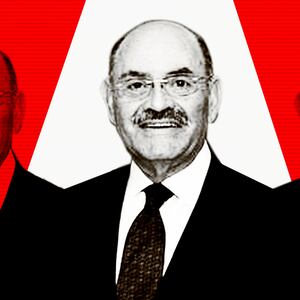

What was clear Wednesday night, however, was that Allen Weisselberg, the company’s chief financial officer and a longtime trusted confidant, will be indicted on criminal charges.

The long-awaited indictment will reportedly not charge Trump himself, but two insiders who testified before the grand jury told The Daily Beast that investigators were still gunning for the former president. These people said they believe prosecutors have a desire to leverage charges against multiple Trump Organization executives and their families to turn them into witnesses against Trump.

Although the indictment remains sealed, people with knowledge of the investigation said they expect it to detail the ways the company and top officers would illegally avoid paying taxes. In previous court filings, investigators have said they were looking into possible bank fraud and underpayment of taxes owed to the government. One witness, who testified before the grand jury and spoke to The Daily Beast, explained how Weisselberg failed to pay taxes on company gifts and perks that amounted to additional salary, like a luxury apartment on New York City’s Upper West Side overlooking the Hudson River.

Companies can give workers what the Internal Revenue Service calls “fringe benefits,” free or discounted cars, flights, and real estate. But if they do, they are generally required to include those perks on an employee’s gross income—and pay taxes on that, according to the Internal Revenue Service.

For weeks, prosecutors have been focusing their questions on how the company provided unreported gifts to its executives and their offspring, who are also employees of the company, according to two people familiar with the case. While the elder Weisselberg oversees the company’s finances, his son Barry manages Trump’s ice skating rink in Central Park. Matthew F. Calamari is the company’s chief operating officer, and his son Matt Jr. is the head of security.

Barry Weisselberg’s ex-wife, Jennifer, told The Daily Beast that she handed local investigators seven boxes of financial documents proving that the company showered their family with expensive perks, including an apartment overlooking Central Park. She also identified a three-bedroom home in a middle-class neighborhood in Boynton Beach, Florida, that she said Trump gifted the elder Weisselberg in 2002 so that the finance honcho could be nearby when Trump traveled south to his mansion at the Mar-a-Lago Club.

The Trump Organization did not immediately respond to requests for comment. Neither did the office of Manhattan DA Cyrus Vance Jr.

Weisselberg will plead not guilty and intends to fight the case in court, according to a statement issued Thursday morning by his lawyers, Mary E. Mulligan and Bryan C. Skarlatos.

Weisselberg’s attorneys also did not respond to questions submitted by The Daily Beast. Insiders say Weisselberg has not cooperated with investigators and shows no signs yet of flipping on Trump and turning over any evidence of wrongdoing.

According to ABC, investigators have also questioned Weisselberg’s right-hand man, company controller Jeffrey S. McConney. Two sources and court filings in an unrelated New York attorney general case show that McConney oversaw big payments and told subordinates to cut the checks. But he too has been described by four sources as a loyal foot soldier within the family empire who has kept the same job in Trump Tower for more than 30 years.

Three people familiar with the investigation said they expect the Manhattan DA’s office to hit others with criminal charges in the future. The case, as laid out by prosecutors in past court filings, explores the actions of several others in and outside the Trump Organization.

Nicholas A. Gravante Jr., an attorney who represents Calamari and his son, told The Daily Beast: “Although the DA’s investigation obviously is ongoing, I do not expect charges to be filed against either of my clients at this time.”

The first iteration of Vance’s investigation started around August 2018. At that time, federal prosecutors in the Southern District of New York focused their attention on Trump’s consigliere, Michael Cohen. That month, Cohen struck a plea deal admitting that he made hush money payments to porn star Stormy Daniels and ex-Playboy playmate Karen McDougal, deals that prosecutors described as “in coordination with and at the direction of” then-candidate Trump. But others who worked on those payments appeared to get away unscathed.

But Vance’s office still wanted to know how the company had reflected those payments, which could be understood as campaign contributions, on its books.

In July 2019, a judge revealed that the federal campaign finance investigation was over, and Vance continued with his investigation in state court.

The very next month, the Trump Organization was served with a grand jury subpoena demanding emails and documents about the hush money payments. Seven weeks later, the company had turned over 3,376 pages— but none of the tax records Vance’s office had demanded, according to court filings.

The DA’s office then turned its sights on the Trump Organization’s outside accounting firm, Mazars USA, asking for the same records. At that point, then-President Trump himself intervened, suing to block the hunt for his personal and company tax returns. That became a years-long battle that repeatedly reached the U.S. Supreme Court—and all the while Trump called the entire ordeal a politically charged “witch hunt.” The country’s top court sided with the Manhattan DA, forcing the release of the tax documents, and investigators in recent months obtained the materials they sought.

The investigation reached a new breaking point when New York state Attorney General Letitia James announced that her office’s civil investigation into the Trump Organization’s alleged bank fraud and dodging of taxes became a criminal probe, at which point she teamed up with the Manhattan DA earlier this month.